The rally today was nice. It’s even better if you add in the past two days. There’s a lot of reason to be bullish just by looking at a chart. After spending nearly a month inside a trading range, the SPX finally broke out from 920 resistance and it did so without a problem, even on a low volume day. I would give it a few days for the market to restore “normal” volume levels.

Next week, I would wait for a pullback before getting serious on the longs. Why? Because it’s at the pullback where the market tests it’s strength. It also gets rid of the weak hands. If the market breaks down, then you have nothing to worry about..you weren’t in it. Likewise, if you missed the move the past few days, the market will give a second chance for entry at the pullback.

The targets for the pullback would be at 920, and/or wherever the 20-day MA ends up meeting the market, and finally, at the 50-day MA (if it gets to that point). Did you notice the 20-day/50-day MA crossover? It’s lagging confirmation for a short-term bullish move. In addition, the market’s neutral range narrowed the bollinger bands that is setting up a squeeze. Watch the upper band expand.

Take a look at the steepness of the 3-day uptrend on the 30-day chart. The purple area shows the likely consolidation area. Many people want to see the market go up, up, and away! However, consolidation marked with down days are necessary and a part of the trending process. The rally continues until the trend changes.

Almost everything did very well today, except for the REITs. If they can’t participate on a +3% day in the market, then they have problems (maybe people realize that many REITs will get crushed this year). On an interesting note, retailers did very well today, which is confusing with what I just said about commercial RE. Many retailers must fail before REITs fail because store closures cut into the REITs NOI and the ability for them to fulfill their debt service.

Yesterday, I briefly mentioned 12 indicators, so I’ll describe what they are and how to use them below the usual charts. This is a bear market rally so don’t expect this uptrend to continue forever. Many indicators say that the market is overbought, but remember that the market can stay overbought or oversold for extended periods of time. Trade with the trend and keep an open mind as we cautiously climb this Wall of Worry.

SPX 30-day

SPX 6-month

REITs stood out like a sore thumb

—————————

12 Common Technical Indicators

1) Relative Strength Index (RSI) – The RSI is a momentum oscillator that shows overbought/oversold conditions. Typically, if a stock falls below 30, it is oversold. If a stock rises above 70, it is overbought. In addition, a stock rising above 30 is bullish and a fall from 70 is bearish.

2) Moving Average Convergence/Divergence (MACD) – The MACD is a centered oscillator that measures the difference between the 12-day and 26-day exponential MA’s (EMA). A 9-day EMA is used as a “trigger”. The best way to use the MACD is to look for divergences between the indicator and the price. If the market is dropping, but the MACD is rising, there’s a high probability that the market will reverse soon.

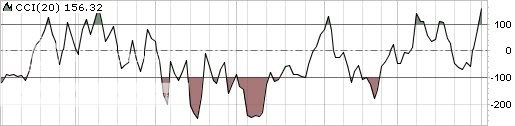

3) Commodity Channel Index (CCI) – The CCI was created for commodities, but it used for everything now. It is a cyclical indicator. The primary purpose of the CCI, for myself, is to confirm reversals. A move above +100 indicates overbought and a move below -100 indicates oversold. Just like MACD, a divergence can give additional clues to a pending reversal.

4) TRIX – The TRIX is a momentum oscillator that measures the rate-of-change of closing prices of a stock. For longer time periods, if the TRIX moves above o, it confirms a uptrend and a move below 0 confirms a downtrend. TRIX crossovers also give buy/sell signals. If the TRIX crosses over the signal line (the 9-day MA in red), it is a buy. If the signal line crosses over the TRIX, it a sell.

5) Force Index – The Force Index was created by Alexander Elder, the author of Trading for a Living, and it is used to determine if the trend is getting stronger or weaker. It is a price/volume oscillator. Buy signals are generated when the Force Index crosses above 0 and sell signals are generated when it crosses below 0. A sideways movement shows a possible trend change.

6) Slow Stochastics – The Slow STO is a momentum oscillator that indicates overbought and oversold levels. Typically, anything below 20 is oversold and anything over 80 is overbought. I’m not writing out the calculations for the %K (black line) and the %D (red line), but just know that if the %K crosses over the %D, it is bullish and if the %D crosses over the %K, it is bearish.

7) On Balance Volume (OBV) – I’ve mentioned that volume precedes price action several times. The OBV was created with that in mind. It basically adds volume when the price is up and subtracts volume when the price is down. This creates the line. A OBV line that is heading up means that there is more volume on up days. The opposite is true for down days. With many other indicators, a divergence between price and the OBV may signal a pending reversal.

8 ) Money Flow Index (MFI) – The MFI is a RSI that is more volume-weighted that shows positive or negative money flow. Just like other indicators, it can measure overbought (80)/oversold(20) levels. If the MFI is trending down, but the price is higher, the stock may reverse. The opposite is also true.

9) Rate-of-Change (ROC) – The ROC is a momentum oscillator that simply measures day-to-day (or period-to-period) change, therefore it is one of the more “choppier” ones. If the ROC moves above 0, it is a buy signal, and if it drops below 0, then it’s time to sell. Any divergences between the ROC and price should be paid attention.

10) Williams %R (W%R) – The W%R is similar to the Stochastics and it shows overbought/oversold levels. A reading below -80 is oversold and a reading above -20 is overbought.

11) Accumulation/Distribution (A/D Line) – The A/D line is similar to the MFI and OBV, but the calculations are different (you can look it up yourself).The best use for A/D line is to confirma move or identify a divergence.

12) Average Directional Index (ADX) – The ADX confirms the strength of a trend. The +D1 is the positive directional indicator (green) that measures upside force, the -D1 is the negative directional indicator (red) that measures downside force, and the ADX is the black line. The +D1 and -D1 are self-explanantory and the ADX is most useful when a divergence can be identify over a longer period of time.

If you enjoy the content at iBankCoin, please follow us on Twitter

very nice post. keep up kid. you seem to have a tremendous work ethic and a passion for your craft, just like Woody. i am really enjoying reading your posts. thank you.

Thanks much. I’ll check out some of the additional indicators that are new to me, when I’m back on PC. Nice to have in the cyclical bull. Look forward to your reads on the upcoming days and weeks.

Beautiful work, man, I’m really getting into it myself.

Your charts are much appreciated. I agree with you, I think TA has much to offer, although I think you make it look easy to some of the guys that read your posts, and envy, the green eyed monster, comes out of its cave (people think, “if its that easy, any idiot could do it!”). Haha.

Good luck, man, I’m working on my skills, and when I feel I’ve learned enough to contribute constructively, I’ll be back to give back to what you’re putting out here.

Peace.

Thanks Chivas…I’m enjoy John’s posts as well. Plus, I no longer feel compelled to create a bunch of charts every night for a post…that is a relief sometimes!

There are 3 keys to profiting from Technical Analysis:

1. Identifying 3 non-correlated indicators (maybe 4 as volume must be included) that you trust, believe in, and are willing to trade based on.

2. Applying a disciplined methodology for using these indicators to create entry and exit signals.

3. Developing money management / risk management rules that fit with the methodolgy you are trading.

I don’t know why I wrote that above. It is addressed to no one in particular.

very nice post. i am going to save this one as i really enjoyed it.

CA, about the only thing fly has done right lately was bringing you on board.Thanks.

CA,

Here’s a chart with three indicators that I think are non-correlated. Which way would you lean based on the technicals?

http://tinyurl.com/99oxpd

A tabworthy dude, if ever there was ..

man.. this is gold.

its great to see it all applyed to actual market conditions.

i have been reading my ass off for quite a while as you recomended, and its great to have your posts as a complement.

keep em coming.

John, Wood, Juice and team: if you please I wondered about situations to use market orders or stops. My previous trades have used limits and all or none, tho concerned they could waste time and opportunity since I’m increasing use of charts and indicators.

A little more detail is included in my similar comment on Danny’s blog today, which is a travel day on bberry for me.

Thanks

Thanks

Thanks, keep learning

Yes

Thanks

Thanks

Link doesn’t work

Thanks

Thanks, keep reading

I always use market orders. I use stops whenever I step away from the computer. Use limits if you want an exact price. I personally don’t fickle over pennies.

full moon on the 10 th turn date on the 11th…. looking for a pop this Monday (spx could trade to the next swing @ 951 ish) then a move down on the SPX back to 860 870 ish. Looking to buy a weak close friday…. provided that we trade downwards on weak volume. the 12 th should mark a Change in Trend.

Bob – I see you’re an IP lawyer. How do I copyright stuff (for example, articles graphs, manuals, etc.). What is the process I need to go through?

Anjing – How do you use a full moon to trade?

Yeah anjing, I gotta hear this one.

How’s the real estate in TDot?

Still frothy?

CA, I’m a bit confused.

How do you intend to copyright your charts when post of them are marked up charts from stockcharts.com?

I’m not an IP lawyer (not that smart) so, under US copyright law you would have to show clear elements of “fair usage” of the stockcharts.com and prove that you’re markups are significantly different to not cause a loss of value to the original source.

A perfect example would be if you were presenting the charts in an ironic manner.

If you are going for a ‘journalistic’ use, then I suspect you may have to fork over some coin to stockcharts.com

Not the charts. They’re already copyrighted.

I’m writing 25 articles for Wall Street Survivor and I was given permission to publish them after completion – a technical trading 101 series. I’m also creating a trading manual.

As for the charts themselves, I got those cleared for use. I just have to follow some guidelines.

John:

From biz side a great way to handle prob is to avoid prob. I’d say read any rights info stockcharts.com has posted on their site about use of their charts. Another biz angle for further consideration if communication with the site seems appropriate is the site may like a relationship as product placement ad for them in your use. Blazing forward from legal position without contacting the site takes some review. In general, if negotiation is appropriate, you often have better position before you’d invest, and could pursue workaround. Toward copyright guidance with fair use review please see my blog posts from October and September. Those posts include link and notes on steps you can take without legal fees. I’m on bberry so cannot insert the specific links to the posts for you right now. Also, the posts should come up if you click copyright in the categories, or type in the search box. Kindly note the posts and results display only one post per page, so you need to step thru the “older” link at the bottom. I changed to that one-post display format to favor loading for SEO as well as a preference mentioned by a reader of my posts. Fwiw I use wordpress. These are friendly notes, tho not legal advice on your specific situation.

John: following are the specific links.

http://bobbrill.net/?p=825

Entrepreneur Idol Class on IP and Your Ideas – October 26th, 2008

http://bobbrill.net/?p=594

You Can Be the Fairest (User) of Them All – September 18th, 2008

I asked them if what I needed to do for works that I create which may be sold using StockCharts.com charts and it seems simple enough.

——————–

Hi John,

Thank you for contacting us about republishing our financial charts. We allow anyone to publish static copies of our charts for free. We just ask that you follow a few simple restrictions found at the following web address:

http://stockcharts.com/help/doku.php?id=support:products:reprint_permissions

Please let me know if you have any more questions or comments about our website.

Thank you for using StockCharts.com,

StockCharts Support

——————–

And basically those requirements were:

1.

Our copyright notice, which appears on every chart, is visible and unmodified.

2.

Daily, weekly or monthly charts only are used (no intraday charts).

3.

You take your snapshot or copy when the market is closed (before 9:30 am or after 4:00 pm EST).

4.

These chart reprint rights are restricted to 25 charts per day. If you use more than 25 charts per day, please contact us at [email protected].

5.

“Chart courtesy of StockCharts.com” be placed somewhere near the chart reproduction. If the chart is on a website, we request that the “StockCharts.com” portion of this notice be linked to our website at http://stockcharts.com.

Thanks Bob. Your 2nd link answered my (c) questions.

hey chart addict can i get your email address? wanted to shoot you over some charts and get your opinion on how you would play it. one on H&S other on wedges. thanks

bravo!

would of used caps & more explanation points , but i see you were suffering from some sort of headache .

13/34 ema crossover mon-tues. Would make a nice bear trick, but they are still sick from all the halloween candy. A little bifidus and they’ll be ready to give prez obama a roaring greet

word.

markets economies etc move in cycles I just like to know where the lunar cycle falls. The SPX has a habit of making highs and lows in the short term near New moons and Full moons. I watch how we come into these areas in terms of price volume time S/R candle Patterns etc. For me its just another tool in the kit.

Pesavento has pointed out that the orbits of the planets run on fibonnaci series and he his the expert in this area along with pattern recognition. He has 50 years experience and has backtested his theories ad nauseum.

Gann’s square of nine is another idea of how to measure time or cycles … Jeff Cooper seems to have figured out how to explain Gann without getting too esoteric.

Like to read eh? Outliers is the latest by Malcolm Gladwell I burned thru that one … check out the fourth turning by Howe and Strauss.

Thanks CA!! You know what’s up… Gotta love learning about this kinda stuff.

ZM

Anj – very interesting. I’m aware of Gann, but never took his shit seriously.

Moose – Word. That is what is up.

We would love to feature this post on our site. We have over 2,000 RSS subscribers and thousands of uniques per day so please email me if you are interested. Full credit and links will be posted with the piece for return traffic. Thanks.

trading down on light volume just what the Doctor ordered…another -25 spx points should set up the next buy