Here we are, once again, with a market seemingly on the cusp of a technical breakdown. But bulls are fighting not to give up. In recent setups like these, we have seen vicious bear traps sprung before V-shaped rallies to fresh highs.

Updating the 15-minute chart of the Nasdaq-100, you can see pennant which has been forming during today’s session. I suspect we see resolution in the final ninety minutes of trading, though the pattern morphing out into a longer base is always a possibility.

Given the persistent selling in the likes of AMZN GOOG NFLX TSLA, etc., risk still remains lower.

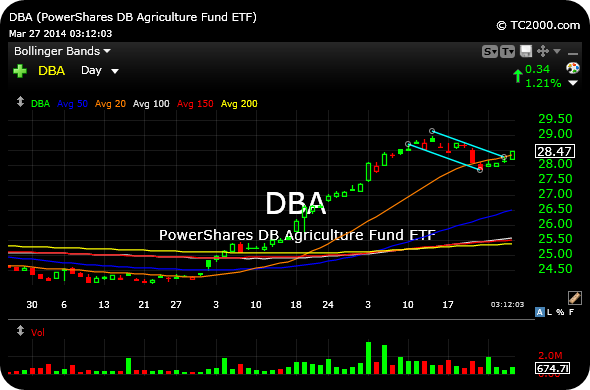

Keep an eye on natty gas here on the long side, with UNG over $25.20.

______________________________________________________________________

Comments »