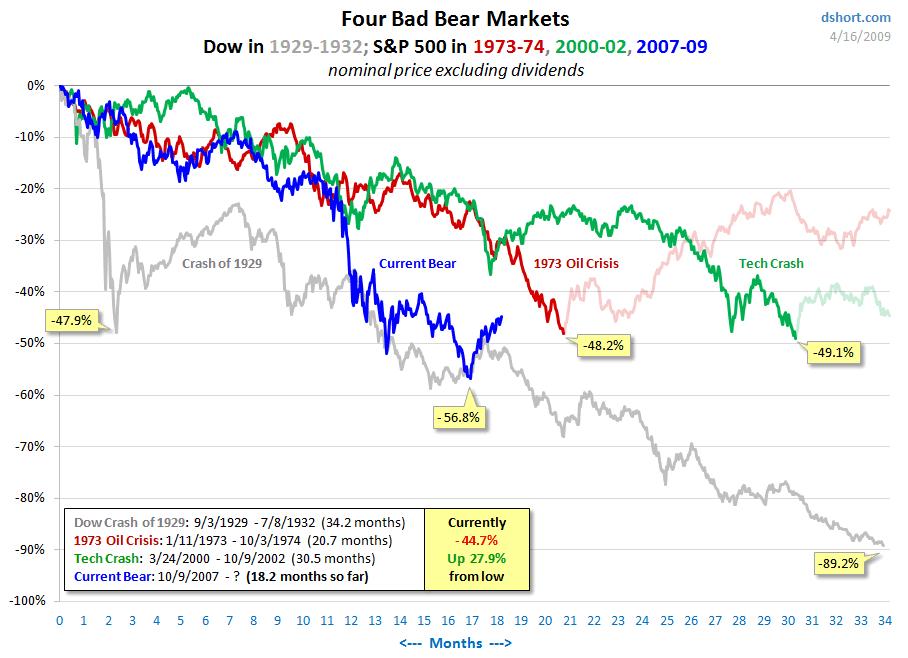

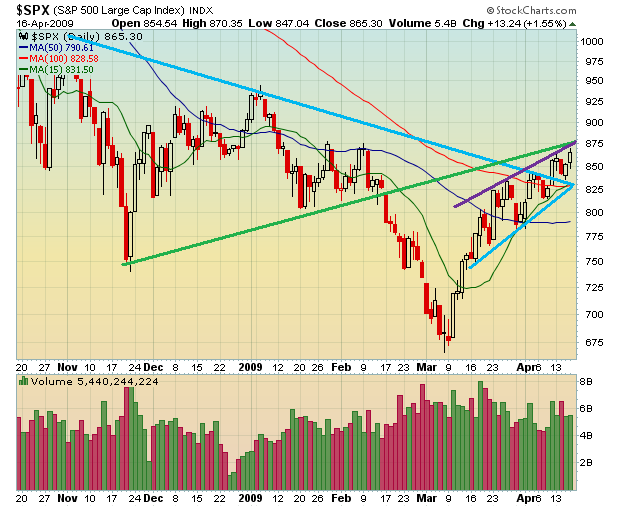

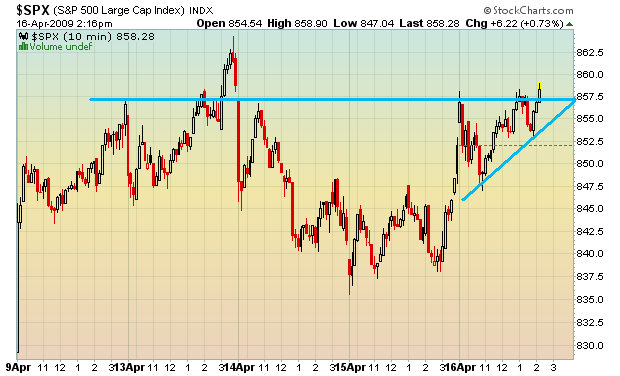

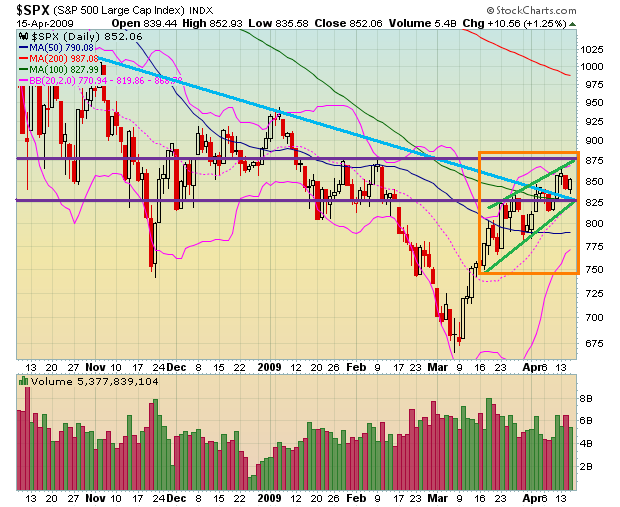

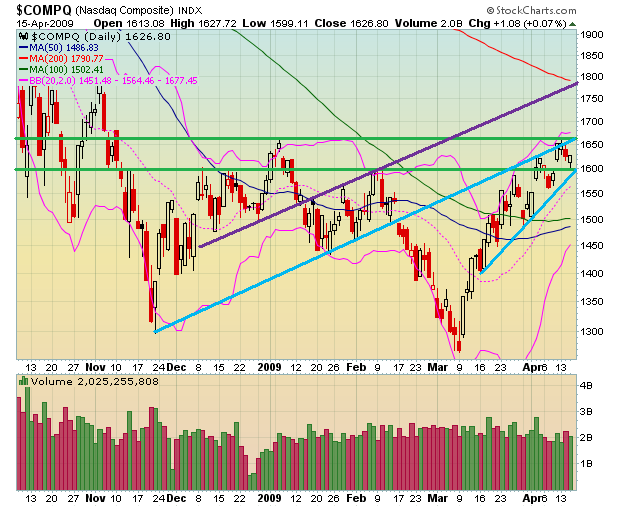

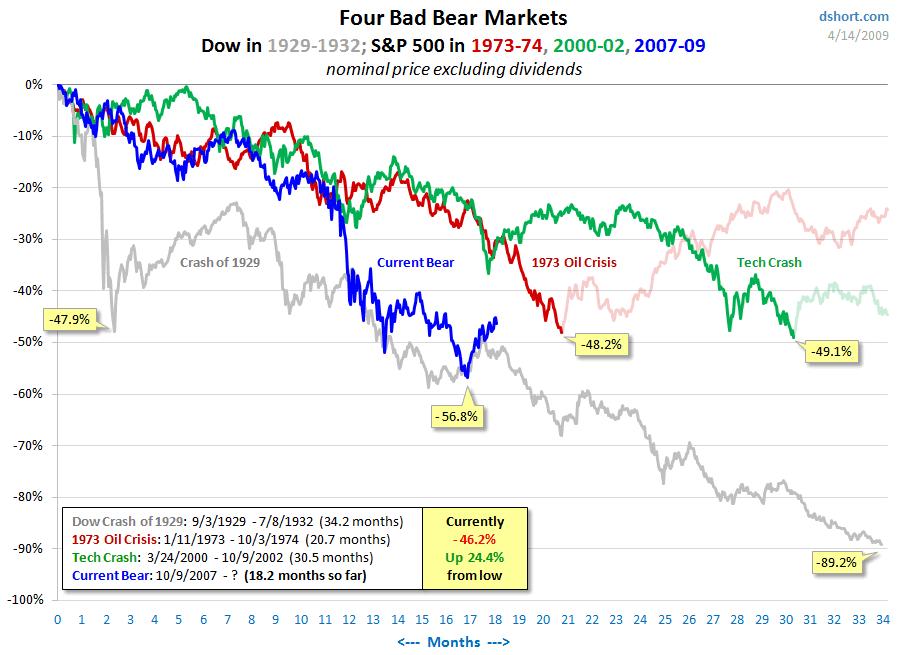

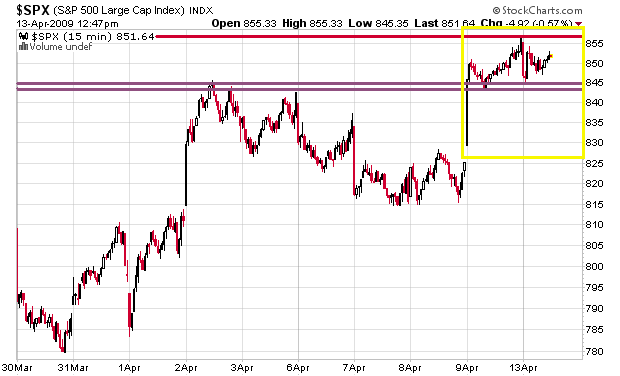

I won’t be able to gauge any levels until after all of the pre-market earnings are out of the way, but if needed, immediate support is located at approx. 858 SPX. If you look on the 40-day chart, you can clearly see the narrowing rising wedge. A major move is coming soon. Typically, in most cases, these patterns are bearish. Coupled with the fact that the market rallied 28% from it’s March low, it seems likely that we will start heading down sometime soon. All options are on the table.

Pre-market earnings: C, GE, FHN, MEG, STU, AOS. None matter more than C and GE, obviously. As for econ reports, we have only the U of Mich. Consumer Sentiment coming out at 9:55AM EST. Consensus is 58.5 with a range of 58.0 to 61.0, with a previous reading of 57.3.

The SPX is closing in on my near-term target of 875. Even though I am long, I grow uneasy as the wedge continues to take form.

Also, voting for the next tabbed blogger takes place at 9:00AM EST in The PPT (JakeGint vs. Cuervoslaugh). For a cost of $2, you’ll be able to see it’s all about. May the best man win. Goodluck Gentlemen.

Comments »