First, I am 25% short (QID, TZA, FAZ, SRS) and 8% long (MRGE). I am net short with a neutral-bearish bias. Once/If I get to the 50% short level, then I am “committed” to the dark short side.

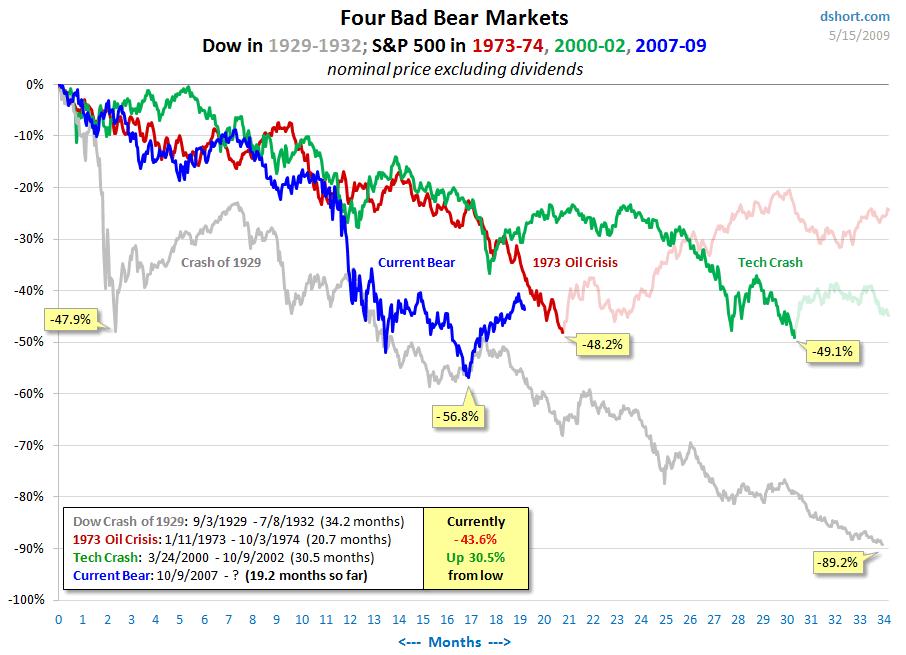

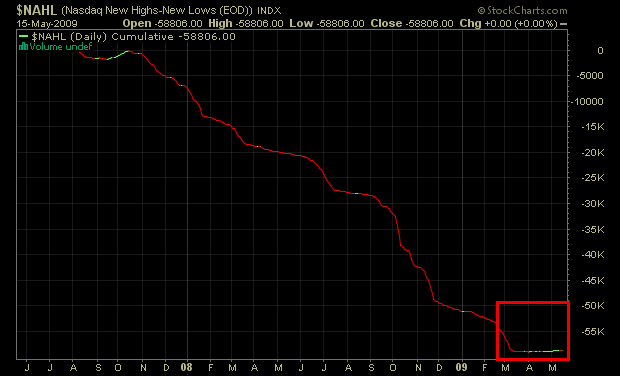

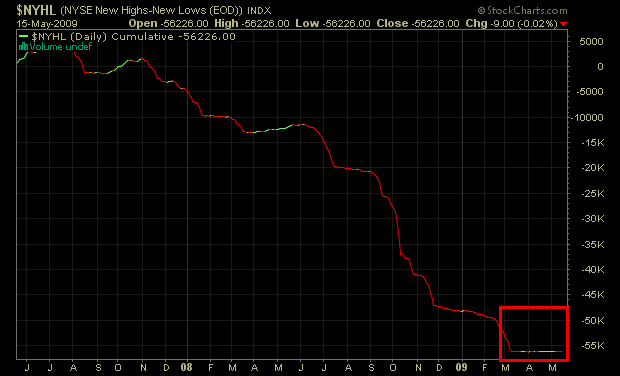

I would like to note the New Highs-New Lows Index and the VIX. The ones below are for the NYSE and the NASDAQ. Do you see a problem on the chart? I do. We had the biggest rally (+30.5% so far) since the bear market started yet we can’t get a noticeable uptick in new highs. This, among other things, tells me that the bear market is not over yet. There is no improvement here if we look at the 2-year picture.

The VIX is forming a bullish wedge and I am expecting a breakout to the upside or at least to the top of the wedge’s channel. Obviously, this correlates with my bearish stance. The VIX also found support at the July 2008 high yesterday (Friday).

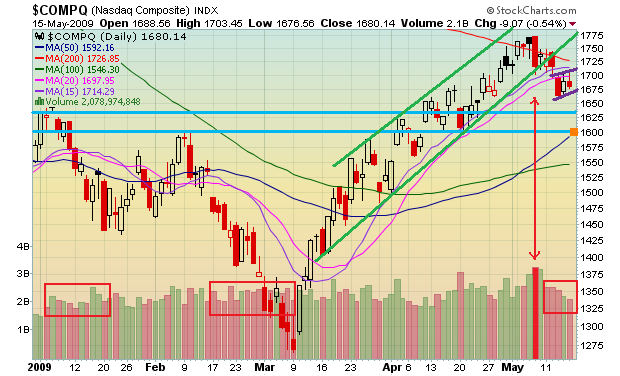

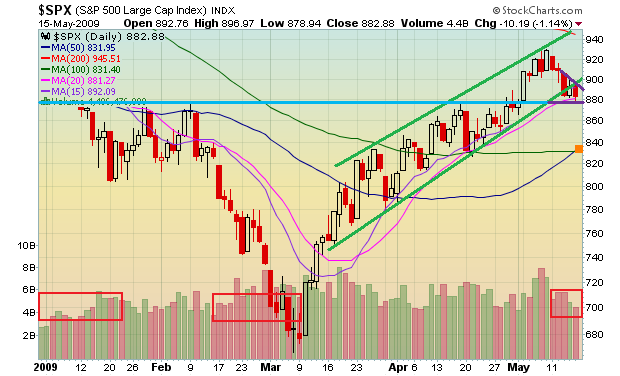

Now, the COMP, RUT, and SPX. All three have broken their uptrends. As the COMP was the first one to reach the 200-day, so shall it be the first to lead the decline, and it has. Some people say that the lack of volume has been an issue. If you noticed, we didn’t get high bursts of volume in the beginning of any of the previous declines. We did get larger volume towards the end of the capitulation/exhaustion stages.

The most important market volume indicator is the COMP. Take a look at May 7th (red highlighted volume bar). This is the day that the COMP failed the 200-day MA, and it is also the biggest volume for the COMP in all of 2009. You may also notice that volume remained weak during previous declines. Price action should be your most important criteria when determining direction.

The RUT also has a pronounced breakdown, and it is very obvious. Currently flagging between 470-485, the RUT has the potential to reach the 50-day MA which should be above 450 in the coming days. There is major support at 470, so I do expect a lot of whipsaw on the daily.

Both indices are below both the 15- and 20-day SMA’s, which is short-term bearish and serve as trend break confirmation.

Did you notice the “stick sandwich” 3-candle formations on the COMP and RUT? The textbook will tell you that it is a bullish pattern, but it is wrong. It’s all about the location of it. The R-W-R (Red-White-Red) stick sandwich in my book is a continuation pattern to the downside (or if the candles were W-R-W, then bullish). If you need more examples of a stick sandwich, then let me know.

Finally, we come to the SPX, which is testing the 20-day. Of course, there is strong support at 875, a level which has acted as a barrier for months. So far, it is holding extremely well. The SPX’s strength is the reason why I am not committed short. If we close below 875, then we could see a move to 840. We’ll know if/when we get there.

As always, don’t forget to exercise caution when shorting stocks.

If you enjoy the content at iBankCoin, please follow us on Twitter

Yes. The stick-sandwich is bearish depending on its location relative to the overall chart. I see the light!

Great analysis! Thanks for posting these.

Nap, you can throw your bullshit textbooks out the window.

You’re welcome, Anthony.

dear CA,

is there any way to learn from you in a more systematic way?

my attempts to make it on my own have been a disaster.

thanks,

larry

Great stuff as usual CA.

Good stuff CA. I see many bear flags forming…. Charts have broken down. Others made their ST yesterday against a high trendline. Bear flags and channels forming and are about to be broken. We’re about to gap down. And we got a H&S with target of 875 at least. If we gap below 870 watch out below(this could very well be the case)

Great analysis as always… will be waiting for the 875 break to load up on shorts

Josh – this might be the first time I actually agree with your assessment.

Thx RC.

Larry, I provide a lot of education. Trading is a learning process that takes years and years. You learn as you go. Knowledge, psychology, strategy, money/risk management, and experience are all tied into each other. If you aren’t in tune in just a single area, then your trading will be a disaster. I suggest that you read a lot of books, trade in small sizes, and learn as you go along.

My psychology article should get you started: http://ibankcoin.com/chart_addict/?cat=14

Thx Enig.

Love your post as always! However, about the new high new low index. The market plunged more than 50% – 80% on average. I think it is normal that we did not see much activity during the 40% rally from march to may on the NHNL index, since most of them are just recovering their loses. Don’t get me wrong I like your post 100%!

i tried jumping the gun early…. well i did jump the gun early…… but my new trading strategy should eliminate that and allow me to profit even more. i will still jump but will constantly lower stops and when taken out i will add back the other way.lowering stops now isnt happening because there are so many indicators indicating a bigger drop

CA question for you. Whats your view on log scales? do you favor them over regular. Or does it depend on your timeframe for trading

“bro” – The SPX is down 43% from the Oct high. The NYHL and NAHL indices are only to confirm bullish or bearish activity. There was some improvement (green areas on the lines), but it’s not enough to confirm that we’re not out of the woods yet.

Josh – what’s your new strategy?

Also regular charts compare price vs. time. The log charts are more for an acceleration of growth and most parabolic charts are shown as such. I really don’t care too much except when a log chart gets fucked up at the top, then I will use a regular one.

My new strategy…… is being implemented now, should have been implemented when i had the IT or what i thought was a ST bottom at March 6th. When we come up to important trendlines and i am long, i will take some off and enter some shorts. Then as we get confirmation as to whether or not it is an IT top (from the set up several indicators or charts, like now) then take off all longs and enter shorts. If it simply a small pullback/flag consolidation then take off shorts and go back to long when we hit bottom of the flag channel/breakout of flag. Also it involves trailing stop % and stop changes….

some money is taken off at key resistance areas and put into shorts. then if deemed this just a ST top it will be re instituted as a long at a lower price.

the goal is to make sure i dont keep shorting thinking i will catch the top. The bottom i have a lot easier time catching so this is not really an issue. It is catching tops that is difficult.

Nice post CA. You talk about learning with experience and yet you are only 24 years old! Thanks for all the education and advice. What kind of stops do you use for the ultra short ETFs? They can go up or down so f*n fast.

Josh – I don’t attempt to catch tops or bottoms often, mostly a losers game. If you’re wrong, the market will rip you another hole. Instead, if it is a true bottom or top, the market will give confirmation, and sometimes, a second chance to enter. It is the safest point of entry.

I don’t use stops unless I’m on vacation, and that was only when I was in Mexico catching the swine flu.

Great stuff – almost as good as your SC skills 🙂

Glad you are still alive!

All those stick sandwitches are making me hungry.

Great shit as always CA.

What’s your thought on the inverse head and shoulders, next shoulder’s support @ the November 750 level IF volume distribution persists?

The “top” of the March rally seems abnormally close to that November top.

i think catching the bottoms is much easier than tops especially when government keeps yapping. I also think that “my new strategy” does not necessarily have me catch the tops entirely as i am still partially long. also my chaning of stops on shorts will maintain profits if the market decides it is not the top. i disagree about the true bottom part. the market in my opinion did not make a bottom at 666 and it never gave a second entrance. sometimes you will get one sometimes you wont. and a stop above where you think a reversal is about to happen usually gets a pullback at the minimum. and the break gives you a chance to get out if you hadn’t already been stopped out. also the breakout sometimes might retest giving another exit point and entrance to reenter longs

Hope you watched and bet on the Preakness today, Maryland boy.

That bullshit song in the beginning is no “My Old Kentucky Home” but ya gotta love how the melody blatently ripped off “Oh Tanenbaum” — B’more thug style.

________

Josh shhhhhh…..

Moose – It’s possible, but I won’t be holding for that long. All of my campaigns will be short 1-3 day hits. There are too many moving averages on the way down. I do not expect the MA’s to be sliced through with ease as they will be met with buying.

Josh – when I said “true bottom”, I meant the operating bottom for that particular time. Bear-ending bottoms are caught in hindsight, unless you are lucky. As a part-trend follower, I do not aim to catch exact tops or bottoms. What I meant by “confirmation” is high volume follow through. You sound like you’ve read a lot of books, good, and you sound smart, but words are backed up by actions, or aka trades. You have been calling tops since 826 SPX or something? And, you also missed the entire upswing. I hope your strategy and your process of thinking are radically different from what they were previously. I say that out of love, and not in a gay manner.

Jake – yea it was really great…on TV. I had to do shit last minute today, so I had to change my reservation to give to a friend, for free. I do not gamble. Funny thing is, I even planned my route up carefully as to avoid as much of certain “infested” neighborhoods in W. Bmore as I possibly could.

*I would also like to add that I did drive through a gang shooting last year unscathed.

*I would also like to add that I did drive through a gang shooting last year unscathed.

Did you have your homies hanging out the back windows, nines blazing?

_______

CA, I’ve been watching the same indicators in addition to my cycle analysis. New SPX low in July.

my trading was up to 750 which was the first point i tried to short. failed tried again at 780 failed and went long only to short i think it was around 820. went long at 780 and close at 850 to short down to 810. went long there to 840 and tried shorting at 850 and that’s where i got whipped hard. but i have been short from 880 decided i wasnt going to take it off but rather just endure the pain as my breaking point wasnt much above 950

my trading was up to 750 from 690 which was the first point i tried to short. failed tried again at 780 failed and went long only to short i think it was around 820. went long at 780 and close at 850 to short down to 810. went long there to 840 and tried shorting at 850 and that’s where i got whipped hard. but i have been short from 880 decided i wasnt going to take it off but rather just endure the pain as my breaking point wasnt much above 950.

i am mad how i traded this bounce, but i feel just fine knowing that W4 is complete and were now going to make new lows and i will profit tremendously also from it..

sorry about double/triple posting for some reason it allowed the post to double post

only new thing in my strategy is my exit strategy pretty much…. which will solve myself a big issue i had and now hopefully have solved it… regardless my accounts looks pretty good after i captured all of the drop in the market, although shorting it back down has taken some pain but that pain will be resolved very fast

lol Jake. I was coming back from one of my properties, and I was just an innocent bystander running a red light to GTFO of there. The Wire could have done a taping that day fo sho. Ya feel me?

Josh – why didn’t you just wait for an initial breakdown for a lower risk entry? Seems like you were allowing your personal opinions affect your trading decisions. This rally sure did rip bears’ faces off. Besides your exit strategy, you should also refine your entry points. Both are equally important.

my entry points all got approximately at least 10 point or so pullback. with lowered stops i could have scalped say 5 points. if we dont gap down we will most likely get a bounce to a little above 900 but below 920

Josh, for the love of God, you better refine your strategy more than that or the market will fuck you.

nah the market will not fuck me as I trade IT trades with money management trades inbetween. my strategy is about to show its strength. i will cover around 790 only to implement around 820 or so havent decided those details. this will only be a ST. my entry points always(most of the time) merit a pullback when deemed simply a pullback and not a trend reversal i dodge out of the way. see you sub 800

Feel free to post your trades real-time here. I will assess your strategy myself.

not around during the day(for the time being), but i will fire off trades prior to market open. consider myself short until 800 or so. might take some off at 855 if we get there tomorrow only to put back on the next day. thanks for the offer though. perhaps later in the year i will when i got more time on my hands to do day trade and that assessment

when i do adjust my positions i will leave my market orders and their execution. shouldn’t have to worry about that until end of the week. best of luck for the week

Dude JOSH stick with your words or shut up.. if you are true SWING trader. You should have it all mapped out how you want to trade this market. Stop telling us how ur day went after the market close. DO SOME REAL TIME CALL FOR ONCE! To be honest I did not even want to reply your comment on my post. It is a disgrace to talk to people like you. I am talking to you right now because you are raping CA’s COMMENT. Listen, if he is spending his precious time to teach you something. GO LEARN IT and stop trading the LEFT side of the CHARTS!!!! I’m seriously sick and tired of your AFTER MARKET CLOSED call. DO SOME REAL TIME man REAL TIME!!! tick tick tick tick…… otherwise CLOSE UR LID please!

With crude doing well this AM, it looks like it might be time to add a long or two in some of these coal names.

They need to hold their gap for the first 30 minutes. Watching ICO, PCX, NCOC

You guys watching UOMO?

Coals are doing well this morning, bought ICO @ 2.78

Bought another coal name; MEE @ 19.48

Josh was heavily short going into Monday and, like always, got his balls ripped off. Josh, please don’t change whatever methods you are using. From now on I want to go 100% constanza on your predictions (margin, credit cards, refinance, everything.). I’ll be banking so much coin, TA’s typical 200-400% YTD gains will go unnoticed by the PPT community.

All coals in play.

UOMO nice!

Josh making noise mean we should get out of that thread…..

lol Charlie/ring.

That’s another thing. Josh, STOP going 100% short or whatever. There is no way you made it out without taking some serious damage.

1.05 is about the most to expect from UOMO

Bought CTIC $1.27 5%

Bought AXL $2.17 5%

CA,

Howz XRTX looking?

CA,

Howz XRTX looking?

NNBR rebounding today.

Is the dollar circus back in town?

CA amazed by your performance, and have learned from your posts . Question : Have you looked at the short covering from last two months? Heavy in the Russell big time {squeeze might be over} two sectors that increased shorts Health care and Consumer goods

CA,

checkout CRDN over 20.32

XTRX looks probable. NNBR is a son of a bitch.

Parts of the circus are back, most of it is gone. Sorry.

This rally was fueled by the largest short-covering campaign in this entire bear market. I will look into that, but I think a lot of bio/pharma names still have more upside room.

Fly guy – it’s good. I like.

CA

Did you look at XTRX or XRTX?

Sold MRGE $3.02. +53%

notes that in the second half of April (Apr 16-30), short interest on the Russell 3,000 stocks dropped to 13.62 billion shares ($260 billion / 2.88% of market cap) from 13.95 billion shares ($259 billion / 2.94% of market cap) on March 31.

There was net short covering in eight of the ten major sectors with Consumer Discretionary and Information Technology receiving the largest short interest outflows of $3.1 billion and $2.5 billion, respectively. The only sectors with net short selling were Health Care and Utilities, in which traders opened new short positions worth $457 million and $183 million, respectively

As always, nice call on MRGE.

Do you think stem cell names have the same growth capacity as other bio/pharma companies? Or will they float in the same exact prices until, literally, they raise a dead child back to life?

CA,

What do you think of CRDC?

Take a look at $WBS while ya at it. Disclaimer: I own WBS

CRDC – are you serious? That stock is on it’s way to hell.

WBS – I like it.

Fuck yes, my ‘stock pick skill’ must have increased over the past few months. I’m in it to win it, but keeping a short leash via giant red flashing alerts set to go off should it get back near 7.20

As Juan and Ramone, former Cuban coworkers back in my pizza/calzone/stromboli cooking days would say when the boss wasn’t around, “It’s easy money man, easy money.”, and kick their feet up.

CA,do you plan to cover any short today? or add more by EOD? thanks.

CA,

STSA

GNW

ODP

what do you think?

Longs (10%): $AXL, $CTIC. Shorts (22%): $QID, $TZA, $FAZ, $SRS. Final.

No selling of my ietfs.

Lol, I don’t know why some people make trading so complicated. Like you said, “it’s easy money”.

CA, If the market gets back under 1700 Nas then I think the longs are toast. Does that jive with your thinking?

STSA – has to close above Jan breakaway gap down.

GNW – no opinion

ODP – looks ok with a lot of MA support underneath.

letsroll – Looking for the COMP to fail the 200-day a 2nd time.

You’re confident in a downturn if you’re holding QID, TZA et al iETFs. I can’t stomach moves like that -13% for that group today. I just can’t seem to keep emotion out of it when there is a big move down.

What do you make of the VIX barely keeping above 30?

CA, HYGN

HYGN is nuts. I may scalp it tomorrow.

VIX will have to meddle around this general area. It’s still in its wedge.

Dave – perhaps your position sizes are too big? Roll with small position sizes because there will be multiple tests here at the 200-day (COMP), so expect a lot of whipsaw. 50%+ cash at hand should be a minimum.

/es short short at 907.5. see you guys later

I have a good one for you guys…HIMX

CA,pleasew can you block Josh in your threads….very scary for me…..toomuch nose…creating emotions

CSTR – Coinstar has shown positive growth from its lows in December 08. They operate Redbox video rental units, as well as public use coin counting machines.

THE DOLLAR STOCK CIRCUS IS BACK!!!