We’re in a corrective phase as expected. We formed a doji which is typical and healthy for any normal consolidation. Notice how the market bounced off of major support at 920? So far, the charts say that we go higher. I’m not saying that we’re going to go up in a straight and uninterrupted line, but I think we have enough juice for another breakout or two.

I would watch the VIX. We are extremely close to the very important long-term 200-day MA. The VIX is currently sitting at September support when the VIX actually flagged before the major breakout to 48. This suggests that the VIX will likely stay within a tight range between 35-45 for several days.

As for myself, I am up +10.87% for January so far. This is mainly due to massive double-digit gains from spikers/momentum plays. GMO, ZLC were held from Friday. CWST was sold. In addition, LVS, ARTC, FIG, and others were bought in the morning. These kinds of stocks are 1-3 day holds and then you just dump them or go short at the end of their runs. I already wrote a short primer on my Spiker strategy on my functioning “third-tier blog” on October 10th, 2008. It’s not complete, but I am working on creating a “cheap tricks” manual.

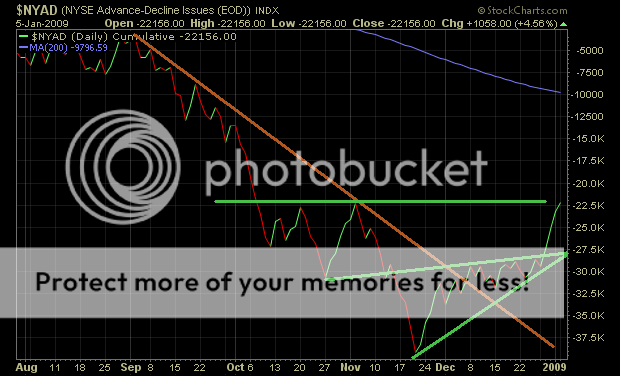

I’ve mentioned many times in the past that breadth must improve to support a market’s rally. New Highs & New Lows for the NYSE ($NYHL) and the NASDAQ ($NAHL) have been net positive for a few days now. In fact, this is the longest streak for the NYSE since May and the longest for the NASDAQ since August. Today, we made 21 new highs and 8 new lows (a huge improvement from the 22 new highs and 4,320 new lows made on October 10th 2008!) . The Advance-Decline lines ($NYAD, $NAAD) also confirm the rally.

This consolidation area is critical. 920 SPX is obviously THE support level. What we don’t want to see are breakdowns from conslidation like we’ve seen many times in the past (Just look at the trading range we’ve been in since December 8th. I would use a 920 SPX and 20-day MA combo as guides for any significant upcoming bounces. As long as the SPX stays above 920, the bulls are in full control.

SPX 5-day

SPX 10-day

SPX 40-day

SPX 5-month

If you enjoy the content at iBankCoin, please follow us on Twitter

We are In Primary B, Major Wave A, Intermediate Wave c, just started small wave b. Still have Major Wave B and C to go on the bear rally … could last another three months!

ca…

look at the charts i found… is this you…

http://www.greenfaucet.com/fundamentals/breadth-must-improve-to-support-a-market-rally/52965

your brother in the battle…

E8 – three month rally? I doubt it.

Duane – I am the youngest contributor at GF, prob the only one that hasn’t been on CNBC or Bloomberg.

wow, great job…

Nice charts as always, kid. Very informative.

And easy to read.

________

Why exactly do you need the CMT you are pursuing ?

I would think you would be qualified to write he exam.

Jake – thanks, as always.

SB – I can take it because I KNOW I’ll get it lol. Seriously though, I wouldn’t take anything else. It’s a formal measure for myself, especially the difficult level III at the end of this year.

If major waveA is coming to an end soon then we still need to correct (M-B) and then complete the final leg up (M-C) … all of which could take some time … ok, maybe not three months but till after inauguration and the delayed Obama plan being passed (2 months?).

Where is that fucking moron who talk shit about you before? Your picks were up some 30% – 40% today! TRUE COIN BANKER JOHN!! THANKS ALOT!! LOL !!!

Bravo on today’s trades! Nice clean exit on ACAS and ARTC. CNBC is in love with ACAS.

Holy Post-Title-Pun, Chartman! Nicely done.

Oh, the pictures are purty as well, but what’s new?

See my post (OEW) over at Danny’s thread for Long/Medium/Short term expectations … maybe you can give Danny a link, no?