__________________________

Tomorrow, and tomorrow, and tomorrow,

Creeps in this petty pace from day to day

To the last syllable of recorded time,

And all our yesterdays have lighted fools

The way to dusty death. Out, out, brief candle!

Life’s but a walking shadow, a poor player

That struts and frets his hour upon the stage

And then is heard no more: it is a tale

Told by an idiot, full of sound and fury,

Signifying nothing.

— Billy Shakes (Macbeth, Act 5; Scene 5)

__________________________

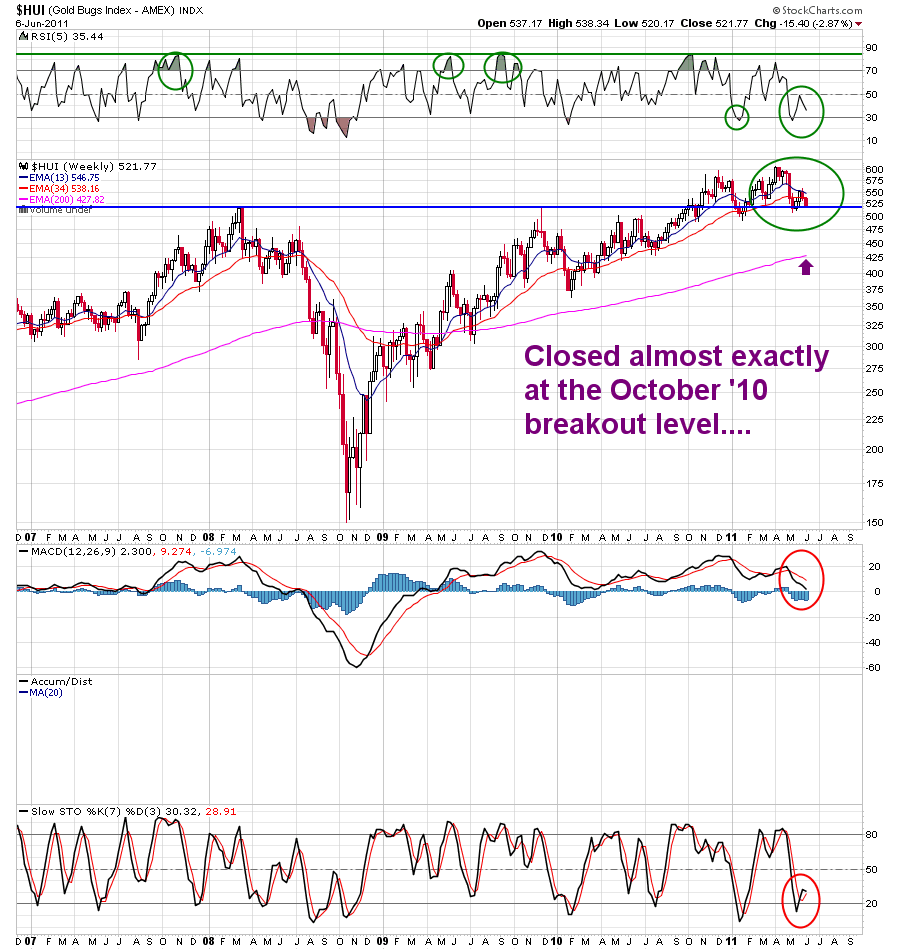

I think tomorrow will tell the tale, as I just don’t think this freaking Blackened Cross situation is going to last much longer. It’s either going to break down and we’re done, or we’ll have liftoff here:

Again, I’m not getting very excited here. Gold is hurting tonight, despite the dollar’s continuing south. Silver has worked off the oversold condition, and it too looks like it might take a breather here. If, however, we get a break through those price barriers above, then it’s “Party on, Garth!”

In the meantime, I have something more immediate: a Monsieur Le Fly special — a Hunnit Dollar Roll stock, starring one of my old clients from the old days — JOYG, whom I love because it sells… what? MINING MACHINERY! What’s not to like?

Note: the above is a weekly chart, so this current move carries even more weight, given it’s rocketing off the 34-week line and through the 13-week EMA. I’ll be balderdashed if we don’t get a 100-plus roll going forward.

Best to you all, my friends.

____________________________

Comments »