You think this market is done? Don’t jump up and stick a fork in it just yet. As John Maynard Keynes has often been quoted, “the market can stay irrational longer than you can stay solvent”. I suspect that applies to both bulls and bears.

That said, my market readings are indicating we are overbought at this point in time:

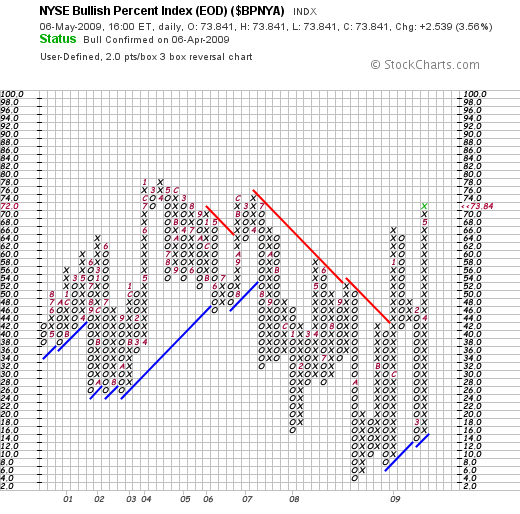

NYSE Bullish Percent: 74%……The last time we were at this level was June-July 2007.

Nasdaq 100 Bullish Percent: 84%….This level is higher than the 82% recorded in April 2001. The only time it has been higher than now, was in June 2003.

Percentage of OTC stocks trading above their 10 week MA: 84%……This is the highest level since June 2003 (highest level ever recorded). The current level is also higher than at anytime during the tech bubble.

Percentage of NYSE stocks trading above their 10 week MA: 92%….This is the highest level ever recorded, surpassing the 90% level in May and June 2003. During the tech bubble of 1999- 2000, the readings were only in the 80%-85% range.

The percentage of NYSE new highs to the total of new highs + new lows is currently at 74%. This is consistent with the bull market readings of the late 1990’s where levels reached up to over 95%(!). During the height of the tech bubble 1999-2000, this reading was actually only 50% in January 2000. The market peaked two months later in March.

Given these simple metrics, one has to conclude that we are very overbought. However, there might still be room for us to see the ratio of stocks hitting new highs expand even more, which would be consistent with the peak of a near term bubble.

A word to the bearish and prudent minded: If in doubt about the ability for this market to continue to rally, go back and re-read the Keynes quote.

In practice, it is prudent to start taking money off the table here and have some hedges in place—-just in case the market regains its senses.

If you enjoy the content at iBankCoin, please follow us on Twitter