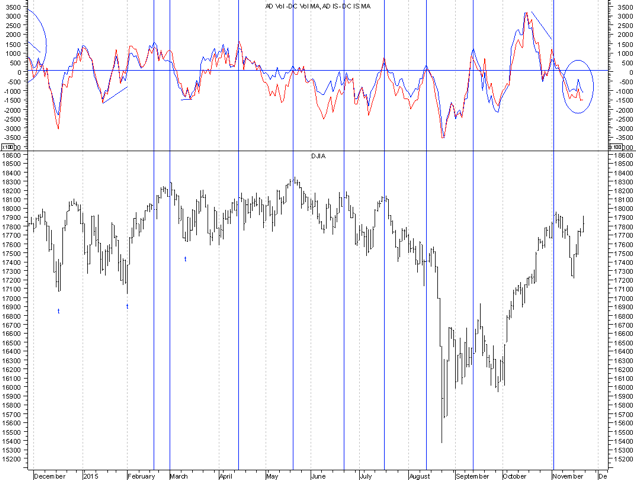

The markets most recent move up was an options expiration levitation trick. I don’t expect much more gas here unless we get some more central bank intervention soon. In the above chart advancing volume & issues versus declining volume & issues has rolled over as price continues to advance. The optimist would say that the breadth of the market should improve and the troops should follow the generals. Everyone knows that 5 stocks are leading the charge. The problem with that optimism is that credit continues to roll over. So odds are high we top out for a dip soon as 5 stocks can’t hold up the market forever. The dip could be brief like 3-5% or more meaningful. I remain short stocks and SPY as I believe that the Top in May will hold. Everyone seems pretty jazzed up about seasonality into year end and complacency remains high while bullish sentiment has returned and bears are all but extinguished. I will remind folks we had a 5% dip last December. My belief is that if we take out last Mondays Paris Terror lows we have the potential for some accelerating downside that could be more than 5%. The bulk of the Santa rally may be behind us. I expect a turn soon maybe after a little more levitation.

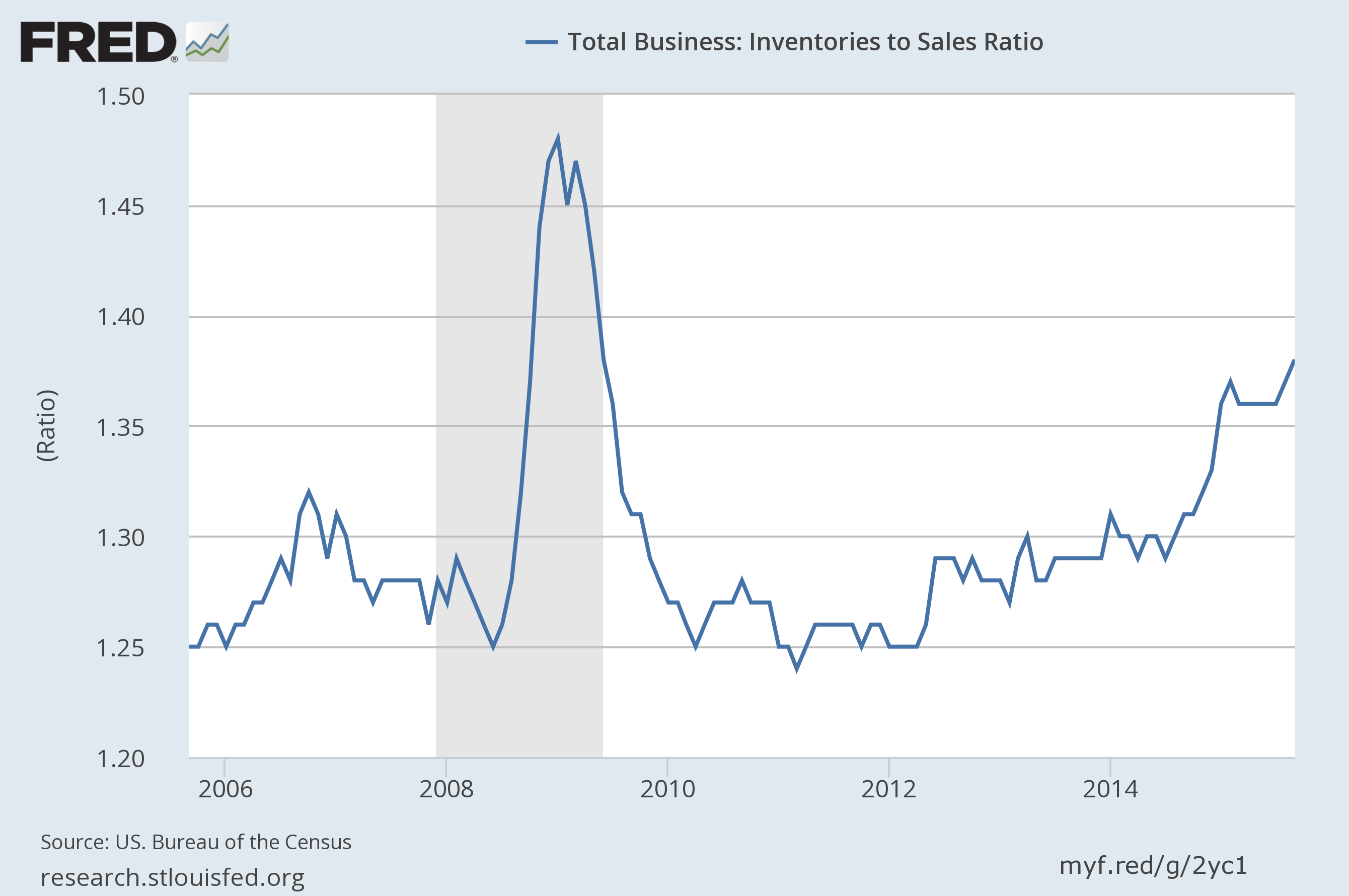

Basically we are slowly watching the Global Economy roll over. Retail sales in the US are looking rather grim as seen from the top line implosions of many retailers. The Inventories to sales ratio continues to climb and is now at recessionary levels not seen since the great financial crisis. Deflation is spreading from the emerging markets and energy into other areas and corporate cash flows are declining. We are basically seeing an old fashioned credit cycle maturing and rolling over. Equity valuations will not hold if credit does not improve soon. I am currently looking at Airlines to short as the charts look awful, they have a lot of debt and follow corporate profits both up and down. The first thing to go in a downturn is business travel. The airline stocks peaked late last year as corporate profits peaked then as well.

Below are several charts showing credit and business inventories:

CCC High Yield Bond Price Index

Leveraged Loan Yields

Inventories To Sales Ratio

If you enjoy the content at iBankCoin, please follow us on Twitter

Hello Blue.

Soon, soon, soon we hope it rolls over.

Have you seen ust yields today in the futures?

The only thing that can seriously extend this bull is for investors to be more scared of sovereign debt than anything else.

I don’t think we’re there yet, but keeping a close eye on yields.

Today so far is weird.

Just saying ,you don’t have the conviction you normally do.

Low fuel costs should prop up airlines for longer but all this

terror will slow travel so maybe it’s a wash. For a bull

case America has what no one else in the world has

right now and that is Jobs.Jobs an more Jobs.

Hey, this rally could totally keep going… AMZN just needs to get up to a 2000 P/E instead of 1000. That seems reasonable, right?

Yawn.

This blog reminds me of late 2011 when everyone was convinced the rally was surely over. Thanks for the memories.

Freebie,

Do you have something constructive to say? A cogent argument against what I am saying or are you a typical low IQ and low EQ troll. Come on tell me your bull thesis? I am all ears.

Blue, you mention CB intervention. Really isn’t the Fed the only CB that matters at the end of the day? ECB seems to be limp at best. The half life of interventions are growing shorter, and the focus on IS is a side show.

50/50 on the rate hike. I think your geopolitical thesis is correct. I think you need to game that one out to see what would happen to who.

Come hell or high water that pipeline from ME WILL make it through Syria and cut off Putin.

Blue, don’t listen to the haters. Everyone is long and no one is making money, unless they are all long the same 15 stocks, which they are not.

There are less and less stocks that present a good risk/reward to hold long over the next month of so.

The big tell will be how the market takes a rate hike (something I believe they will actually do). If buyers emerge, look out above. Until then, it’s playing small ball / tactical trades for me.

Smoke and mirrors be gone. Poof.

Bluestar, I’m just a buy and hold investor who is always amused at people who try to call tops with great conviction.

Freebie,

I am amused by folks that are are lazy. You clearly are a negative karma person who doesn’t even have the intellectual ability to articulate why you are long. You just amuse yourself by taking pot shots at others. You don’t add anything to the discussion so unless you do I will Ban you.

Bluestar.

Free speech, man, free speech. Thick skin, dealing maturely with offensive ideas, and all that. I’m sure I just read about this somewhere.

That said, I agree there’s a lot of useless banter here to wade through (and I mean this entire site). But now and then a gem of analysis shines through.

Happy Thanksgiving, all.

Sy,

Yes. Touche. I thought I was dealing with him maturely by asking him to disagree with a cogent argument rather telling me I suck. I don’t care if he says I suck but I am trying to raise the level of the debate in my comments section. The banning is not because of his ideas its because he does not seem to have any.