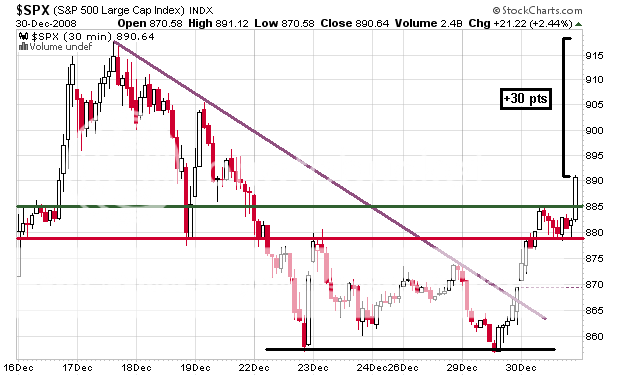

Another last-hour WTF moment…great. Just when you’re about to wrap things up, a power rally shows up busting through the door at the end of the day. I’ve been in cash the whole day (still am), so it didn’t make any difference to me. The action at the end of the day brings the SPX close to the 50% retracement level, or the halfway point between range support and range resistance located between 855 and 920.

The SPX also closed above the 50-day MA, but it must maintain itself above the 50-day by not breaking down during a consolidation period like it did mid-December. At this point, we need to see a solid breakout above 920 SPX. Keep in mind that we do have major overhead resistance.

I stepped back and looked at the 4-month chart for a while and noticed that we formed a “Pipe Bottom”. These formations don’t occur as frequently as flags or wedges, but they are highly reliable. A pipe bottom is formed when there are two large spikes right next to each other after an extended decline. In addition, the volume must be high on either one or both of the pipes.

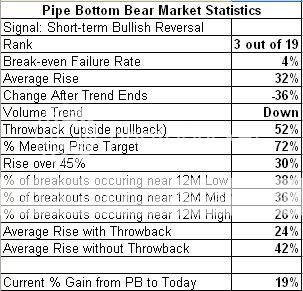

Statistics show that bear market pipe bottoms have a 4% failure rate and an average gain (rally) of +32% which makes this a highly-reliable pattern (as we can already see). 23% of these formations have gained in excess of 50%. This is one of the few patterns that are confirmed “after the fact”, however, the point is not to say “duh”, but to get some sort of price target.

What’s interesting is that we also formed a seagull pattern. This pipe smoking seagull is about to get HIGH. Keep in mind that this is a “short-term” bullish reversal, which means that it will most likely be a temporary fix and we will test the 750 lows. It is unlikely that this is the THE bottom like many have been calling recently. However, it doesn’t hurt to partake in the rally until a good shorting opportunity presents itself.

We still need some confirmation because the holiday volume just doesn’t confirm any type of price action when more than half the players aren’t even participating.

Here are the details:

SPX 10-day

SPX 40-day

SPX 4-month

For more on the Pipe Bottom, read Bulkowski’s 964-page Encyclopedia of Chart Patterns.

If you enjoy the content at iBankCoin, please follow us on Twitter

Good stuff.

Sorry to bump your post so soon, but had to get a few things off my chest.

nice post kid.

RC – Do what you gotta do bro. A little bird told me that he’s a ballsac hair away from getting a rootkit or maybe a logic bomb for New Years if he doesn’t quit this shit.

Chivas – like the POT-headed seagull?

LOL. loved it.

John, is that the same as a tweezer bottom?

I don’t know. I just like the thought of the pipe smokin seagull having some tweezers.

I want to add something. That type of bottom is possibly my favorite bottom. That was the type of bottom I was looking for, in terms of a reliable bottom.

It is damn near perfect. The strange thing is I missed it, initially, and didn’t get long for the rally into Turkey Day. However, I did get really short and caught that nice Dec. 1 swoon.

yes, a pipe bottom is the same as a tweezer bottom, but a seagull can’t have a good time with a tweezer.

I remember Dec 1. I made a paper 27% total portfolio gain in one day, but managed to take only 9% a few days later when I didn’t cover EOD. Oh well.

Dude, you’ve never seen a seagull plucking its eyebrows? Where’ve you been?

LMFAO

I don’t want to know where YOU’VE been.

CA – I know your pain… December 1st threw me for a 20% gain and I got my ass kicked the rest of the week. I like what we have setting up though, it matches the Dec. 15-17 trend very very closely, and I’m waiting for that 900-920 to drop… We have a chance of hitting it tomorrow, and if not tomorrow, then definitely by the end of the week. Awesome stuff as always man!

ZM

A toot from my horn …

Employee8 Says:

Told you before this would happen …. this is a slow melt up, no one believes it due to low volume but by the time the retail buyers and the doubters get in and the volume develops it will be over … that’s how it works … damned if you do and damned if you don’t kind of thing.

December 16th, 2008 at 9:11:47 pm

http://www.ibankcoin.com/dannyblog/index.php/2008/12/16/the-new-great-bull-of-2009/

ZM – It’s a lesson learned the hard way. It happens.

E8- A toot well deserved. Good job.

I know how it works, but there’s always that unknown factor. We should see the volume about 3-5 days after we come back from NY’s. We’ve definitely broken some key levels, but 920 still remains as the biggest bitch of all.

E8 – lets revisit those comments in two weeks.

OK, I may be short by then but no matter …. I’m with the Jake/Wood camp playing this rally for the time being.

HNY!

John,

Great stuff this year. All the best to you in 2009.

It’s funny, but I’ve been calling that “seagull” a “batwing” for about three weeks now. And I don’t remember where I saw the reference to batwing, but it was from a couple of years back.

Or maybe it was a DC comic book.

_______

So, there’s a 48% chance we go above 978 (34% from bottom) by my calculations. (.5 * (1-failure rate of .04))

Wondering if you have the standard deviation of the average rise? On today’s tape we hit a ~23% rise. Also, is the time to the peak of the rise a meaningful statistic? Is it usually a matter of a month or so, or longer than that?