Before you say anything about Carl Icahn, you cannot argue with the fact that he is one of the greatest investors of all time. Is he intelligent? Is he ruthless? Is he is lucky? Yes to all.

However, with his recent double downs in LNG and FCX, as well as holdings in CVI, CHK, and RIG, one has to wonder whether he’s losing his touch.

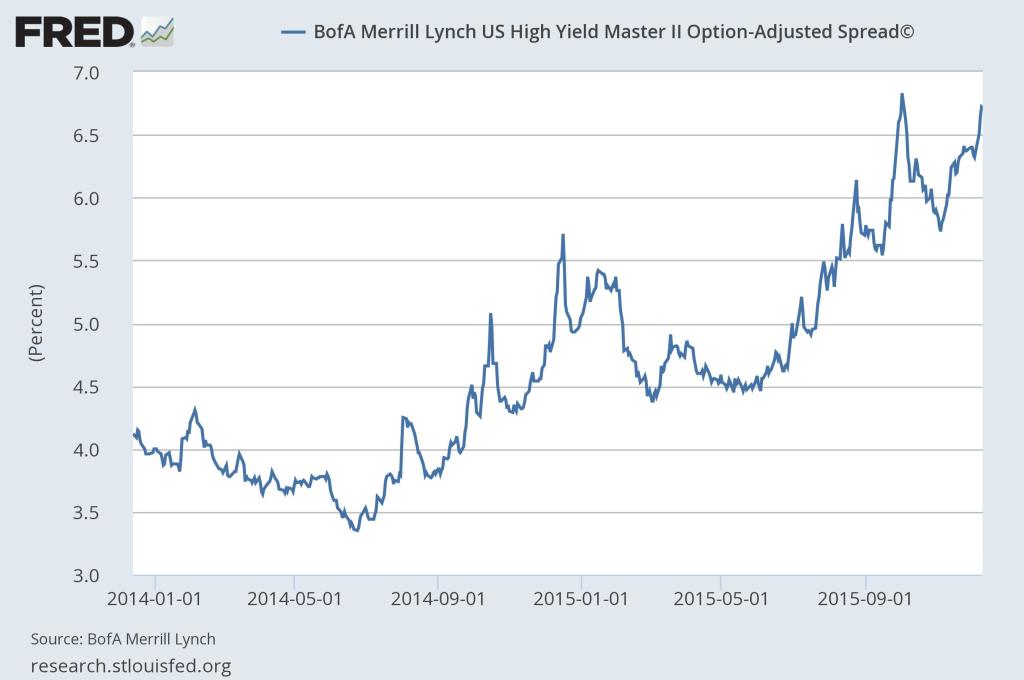

With the high yield market starting to publicly teeter (this isn’t a surprise to many); I had wrote about this in a post just over a week ago: Coming Down from the High.

After reading two separate posts on iBankCoin about Uncle Carl, one from The Fly Icahn: This Market is a ‘Keg of Dynamite’ Ready to Blow and the other from Activiststocks Icahn Goes Senile: Loses Half Billion, something came across my mind.

How and why is Icahn pushing a large amount of chips in the middle of the table on his holdings in these debt laden commodity companies, while giving out warnings and at least seemingly being cognizant of the dangers in high yield?

While Activist gave an entertaining and very possible explanation, I’d like to explore three other reasons, and will conclude at the end where my vote is.

Hypocrite

The reason I say this is because Carl has been at the forefront beating the drum about the dangers of high yield. Just take a look at this strange video produced by his daughter, Danger Ahead.

Carl has also been a stringent critic of Larry Fink, Blackrock’s CEO, saying that his high yield ETFs and mutual funds are in deep trouble and will cause major problems investors. I love how he always just refers to him in interviews as “Larry,” as if the viewer was a dear personal friend of Fink’s.

Lunatic

After watching the video referred to above, one has persuasive evidence that this is a sound choice. He would also be considered borderline because he has been buying more shares of LNG and FCX, a liquefied natural gas company and a major commodity player.

Both of these organizations have been issuing debt like a fat guy eats donuts; quickly and messy.

Someone with the investing acumen as Carl would realize that these are risky businesses, with commodities in a constant deflationary state. The actual operations and basic materials that drive these interest and principal payments are in serious peril.

Only a mentally incompetent person at this point would be adding to their position, especially one that manages billions of institutional dollars.

Strategist

So that brings us to the answer that, with everything being equal, would seem to be the most correct explanation. I can also explain why this is the best answer, without everything being equal.

Carl runs a hedge fund, a giant one that moves markets. A hedge fund is supposed to hedge! Over the past few years, the running joke on Wall Street has been long/short funds are just long.

Over the past few years, the persistent rumor (and likely truth) is that many managers have stopped hedging.

However, I am of the belief that Queens’ own Mr. Icahn has very likely been hedging, and this is what explains the perceived talking two sides of his mouth in going very long LNG and FCX, and screaming like the Boy Who Cried Wolf that high yield will drastically crash.

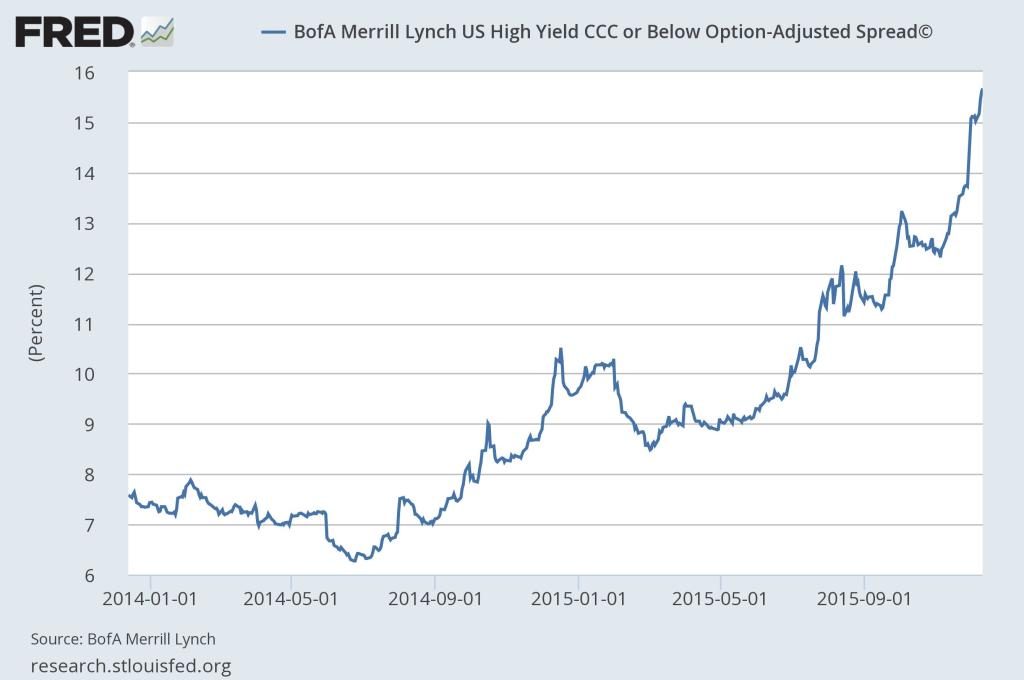

If you read my prior post about high yield coming down, my belief was based on the divergence of spreads between CCC and Below rated from the Total High Yield. While I believe charts have their limits, I’ve based my thesis on the charts themselves telling me and the general market a story.

If a beginner blogger who recently had his training wheels removed, such as myself, was able to catch this move, there is absolutely no reason why Mr. Give Me Three Seats on Your Board and his team Ivy’s wouldn’t be aware of this.

Remember, 13F’s only disclose long positions; Icahn could easily buying puts or shorting HYG, or selling calls on his commodity companies, or multiple other strategies of protecting the downside.

This is the divergence I’m talking about; please see the upward sharp move in the CCC and Below in late October of this year:

Conclusion

I believe he is a Strategist, and doing something he always does: talk his book. Although there is no way for me to prove that he is also protecting his tail and hedging, him building up his long position and warning about high yield makes complete sense.

But then again, Carl Icahn could easily be senile, a hypocrite, a lunatic, or all of the above…

If you enjoy the content at iBankCoin, please follow us on Twitter

excellent.

KRAMPUS is still coming.

Thank you good Dr. Hopefully this will fight away the evil spirit. I’ve avoided oil and energy names this year so hopefully Krampus and St. Nick will both take note.

Nice post.

Thanks DJ; I always appreciate any feedback and comments.