As the saying goes, the bond guys are the smartest in the room. The alpha male out of all those Rain Man brainiacs is Jeff Gundlach.

Gundlach has been pounding the table and shaking his head at the notion of the Fed raising rates. Recently, he was quoted as saying, “I do believe the Fed raising interest rates will increase volatility and will weaken the economy.”

However, as another saying goes (for you newbies, there are plenty of mantras on Wall Street), don’t fight the Fed. Gundlach’s play book to prepare for a rate hike: Take more interest rate risk and less credit risk.

Translation= Buy long-term Treasuries, and sell high-yield bonds. In his words, “the long bond wants the Fed to tighten.” He oversees $80B. How much do you manage? I for one will not argue with him.

While I encourage you, the reader, to explore the idea of buying 30 year bonds, the rest of this article will explore the notion of selling high yield bonds, and what potential impact that may have on equities.

This will be broken down in a few graphs/figures/exhibits, along with commentary.

High Yield Spreads

The first graph represents the spread for all credit classes of High Yield bonds. The second graph represents a subset, CCC or Below. Higher spreads means an increasing amount of credit risk.

Think of the first graph as a bunch of different whiskeys, while the second graph is swill contained in a plastic handle that you wouldn’t even serve at an undergrad house party.

The takeaway: For the most part, both lines tend to move in a very similar pattern. However, you’ll notice a steep move to the upside in the CCC or Below but not in High Yield as a whole beginning about a month ago.The credit market seems to be signaling that there is more risk underneath the surface, especially in the lower rated issues.

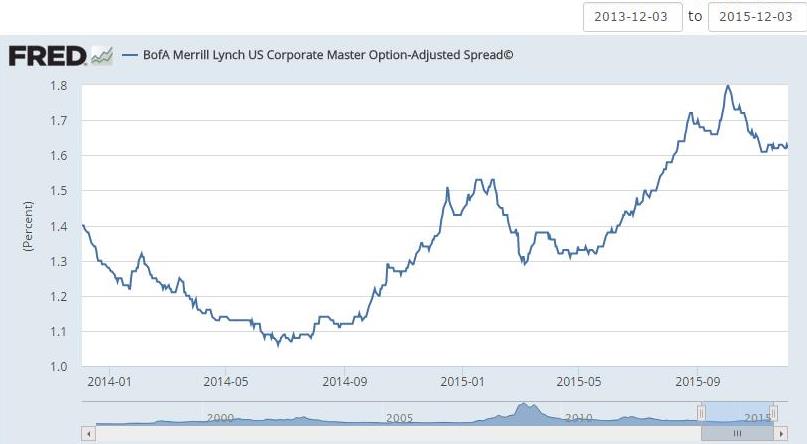

Corporate Debt Spreads

This graph represents credit spreads for higher grade credit issues, particularly in the corporate debt space. Essentially, a much tastier and higher quality group of wine bottles as compared to the High Yield’s collection.

The takeaway: While spreads here have been in a general uptrend as well, you’ll notice that they’ve been flat, and almost dipping lower, right at the same inflection point of where CCC or Below broke out to the upside. I interpret it as rate risk not impacting the higher quality instruments, but that there is major concern in the junk. And remember, dumpster fires can spread to nice areas rather quickly.

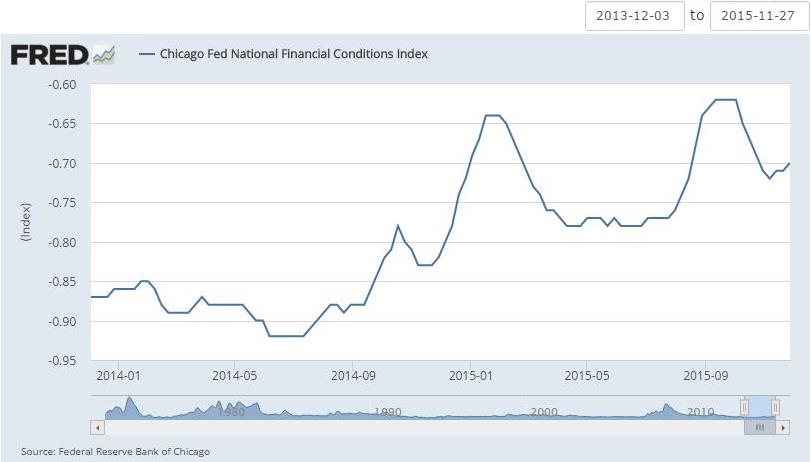

Financial Conditions Index

Here, the higher the number, the tighter the actual financial conditions and environment. Not too alarmed here, despite the upward trend. I’ll trim some risk and sound the horn if we start creeping into -0.5/-.55.

Leveraged Loan Index or ETFs

There has been a continuing decrease in Leverage Loan arena, as measured by the PowerShares Senior Loan ETF (BKLN). This is another factor in considering that higher yielding instruments are becoming less attractive.

Conclusion

The combination of the credit cycle being stretched as far as it ever has been, the seeming intentness of the Fed to raise, and under 50 ISM reading in November, the maturity wall may be too high to climb for a ton of these High Yield instruments.

With everything presented above, I do believe it would be wise to take a little risk off the table and go into some cash. I’m not predicting a crash or a spike because, even if I knew, I wouldn’t be posting it here without charging all of you.

An additional tactic is to buy SJB (Inverse High Yield ETF) or purchase puts on HYG. With the cash on the sidelines and with HYG being a much more liquid trade, the plan is to hedge by using 2%-3% of my account and purchase long dated HYG puts.

If you enjoy the content at iBankCoin, please follow us on Twitter

Great post BOYAJ

Thanks probucks. It was my first credit-based post, and hoped it shined some light on the credit market. It’s impossible to predict a crash, so I just try to take some risk off when I believe there could be rocky times ahead, but I won’t go all cash or short because there’s always the fact that the market drifts upwards in the long-run.