WHO raised their alert level to phase 5. I expect it to be raised to 6 in a matter of days. Remember the avian flu outbreak? The highest WHO alert on that was 3. Even though Americans are recovering, it is the virus geometric rate of infection and possible mutation into a second strain that worries me. A vaccine will not be made available for months. Take proactive measures to isolate yourself from anyone showing symptoms. That’s right, no hugging or kissing, sorry.

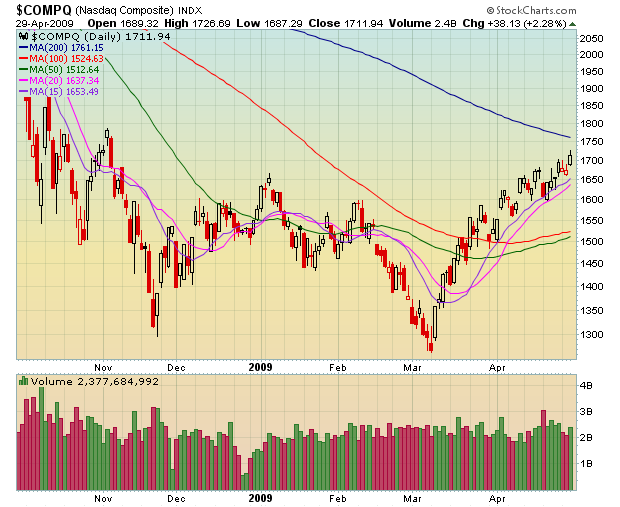

As for the market, it went higher as predicted. Any sized pop will bring the market over 875. This level on the SPX is absolutely critical. It is the largest and most powerful resistance level that is preventing possible movement up to the 200-day MA. Nonetheless, the fact that we’ve been testing it for several weeks shows me that the market still wants to go higher. We may be forming an ascending triangle off of this range. 875 is the tell. I personally expect some sort of consolidation after a 2%+ move.

A look at the RUT and COMP also suggests that we move higher. Out of the DJIA, SPX, COMP, and RUT, the latter two show the best promise. Is it no wonder that all my longs are small caps? If you’re in tech stocks, then you’re winning big. Concentration should be placed on small caps and tech. If you are looking to go short, the airlines formed a breakaway gap on Monday. This viral strain will spread quickly, and it will hurt the industry. CAL and DAL are possible prime swing short candidates.

Despite my near apocalytic first paragraph, I am long many $1-3 stocks. I have a 8% FAZ position as well as a 22% cash position. The FAZ is there to serve as my portfolio’s insurnace policy. Long holdings include FEED, FIG, CBB, WRES, THC, IO, and CAR. I am looking at QTM, PKD, and HERO as long candidates, among others on my list.

If you enjoy the content at iBankCoin, please follow us on Twitter

CA, The only thing I remember about the avian flu outbreak was that I had a trigger finger for Armageddon plays.

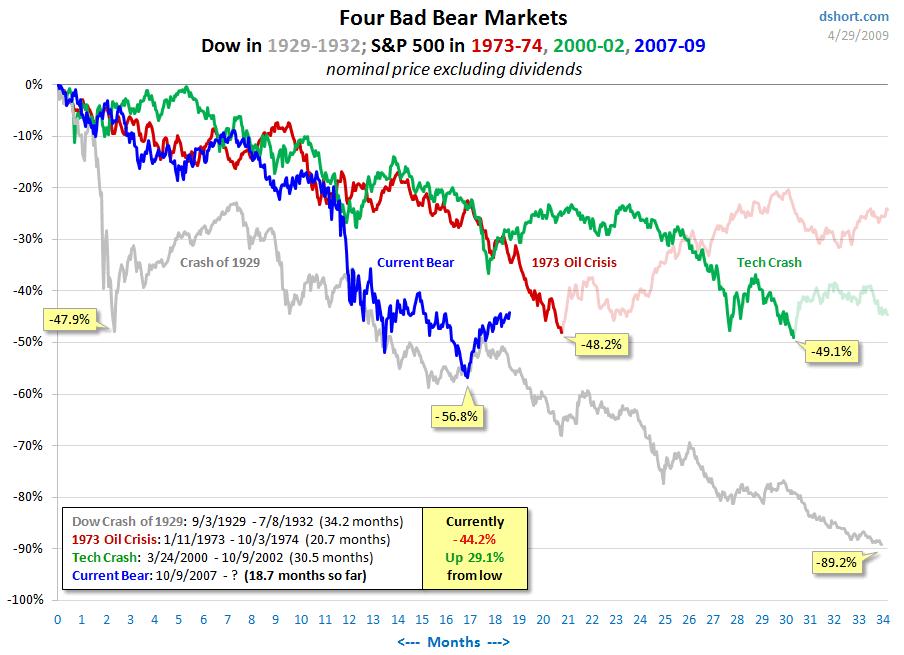

Any idea as to how fast we get to the 200-day MA if/when we break out? Last bear market we had 4 tests of the 200-day MA including the final retest with the period from top to bottom of 48, 75, 53, and 9 (calendar) days. we’re at 54 days now. (So much data, so little time)

Good words on protecting yourself. Everyone should remember that avian flu never developed proven human to human transmission. This new flu has it.

Second THIS FLU HAS NOTHING TO DO WITH PIGS so go buy FEED with wild abandon! The fact that China banned pork imports from Mexico, US, and Canada (even though the virus is not transmitted by pigs or pig products) means FEED’s market competition just got eliminated. I would also argue that the fact this flu pushed FEED down the other day gives the stock a cooling off period that may allow for a longer move up over time.

Not a chart person but that 3rd chart has been going through my mind for many days now.

I bought some IO following your lead yesterday. (small position). Did some research last night and noticed a ton of insider buying over the last 2 months. I might just sock some of this away and forget about it for a while. Sometimes if I remove myself from the equation things work better.

Also, DRYS has done some backing and filling between 6 and 7 and reports after the market today. It’s up strong premarket. If it gets past 7.25 or so there may be some broken field running ahead.

Keep up the great work, Thanks.

CA,

What is your take on ALU? Looks poised to make a run.

Sold CAR $2.20

Sold FIG $3.26

ALU is already running.

I do not know when/if it will reach the 200-day. You have to take the price action day-by-day.

Sales are to raise cash level.

FEED reduced to 10%.

great day to be taking profits. Been doing it all morning.

COMP hit the 200-day MA, FYI. Don’t ignore it.