SUNE could go lower –it should go lower– but I’ve always been wary of the high short concentration, most of which may be a hedge by SUNE’s convertible bond holders. IV on the Jan options are now over 600, having doubled since yesterday.

I’m holding what is now a decent-sized TERP long* but I still expect volatility ahead. My (unpopular) thesis is Appaloosa actually wants VSLR to close – but will then seek an injunction blocking TERP’s involvement. This should leave SUNE in (another) desperate scramble for cash, a situation Appaloosa will then use to negotiate majority ownership & control.

Not a believer? No problem. It’s what makes a market. (The lawsuit should determine if this is a correct view or not.)

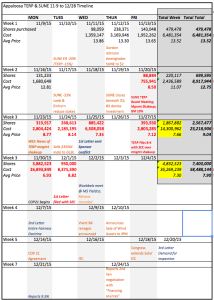

Here’s the calendar view I put together of Appaloosa’s filings for Twitter a few weeks ago (backdropped against the daily headlines for context):

What do you see?

What jumps out to me:

Week 1: Appaloosa starts buying in size – doubles down on their previous 200k shares – but only after SUNE/TERP ER collapse

Week 2: TERP drops an additional -35% (from $13 to $8.5) but Appaloosa only buys 1/3 of prev week’s volume? This is unusual.

Week 3: TRIPLES down (!) *AFTER* TERP board shakeup

Week 4: DOUBLES down AGAIN and completes full purchase on the day 1st letter filed w/SEC

The best part, Appaloosa ticks the absolute bottom on 11/30, buying 1/2 their TOTAL position at the all-time low (knowing its SEC filing is public on 12/1). That, my friends, is the power of carrying a big stick. What can be better than being your own catalyst?

Appaloosa filed another 13-D on Jan 7, updating their Demand for Inspection request. A lot of conjecture out there that using this approach shows the weakness of their lawsuit.

I disagree. Anyone thinking Appaloosa is putting the reputation of itself and its founder – a member of the all-time investor’s pantheon – at risk of negative PR over a sloppy legal interpretation simply hasn’t studied them, much less how their buy was executed.

Ok, I already know the answer. There are a lot of folks out there who think exactly this.

Timestamp this post, folks, the guys that did *that* surgical buy probably don’t do anything without complete conviction of purpose. And in my book, 150bps isn’t going to cut it for them. (Their position, should it go back to the all time high, would represent 150 bps gain to the greater Appaloosa $24B AUM)

Remember, the whole SUNE complex that was trading north of $35B 6 months ago now has a combined market cap of…exactly $3.1B.

(Fun Fact: SUNE at $1B now trades for exactly it’s remaining ownership stake in TERP and GLBL.)

Speculation Warning: I’ve wondered since the July announcement as to why the management team at SUNE levered up so high to pursue VSLR (and other renewables) in the first place. It never made sense. With the advantage of hindsight, probability is very high they had advance knowledge from their lobbyists that the US Congress was putting renewable tax credits (ITC) back into play in the Fall. Combined with the global climate summit in Paris, were they using M&A to front run what they speculated would be a 4Q run in solar and renewable stocks? Why else would they leave themselves zero contractual outs with BX?

From that viewpoint, everything they’ve done since resembles a fully margined swing trader who was too early with his thesis – and is now raiding the wife’s 401k and the kids’ trust funds to make good on the margin call that just blew up their account. Frankly, I think the odds are better for the Shkrellied KBIO retail shorts to get Etrade to forgive their debts than Tepper’s allowing SunEdison’s C-suite to regain the value of their equity via his involvement. I could be wrong, but for now, I’m convinced he’s set on taking it all away from these foolish, reckless managers.

After putting the buy chart together, what stood out to me was the discipline, conviction, speed and precision of the Appaloosa buy. They had a plan in advance, they waited until they saw what they wanted, and then moved with astonishing aggression. Quite honestly, I’ve never seen anything quite like it, at least in the world of finance. They executed this buy like a special forces operation…or, even better, a lion hunting a gazelle.

For that reason, I’m sticking with the Tepp on TERP, and that likely means increasing the position should TERP tank on a possible dump from…oh, I don’t know. Say some large shareholder out there who’s desperate for cash.

And should Tepper gain control, could the capital and standing of the mighty Appaloosa allow TERP to revisit its former highs?

If that happens, I’ll likely close the long.

At the end of the day, the yieldcos still give bond-like return for equity level risk.

In the interim, I expect the market to continue getting this one wrong.

-g

*There are some concerns with the quality of some of TERP’s holdings in regards to counter party risk (a copper mine in Chile comes to mind) but these are difficult to investigate. That said, TERP’s distressed price & yield leaves something of a margin of safety.

If you enjoy the content at iBankCoin, please follow us on Twitter

so u shorted a sub $10 stock with high short interest that u knew was under heavy institutional buying? how well does that work for u in the long run?

not to stroke ur own cock (no homo) but what puts did u buy and when and what was your % profit.

congrats on the trade

Don’t know about the heavy institutional buying.

What matters are the specifics and particulars of each unique short, not whether it’s sub $10.

$7 $6 $5 and $3 Jan Apr and Jun strikes. Total gain 125 bps on AUM. The poor r/r was why I closed. With IV so high and SUNE shares unavailable, not sure how anyone can put on a rational short trade without CDS. With today’s decline and rumors of a lawsuit, I’m a spectator in SUNE and unhedged on the TERP long, which is up about 200 bps on AUM.

Read my Twitter stream, it’s all public record. I warned followers the SUNE short was high spec, and partially a hedge on another sub-10 purchase (TERP). My changing take on the situation was considered controversial, and it’s posted here on the blog. I flipped short on SUNE back in early December AFTER going long post earnings with an ultimate cost basis in the low $4s (closed for no gain.)

Good luck.