Let me get your opinion:

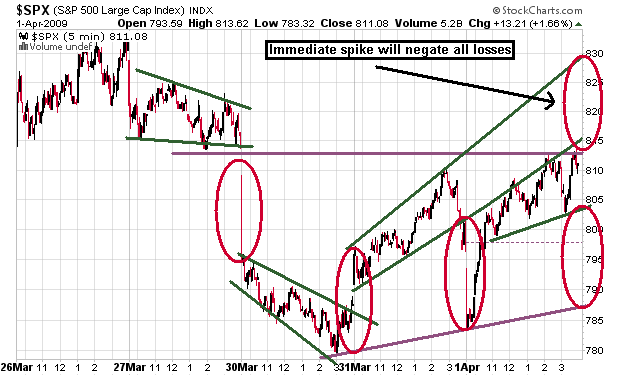

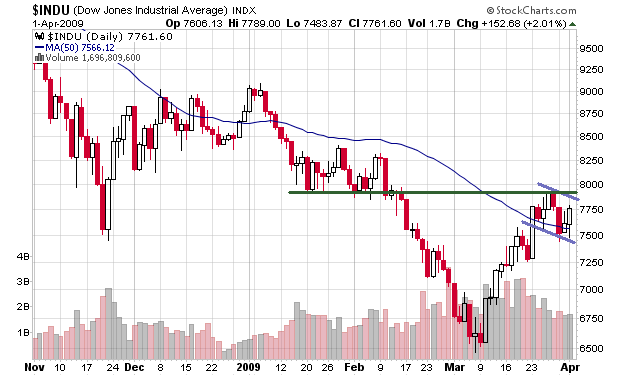

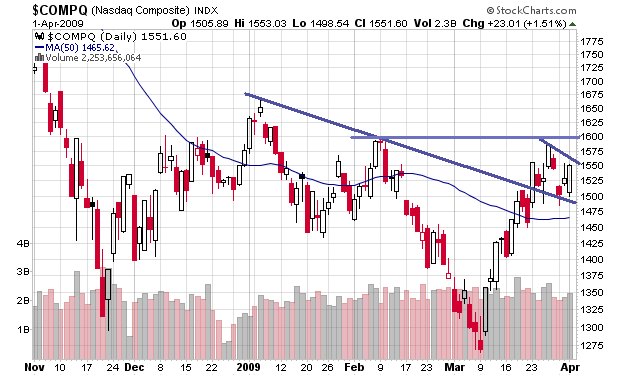

There has been a lot of rising/falling wedges and funnels as they can be seen most clearly on the 5-day chart. They are typically followed by a spike. Today’s action suggests the market has an equal chance of going in either direction, diminishing any edge that once was present. As a result, I removed more than half my positions and hold onto a majority cash position until this resolved. The market has flagged the past 3 days, within a larger flag.

(Note: Futures indicate a large spike to the upside).

World indices are not breaking down as expected, with the FTSE leading the European markets with the DAX, and CAC following. The Nikkei is leading the Asian markets. Not only that, almost all sectors negated their reversal patterns. Patterns do fail, so be aware of that.

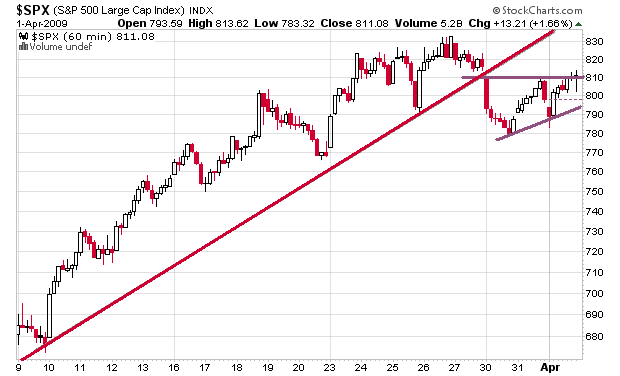

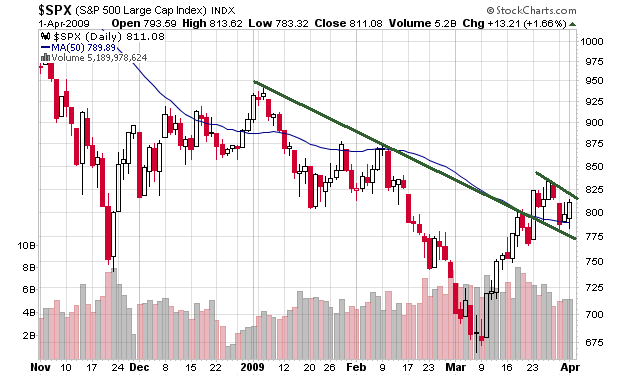

My thinking is not “bullish”, but rather neutral for the time being, just as the market is neutral. The market rebounded from the 50-day MA, but remains in a larger multi-day consolidation. The 5-month charts are drawn with a bullish bias, and I can clearly see the multi-day flag forming. I will have to see another 50-day MA failure to re-initiate committed short positions. It was definitely fun and very interesting while it lasted.

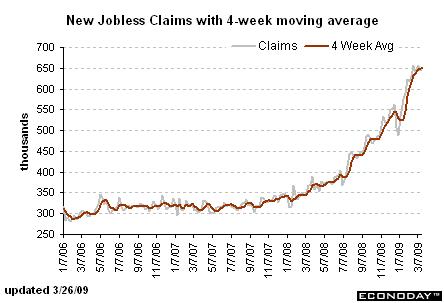

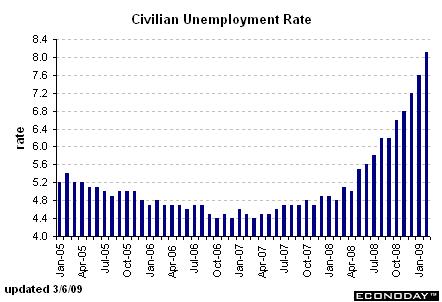

The M2M FASB meeting is scheduled for 8:00AM EST with approx. 5 hours of discussion. In addition, jobless claims will be reported at the usual 8:30AM EST. The consensus is 655K with a range of 630K to 672K, the previous reading being 652K. The employment situation report will be released tomorrow at 8:30AM EST. The consensus is -650K with a range of -711K to -525K, the previous reading being -651K. Shortly after, the ISM non-mfg report comes out at 10:00AM EST. The consensus is 42 with a range of 40 to 44, the previous reading being 41.6. Lots of news ahead folks, strap on those seat belts.

With the present allocation, I can take about a 40% loss on the current FAZ position before my March gains are entirely wiped out. As much as I would hate to see that happen, I am willing to hold if the market runs and tops out in the short-term. If you are short, daytrade long to recover as much of your losses as you can.

The riots continue into the night…

If you enjoy the content at iBankCoin, please follow us on Twitter

holding faz too,I dont feel that bad,

lets see what happens,who knows sell the news?

This thing runs another 2-3 months at least, imo. I called it the Costanza Bump and Grind last week, where the bump comes early April as money managers position themselves to make some pesos in Q2 and the market grinds up to a very important SPX fibonacci level before it coasts sideways through the summer and toboggans down the hill this fall.

Bad news will be trucked like Jerome Bettis used to run over defensive backs and disregarded with a simple butler’s slap of the dick.

I’m longer than a hillbilly’s middle toe and will stay that way until proven wrong.

FASB Meeting webcast LIVE:

http://fasb.trz.cc/live.php

Glad to see my prediction (3 weeks) has (thus far) garnered the lowest agreement.

Kinda stuff I like to see.

________________

And in which county in Maryland does burning a couple of bags of garbage constitute “a riot?”

Shit, we’d do worse stuff when my div-three small liberal arts school would beat Williams in lacrosse.

______________

My first comment got swallowed. I was saying that I was glad to see that my choice on the survey was coming in dead last.

Warms the cockles.

________

2005 College Park riots when the Terps kicked Duke’s ass

I was at/in the first MD-Duke bonfire/riot in 1999 on frat row! Good times

Did absolutely nothing in the mkts today

If you are short, daytrade long to recover as much of your losses as you can.

good luck that’s a tough way to make bread! and I am surprised that your fighting the tape for a trader objectivity is an asset my guess is your biased towards the news and your fundamental views… short will be right in the future just not the next little while. Let an IT form and wait for the break on volume.

>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

Close your shorts and buy the dips …. if you want to be short short the gold stocks… look at the break on AEM today.

Broader markets are going higher…Jan highs have already been taken out on the Q’s and the others will follow suit….and with the RIMM news AH look out above tomorrow…. GOOG and APPL are on a roll as well.

Being short here is fighting the tape and its pointless. You will be able to get short once this euphoria plays itself out.

everybody is babbling on about the EMP # tomorrow… well the ADP and Challenger reports have foreshadowed a bad number tomorrow. Is Unemployment a leading, lagging or coincidental indicator?

Jake 2/3 rd’s of the pollers don’t think the move has more than a week left to it…..interesting

945 on the SPY is where the broader market wants to trade to…its gonna take longer then a week to get there IMO.

AB — I had three weeks on the timeline.

_________

i am in for 2 months because they didn’t offer 6 weeks

Interestingly, the results are all over the place:

How long does the rally last? [173 votes total]

1 day (45) 26%

2 days (26) 15%

3-4 days (13) 8%

1 week (16) 9%

2 weeks (13) 8%

3 weeks (13) 8%

1 month (20) 12%

2 months (8) 5%

3 months (7) 4%

Longer… (12) 7%

You didn’t really give up trading, did ya??!? Say it ain’t so, please, say it ain’t so. Didn’t see you today.

I didn’t think people could get fooled on April 3rd. lol

I will never quit, but I suckered in a lot of people.