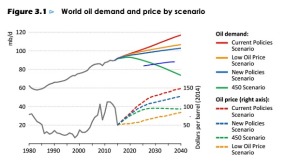

From AEP’s latest, the IEA projects oil demand will fall to 103m b/d in 2040 under even modest carbon curbs, along the lines of the climate pledges made for the COP21 summit in Paris by the US, China and India, among others. By 2025, a “two degree world” may be well within sight, collapsing oil demand to 83.4m b/d.

Meanwhile, Opec keeps forecasting that oil demand will keep rising, to the tune of an additional 21m barrels of oil per day (b/d) to 111m by 2040.

~30m barrels is a big delta. Somebody is 30% wrong.

The next leap foward in technology is going to be in energy storage. Teams of scientists at Harvard, MIT and the world’s elite universities are in a race to slash the cost of batteries – big and small – and overcome the curse of intermittency for wind and solar.

A team in Cambridge says it has cracked the technology for lithium-air batteries that cut costs by four-fifths and enable car journeys of hundreds of miles on a single charge. By the time we reach 2040, it is a fair bet the only petrol cars still on the road will be relics, if they can find fuel at all.

“Everything will be electrified. The internal combustion engine is a dead-end. We all know that, and the car companies ought to know that,” said one official handling the COP21 talks.

All this may be a long way off. Regardless, it doesn’t sound too promising for the future of oil, coal and gas-related investments.

Here’s where energy –particularly oil– investing gets complicated:

Al Qaeda in the Islamic Maghreb showed it could launch a devastating surprise when it crossed into the Sahara two years ago and seized the Amenas gas facility in Algeria, killing 39 foreign hostages. Variants of Isis can strike anywhere they find a weak link.

“We remain concerned that they may eventually set their sights on a major oil facility. These are obvious targets of choice, and none of this geopolitical risk is priced into the market.”

There have been five Isis-linked terrorist acts on Saudi soil since May. They include an attack on a security facility near the giant oil installation at Abqaiq, where clusters of pipelines offer the most inviting sabotage target in the petroleum world and where the aggrieved Shia minority sit on the Kingdom’s oil reserves.

The Shia, as in Iran. The guys the Saudi’s are waging proxy wars against in both Yemen and Syria. Yeah, Syria. The former country where all the newest Europeans are from. The place where Russia is wintering its soldiers, planes, missiles and bombs. (I wonder where the Russians want the price of oil to go?)

So, the probability of an “incident” that spikes the price of oil is increasing.

But such a move might only be temporary. Any spike allows the U.S. shale E&P sector to re-emerge, re-hedge, and re-flood the market, re-tanking the price of oil and gas.

Both the supply and demand sides of the fossil fuel story look increasingly poor. Energy investing, at least in fossils, looks increasingly binary and volatile.

Interesting times. So what can we conclude?

- Expect intermediate term volatility. Big binary up and down moves are increasingly likely.

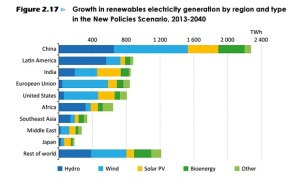

- The long term trends indicate less, not more fossil fuel demand. The impact that has on both the global economy, and the underlying shadow banking system are far-reaching.

- The long term trend suggests increased demand for renewable power generation.

Are there other conclusions to be made?

Whether SUNE is the right, best investment or not, it’s tough to say. But it seems to me that it’s in the running for the most misunderstood & scary award.

Assuming it can make it through this bit, it also likely has the highest upside potential. (Priced like it’s insolvent but the data suggests it probably isn’t. Its debt levels are high, but perhaps not as high as believed, their counter parties are strong and while interest rates are going up, it’s going to be at a measured pace. At least that’s what the Fed promises. The biggest SUNE problems appear fixable. Meanwhile, we know it was a hedge fund hotel, and we’ve discussed the short-term, weak-hands issues that involves.)

Am I being too conservative to only allow this thing a 2% position? Hmmm. Probably not. Consensus seems split on it going to zero or being a multibagger. I’ve decided to treat the equity like a call option with zero theta-decay.

What are some other investments you see to play this increasingly probable green-energy carbon reduction trend?

How are you managing shallow and deep risk?

-g

If you enjoy the content at iBankCoin, please follow us on Twitter

As much as I wanna go balls to the wall, I keep my oil short to 1 – 2% positions like every other investment. What the oil bulls need to fear most is that energy battery breakthrough announcement that would relegate oil to primarily military and industrial use. At that point we can probably produce enough oil on our own.

Sarcastically I am thinking the car manufacturers are offering insane deals and ez financing to offload every gas engined car they can before the tide turns to electric. I am hoping to get 10 more years out of my gas engined car so I do not have to buy new gas engine.

Have no idea which solar company rises to the top. I can see natgas as a bridge to alternative fuels and will have a renaissance in the ensuing years.

Hi G. Enjoy the post, and your analysis is always thought provoking, even for those who may not agree with it. Couple things…

First, to answer your question about how to play this, I think the ETF $TAN is intriguing. Good way to reduce micro risk, especially for someone who wants to play solar in general.

Second, could you expand on your thesis about $SUNE’s counter party risk being low? Not questioning you on this, but interested in knowing how you came to the conclusion.

1/ Most (all?) of their projects non-recourse. Specifically construction finance can be termed out as project finance when the construction is done.

2/ They compete against retail power rates v wholesale. (All?) These are low risk entities like airports and Home Depot who would otherwise be paying utilities. So the counter party risk equivalent to what the utility sees.

If true then market fear for this company cannot cause insolvency.

Could be wrong though, because we can’t see *all* the funding (the disclosure is complex) but the bits we can see have this character.

Unlike counterparty risk, liquidity risk is the core SUNE concern. Margins falling due to wattage ASPs, and they missed on turning around sales to investors. This thing is hard to analyze, hence the current valuation. This along with weak hands and fear are what drew my interest.

*If* it gets through this patch, it will be ok. (By the looks of price action, not looking so good is it? We shall see.)

I’m willing to stake 2% –and no more– on the counterintuitive trade and treat my equity like an indefinite call option.

Anyone backing up the truck is doing it wrong.

In my mind, it goes to a min of zero or…4-5x? That’s risking $4.5 to win as much as $16. Good positive optionality.