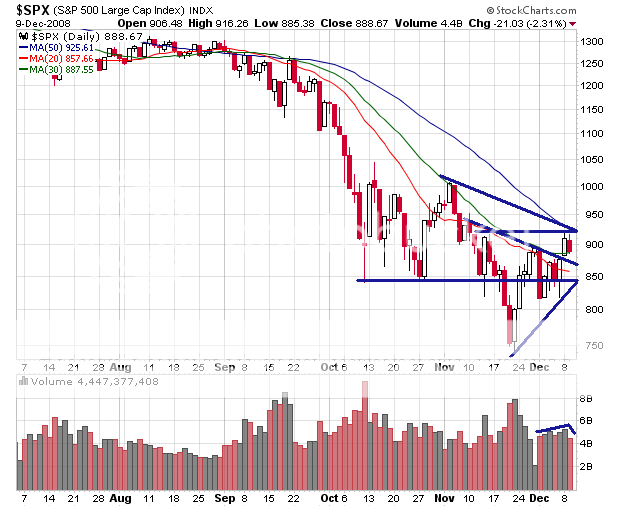

We formed an inside day. Technically, the market can go either way, but it usually marks a period of consolidation which marks a continuation in the trend. The market (SPX, DJIA, COMP) is sandwiched between the 30-day MA and the 50-day MA and there’s going be more neutral trading.

Volume has also become increasingly light. Typically on a breakout, you see huge volume, and during consolidation, you see declining volume. We are seeing the second but we didn’t see the first, and that alone can be worrisome.

Still, the market remains in a neutral range bound by the 50-day MA and Monday’s gap. As long as the market doesn’t breach 880 and breakdown, then the bulls still control the market for the short-term. As of today’s action, the breakaway gap still stands and judging by the action in the last 2 hours, we could be setting up a small double-bottom.

What I’d like to see is a break out from the 50-day MA, but that is probably too much to ask for. If we form a bullish stick sandwich and cancel out today’s loss, then that would be bullish enough. I think the smartest thing to do is to have a large cash reserve to take up positions once we leave the consolidation zone.

My two biggest plays today were long DRYS (since yesterday) and EXM (this morning), bringing me up to a +18.4% gain for the month so far. I got smart this week (vs. last week) by getting into a 50% cash position and cut out all leverage. Those we’re heavily-concentrated allocations for my spiker strategy. Typically, these same names turn into short candidates once they run out of steam, enabling you to profit from them on both sides. Always look out for spikers for a quick day trade or 2-day hold.

SPX 1-day

SPX 3-day

SPX 5-day

SPX 10-day

SPX 6-month

DJIA 6-month

NASDAQ 6-month

If you enjoy the content at iBankCoin, please follow us on Twitter

TCA, I’m not sure that volume is such a concern here. Honestly, volume has been high, relatively. Have you looked at other intermediate term bottoms in bear markets, in regards to what volume was doing when they started coming off the lows?

I have not performed any exhaustive studies, but what I remember from some of the exploring I have done is that volume is typically fairly light as the indices consolidate and then come off the bottom.

In fact, from a contrarian view, a surge in volume may mark the return of dumb money, which may signal a top is near for the rally.

word, I agree. More volume on yesterday’s breakaway gap would have been nice.

Dude, where are all the little cartoon pictures? I’m having trouble reading these charts.

BTW, as for volume, we’ve had 3 accumulation days in the past 4 days counting back from yesterday (i think i just confused you). Last week Tuesday was a Follow-Through Day on the SPX. … therefore, we are in a “confirmed rally” (Ha!) and it’s buy the dips on the high volume leaders for now.

Longterm, volume is against the bulls… until we get an up-day or a combo of up-days with volume matching October’s high volume selloffs, then this rally will, as Shed put it, be full of “dumb money.”

-gio-

Gio — reread Wood’s post. The low volume buildup here (without the subsequent heavy selloffs) indicates it’s NOT dumb money putting this (possible) intermediate low in here.

_______

30 day simple MA turned upward friday yo

all money is dumb money.

All Lakers fans suck cock behind closed doors.

sold EXM and DRYS. It’s their last day.

Patience.

_______

I sold near the 50-day MA on those two. I’ll get in if break that level. Otherwise, they’ll prob form an indecision day that could turn them into short candidates on a morning gap down tomorrow. A gap up tomorrow means buy!

I made over 40% on each of them so I’m content.