Those are words you never want to hear.

Unfortunately, for one trader who was caught short KBIO yesterday this is a reality.

Poor fellow started a gofundme.

Hello to all you traders out there. I’m starting this page out of the recommendation of other traders in the community.

I hesitated on doing this but I literally owe Etrade $106,445.56 as of this moment what would you do if you were in my situation? I’ll do whats needed and sell what I have to get them paid but if someone feels my pain and is willing to help out—who am I to say no?

If you don’t want to donate I understand, at least read my story of what happened today and protect yourself from the same happening to you! This is a terrible lesson for me but if this helps just one person than I’m happy I wrote this.

I’m a fairly new trader, been trading since about March of this year. I have learned alot about the community and trading…well not enough about trading as you will soon hear.

I have a fairly small account, but its over PDT. As of this morning it was $37,000. I keep it small because I wanted to manage risk, the most I can afford to lose is what I have in the account….$37,000. When I get some profits I take them out of the account because I wouldn’t want to lose more than $37k.

I was holding KBIO short overnight for what I thought was a nice $2.00 fade coming. At the close of the bell I saw the quote montage clear out and figured today there was no action after hours in the stock. So I went to my office for a long meeting. I got out of the meeting and saw a message from one of my buddys, he asked if I was ok since I was short KBIO….my heart dropped. “Shoot did I blow up my account, everything I worked for? I don’t want to lose all $37,000 that would be terrible.” —It was much worse.

The stock was at $16 and my account was negative over 100k. I figured it was a mistake, Etrade would never let that happen, they must have cut the position when my account got to $0….nope. I immediately called them and they confirmed I still owned all the shares. He says that it got out of hand too fast for them to cover me, he says that all he can do right now is cover. I was devistated. I asked him to cover at $16 and he waited trying to find me a good exit. I told him to do it asap and the fill was around $18.50 avg.

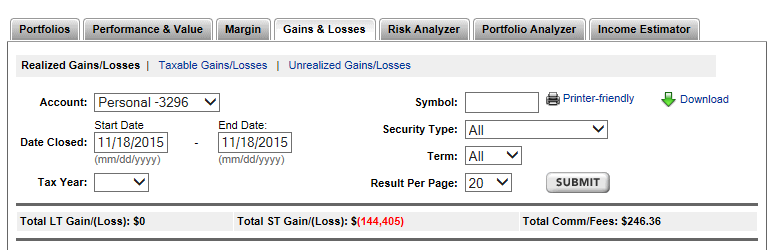

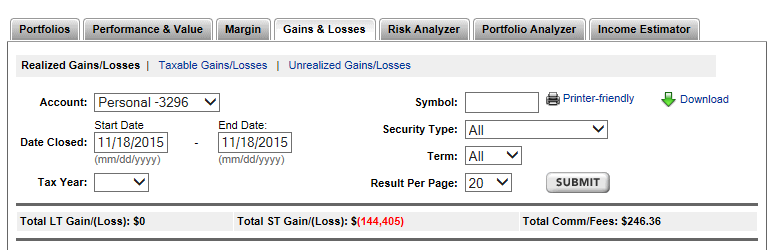

At the moment not only is my $37k gone, but I now owe ETrade the negative balance of over $106k. I always knew I could blow up an account and I was financially able to “afford” to lose the $37k. Never in my wildest dreams did I imagine that Etrade would NOT have some sort of stop or circuit breaker in place that would automatically cut a position if the account went to $0…..how could they ever let it get to -$144k loss on a account that small! Also, why did I have to call them to find out what was going on, why did they not alert me or call me when it went neg???

I’m never one to ask for a handout and honestly I’m kinda not sure if I should post this but here we go. I’m sure it will cause lots of controversy on whether or not I deserve even a $1 donation but it doesn’t hurt to ask. Anything you traders can do to help me get a little out of this hole would be a blessing for me. Anything donated will go 100% to simply paying Etrade some of this $106,445.56.

My plan moving forward is to liquidate mine and wife’s 401k’s and try work out a payment plan with Etrade. I’m also going to ask them to help out in some way…thats a longshot. I will pay them and be back trading….only with set stops this time. What an expensive lesson that was.

I hope my story helps someone else from the same.

Not being short low float biotech is a cardinal rule of this game to avoid being blown out. But a company that was planning on liquidating? This is complete fuckery and even more evidence that one should not short low float biotech.

For even more evidence, look at AQXP in August.

I would like to think I wouldn’t be cable of doing something as stupid.

Either way this story is scary and I don’t feel like trading stocks anymore.

Comments »