Greetings internetland, lets speak for a moment about the state of the market as a whole.

Last night, I spoke of how a chart is a visual representation of the behavior of market participants. Since the start of the year, the tenor has been one of euphoria. Down days were scarce and volatility had completely dried up. Clearly, in the past week, the market has taken on a different character.

If you follow these posts, you will recognize that I had difficulty with going in big when the market was in “levitate” mode. Now that a tsp. of chaos has been thrown into the mixture, why should I have conviction to add to existing positions and/or buy new stocks?

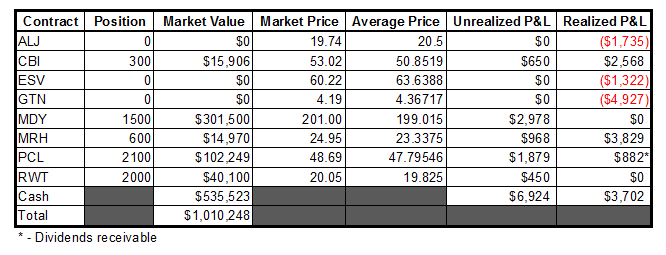

From an intermediate term perspective, now seems like a perfect time to play defense, protect gains, and wait this out. I have exposure to the market via my ~30% position in MDY, and a handful of other reasonably defensive positions so it’s not like I will miss out completely should we resume our ascent.

On the other hand, as you may know, I recently rediscovered my stash of insidious crack rock (via the options market) and have been trying my hand at a few short-term trades. In true addict fashion, I closed my VXX Weekly 24 put position yesterday at various points, and ended up with an 83% return overall on that trade.

Heh, nothing like a big winner right out of the blocks to inflate my confidence, right?

I thought about buying puts on SLW or SLV, but instead opted to buy some weekly calls (460) in AAPL later in the day after the post-meeting sell off. So far, that trade has been a dud.

I will be watching for signs of the market starting to roll over when we reach the top of this new range that has formed since mid February. Right now I think the most productive scenario is a slow grind sideways around between 1515 and 1530 on the S&P. With my market indicator still showing “green” it will be difficult for me to go short the market here, but I am starting to look in underperforming sectors for individual candidates to short if it looks like we are going to roll over.

Interestingly, I just ran a screen on the sector ETF’s (XL_) utilizing the same metrics I use for my market ETF ranking, and the top 3 sectors (1-3) are: XLU (utilities), XLV (healthcare) and XLP (staples). Humm…that is a very interesting development, considering running the same metrics one month back placed these three at the bottom of the pile.

Outperformance by those aforementioned sectors typically coincides with market corrections more so than bull runs. Maybe this is just “noise”, but this is also something worth monitoring. This is really a spur-of-the-moment observation seeing that I just ran this screen to try and determine which sectors would house the best shorting candidates (turns out that XLB – materials and XLK – tech are currently the worst).

This strengthens my view that we are in the beginning stages of a correction here, so my desire to lighten up and play defense with my intermediate term account (as reflected in these portfolio updates) is warranted.

As for that portfolio, here are some notes:

- It looks like CBI beat on earnings and met revenues and the stock is up over a buck PM. This has been a nice stock to trade and I am happy holding the remaining shares that I have.

- I made an error yesterday stating that I would be making a decision on MDY at the close today, then I remembered that my backtesting with this strategy used 21 trading days (i.e., one month) as a rebalancing timeframe. Today (2/28) marks day 40, so the rebalance may/will come on Monday.

- PCL broke higher yesterday, but I feel like this move is dubious and I will be on the lookout for a headfake.

- RWT is making what could best be described as a “diamond” pattern on the daily. I’m not very familiar with this type of action, nor am I particularly enthused by it, so I will be watching closely for a breakdown as a sign that it’s time to move on.

One Response to “Portfolio 02/27/13: Market Thoughts and Observations”

Sooz

Very nice trade off ‘The River Boat’, EM

😉

(plan to re~read in the morning..as I’m falling out quick..need sleep)