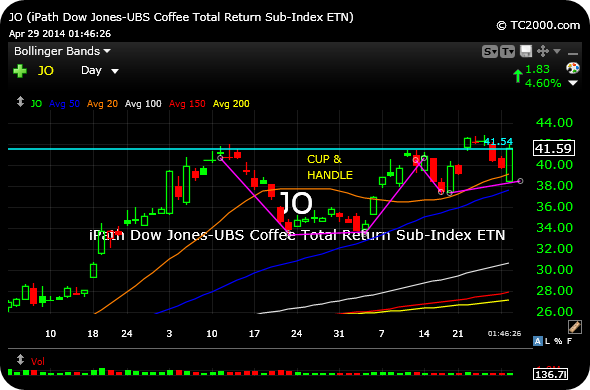

Following-up on my last blog post about coffee, 12631 member @StuOnGold offers the above chart on the coming bullish seasonality. Perhaps this may add fuel for the next leg higher, too.

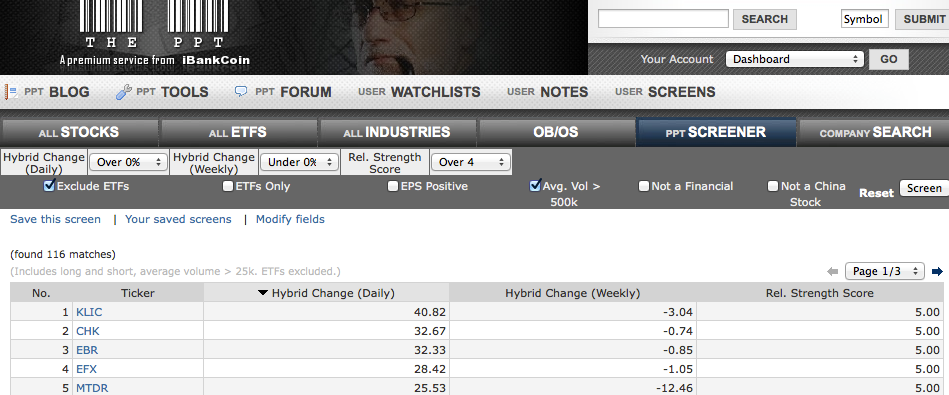

As for equities, into the final hour the we can see the grinding session taking hold. Watch for resolution from the triangle, below.

But we do have the Fed tomorrow. So I am inclined to remain flat until after the announcement and initial reaction.

____________________________________________________

Comments »