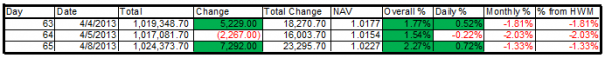

Though my contributions over the past few weeks have been fewer, throughout this time I have maintained is that there was not enough froth/euphoria to see a meaningful “correction” in equity prices.

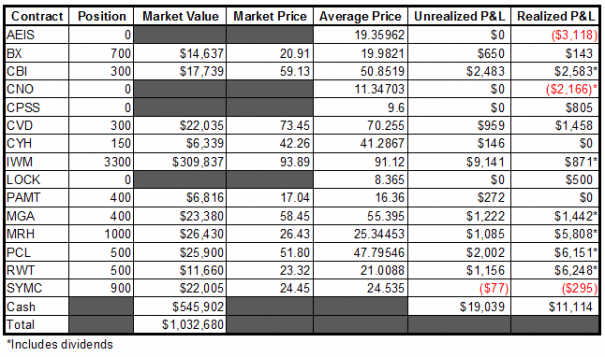

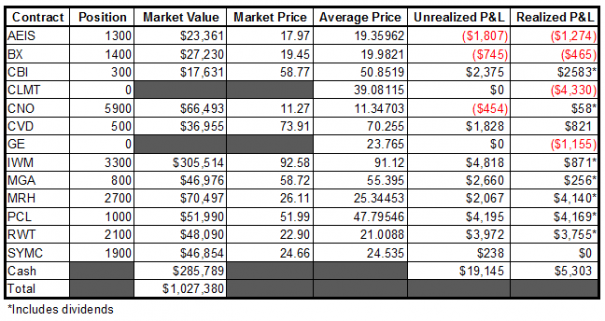

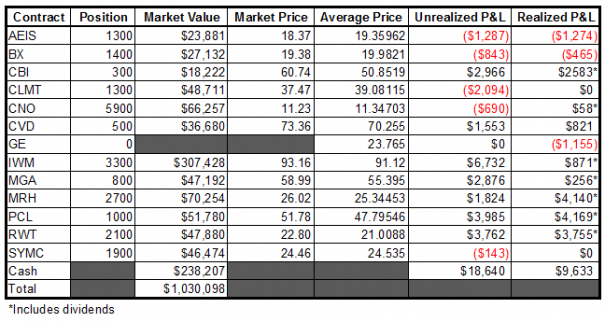

Last week, the frail were frightened by the stock exchange, the headlines all turned dour, and the markets began to slide. On a personal note, my account took on significant fire as 2/3 of my March gains were quickly eliminated. I sold out of a few names that I was growing leery with, but committed to the remaining names in my portfolio.

I have said several times ‘we are going to blast higher, and that will be a more meaningful sign that we are going to top’ (at least on an intermediate term timeframe…i.e., months).

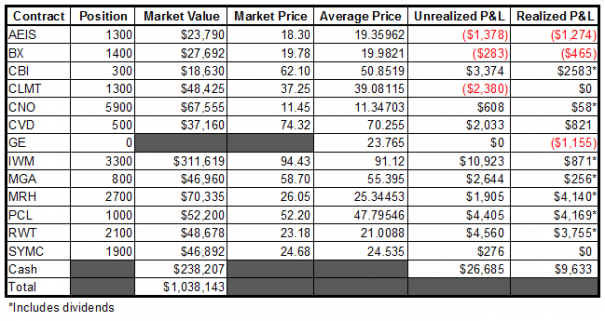

Lo and behold, yesterday we are greeted with a massive meltup in just about every sector of the market. Except for the most stubborn of realists (extra Bleier), once again we are sipping from diamond (and sapphire) encrusted mugs filled to the brim with cocaine laced ambrosia.

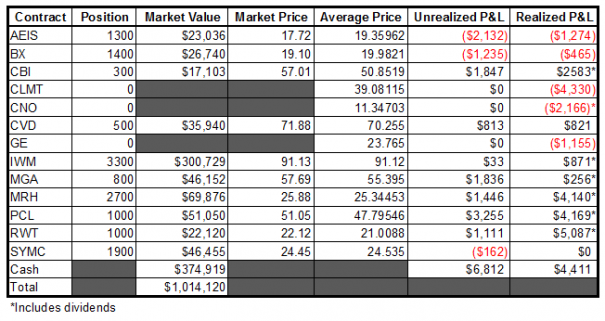

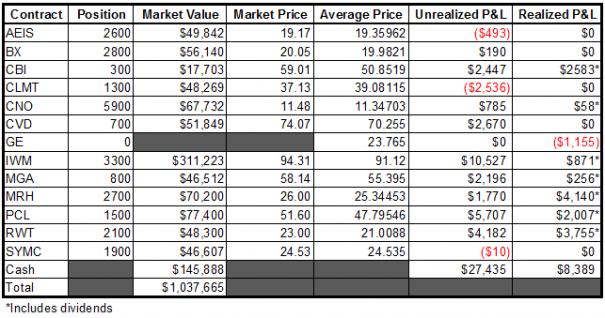

I’m not calling a top here (vis a vis going short), but my positioning as of the close yesterday would indicate that I have very little confidence in the sustainability of this rally.

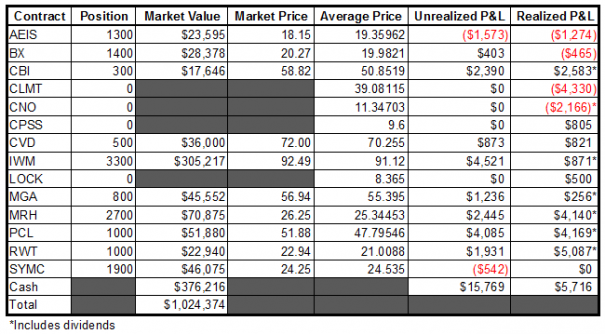

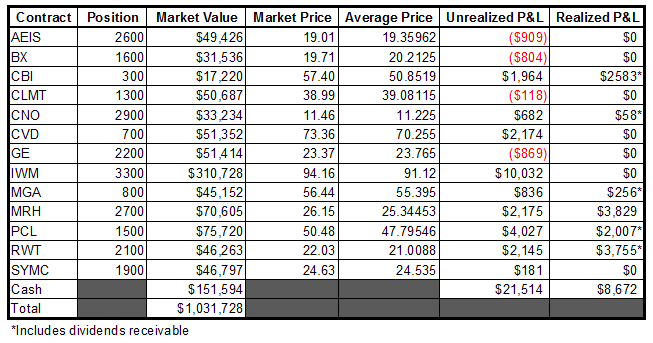

Every single one of my positions (save my “system” holdings in IWM) has been reduced by at least half. My cash position sits at 53%, and I have locked in meaningful gains in many names. I was determined to not let this opportunity to sell at higher prices slip through my fingers.

My sales yesterday were as follows:

BX at 20.85 (19.98)

CVD 73.44 (70.26)

MGA 58.36 (55.39)

MRH 26.45 (25.34)

PCL 51.76 (47.79)

RWT 23.33 (21.00).

What remains of these stocks is still game to make some profit should the rally continue. If the market turns south, I can close them out without taking on too much damage.

With these sales, I am in the process of shifting my focus from longer term trades (in terms of a quarter+) to trades that are less than a week in duration.

How do I plan on implementing this transition?

Good question.

Answer: via employing a strategy I’m calling the “knife catcher”. Yes, the title is self explanatory. Beta testing is complete, and now I shall employ it in real time via my Twitter feed, so tune in if you like, things are about to get more “exciting”.

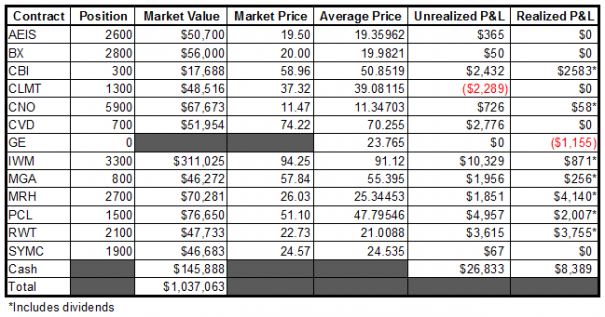

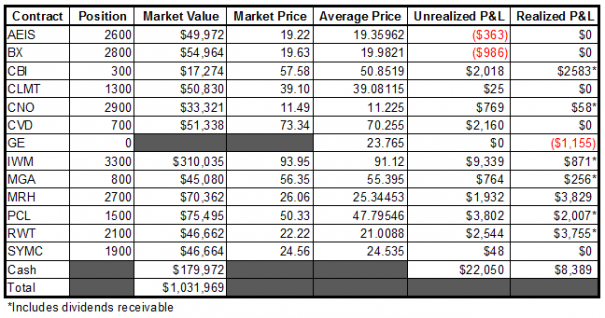

Here is where I stand:

MORE COWBELL: