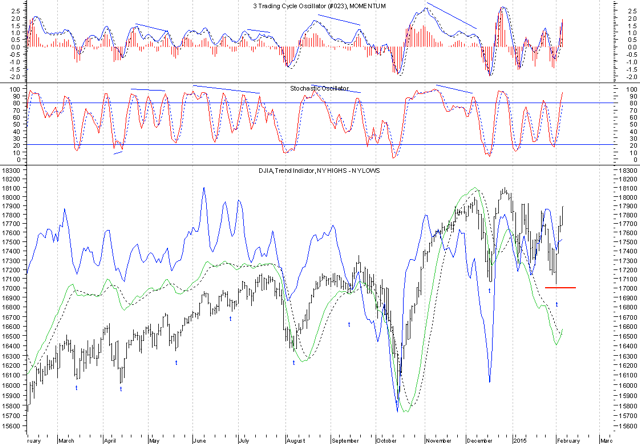

I predicted at the beginning the year that we would have bone crushing volatility. That has turned out to be the case. For example the IWM has had six 5% moves up and down since the start of 2015 for a total return of 30% if you traded perfectly both long and short. Of course no one has done that so most of us have been frustrated.

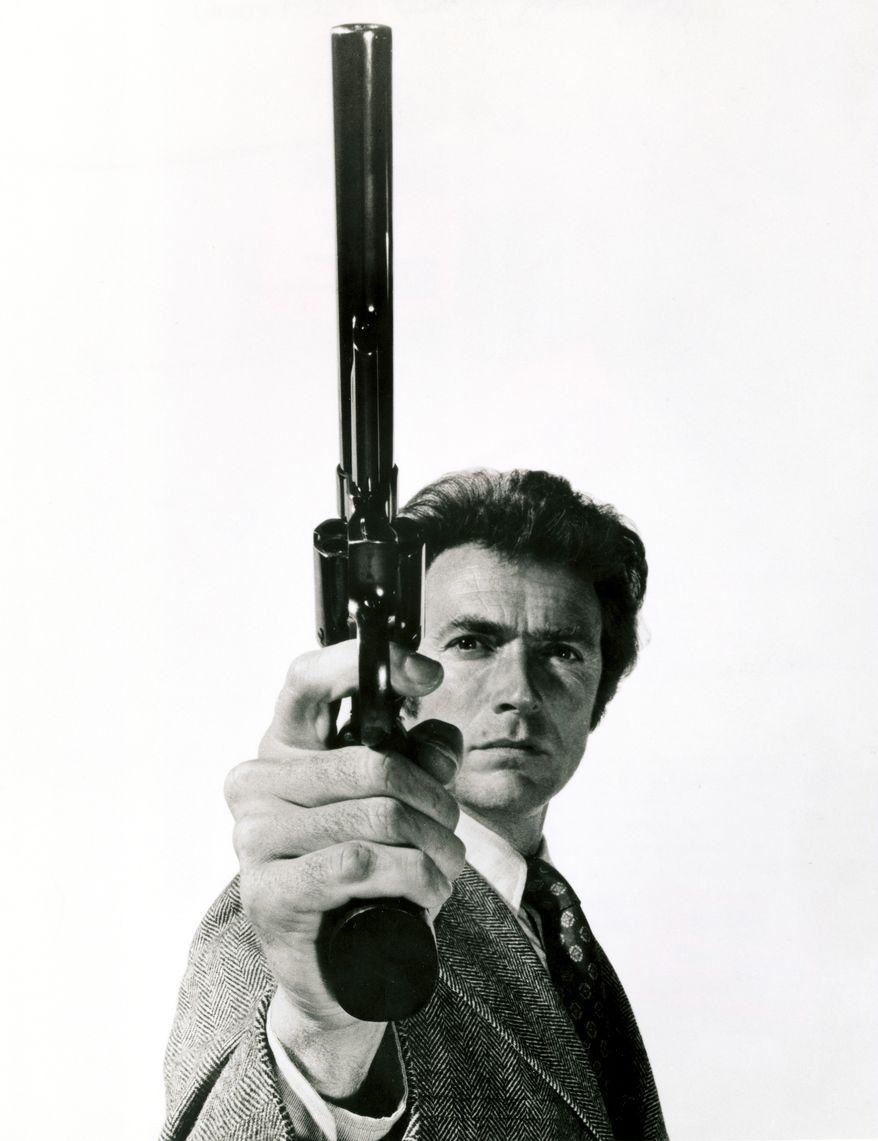

We have arrived at the moment of truth as this market is coiled and will soon break out of its range. The next move will be a quick 10% move either up or down and will likely set the tone for the next several months. The battle is between those who believe it is business as usual and that the CB’s have our back or you are a bear and the CB’s are about to lose control. The bulls have to be at peace with the fact that currencies and commodities are seeing 6-10 sigma volatility and that the increased volatility has not caused systemic dislocations both financially and economically. The Bears have to be at peace with fact that they have been utterly wrong for the last 6 years and do they feel lucky this time. Everyone talks about these bears. Where are they? At tops there are no more buyers as the longs have run out of ammo and the bears have run out of capital. Nothing but air below. Is it time for the blow off top or time for a greater than 10% correction? Let me know your thoughts. Do you feel lucky…well do you? Seriously, I wish both bears and bulls good luck over the next few weeks.

If you enjoy the content at iBankCoin, please follow us on Twitter

taking this market one day, one week at a time … as it can change on a dime

trust is eroding:

http://wallstreetonparade.com/2015/02/gallup-ceo-fears-he-might-suddenly-disappear-for-questioning-u-s-jobs-data/

I have a longer term outlook (1 mo. to several years) so I don’t care which way it goes short term. However, I expect a downdraft sooner or later where I can deploy some cash. Once John Q ‘gets it’ ie this is not a recovery; the elevator cable will snap. That, most likely will require some type of undeniable financial event.

I am waiting for jobs report but I’m

betting 10% move up.401k season and

general optimism are the reasons.

Boom

Handwriting on the wall for anyone with their eyes open – decline of an empire becomes more and more visible.

I wish it were not the case; but what I wish for is irrelevant.

http://rt.com/news/229783-hollande-merkel-moscow-ukraine/

Logic would dictate a drop. Gut says a ramp higher as capital flows continue into US. Nothing economic related simply where is the capital flowing and who can absorb it. Especially with the gong show that is in the Eurotrash zone

Looking at some of the weekly charts like SHW, COST, LOW, ALK, DPZ, V, etc. I have to wonder if maybe we already had the Blow Off.

Anecdotal, those are are pretty bombastic takeaways from those two headlines. One from a guy making a snarky remark on CNBC which is essentially a network to go on if you want to pitch you’re self/company/book.

And gettting snubbed for a meeting with Vlad doesn’t mean the US “empire” is declinig. It means that the world has given up on the Prez just as most of we have. No big story there. Lame duck, no mandate, flailing to make some kind of impact in the last couple of innings in his presidency…who cares?

sonny,

i noticed that as well. COST had a special dividend that overshot by 5 bucks. crazy chart

I haven’t studied the charts this week (currently on vacation in Punta Cana), but before I left I was leaning Long. The Russell had a good chance to break down, but couldn’t.. I think we go higher..

I missed a good week for trading..

Forgetalpha,

I’m rooting for you;

but betting against.

There are many signs of decline. Countries around the world are openly doing things that previously would have gotten them Libya’d.

All empires fail starting at the periphery, when they become financially unable to enforce their will. Sending some drones won’t cut it.

Anecodtal, betting on falling empires is not a great strategy. Optimism wins out in the end, and most “empires” can stay irrational longer than you can stay solvent.

There are no signs of a market top.

Go get a sandwich:

http://www.sovereignman.com/finance/bubble-meet-the-25-million-grilled-cheese-truck-16091/

& cash in on Sasquatch

Forgetalpha,

You are correct. Betting on falling empires has been a losing strategy.

“Optimism wins out in the end,” also true BUT things can be bumpy in the interim.

How long do you think it will take for optimism to win out

in Detroit?

Hope is not a viable strategy.

“In the short run, the market is a voting machine, but in the long run it is a weighing machine.” —Benjamin Graham

I think we’re in the voting machine stage.

Marc Faber says ” If you go to talk to ordinary people around the world, I would say 90 to 95 percent will not approve of U.S. foreign policies of meddling into other people’s affairs and doing so continuously and stirring up trouble everywhere they go. This is the view of most people in the world. And I tell you, the big surprise in 2015 could be that Europe gradually breaks away from NATO and lifts the embargo against Russia.”

anecdotal,

I believe that will happen. Germany and France gave a huge finger to DC this weekend when they went to see Putin. The wheels have been set in motion.

But then Merkel has a press conference today to discuss the same issue on a bilateral basis? Who cares if they talk to Russia without us, lifting the embargo would help Germany more than it would anyone else. As long as crude is sub $70, Russia is screwed.

Europe is bat shit scared of Russia. If

they come to believe that America does not have their back militariy then they will lift the embargo. As long as America

has their back they stay on board.

I think Russia supplies 40% of the natural gas to Europe & 50% of their uranium supplies. Germany has cut their own nuclear production; but they cheat by buying some power from France who generates 90%? of their electric from nuclear. I’ve heard Germany has 5,000 companies that do business with Russia. I don’t think they are big fans of sanctions.

Forgetalpha, Gorby and anecdotal:

GAME OF THRONES as Written by Zero hedge today. Bottom line: Currency wars have begun, old alliances will be tested and China will devalue the Yuan within months. When they do that you will see real deflation. Stay away from any companies that compete with China.

We have a debt problem globally. Insolvency is the main issue today and it is choking growth. The good news is the US is the best house in a bad neighborhood. The dollar will continue to go up and it will likely exceed 121 on the DXY before this is all said and done. The bad news is the dollar is that the dollar is going up and is causing the largest margin call on the planet.

Thanks BlueStar.

Faber – derivatives may not exist in 5 yrs

http://kingworldnews.com/dr-marc-faber-broadcast-interview-available-now/

Europe is not scared shitless of Russia, they just don’t want a retarded civil war to be ongoing a stones throw away from their eastern border. This is a perfect time to negotiate with the Russians. Thjey can’t threaten cutting of gas supplies as winters already half over, and Russia’s is hurting so badly from the crash already that they couldn’t even cut off Europe if they wanted to. Stop thinking that every damn event in geopolitics is some complex conspiracy that proves the world is coming undone. It’s just nonsense!

Also stop reading ZH, it helped my portolfio tremendously. If they weren’t good writers, that blog would have been shut down years ago. They’ve touted the same nonsense and have been 100% wrong on almost everything. It’s designed to hook you in for page views and that’s it. Not only is it biased, but completely off the mark as well. Not every hiccup in the global economy is going to start GFCII for Christs sake.

Forgetalpha,

I have been blocked by zero hedge on twitter. they are a tad sensitive.

Everything is biased. That’s a given.

“Russia’s is hurting so badly from the crash” Maybe so, maybe not. I don’t know.

Have you been there recently?

Nobody knows nothing . I do appreciate

all the respectful and differing views

that help my understanding but

it would be something if after this, my trading skills improved.

Bue,

I’d consider that a badge of honor haha.

I always feel lucky but even I haven’t found the balls to short yet.

TJWP,

shorting has not worked yet. There have been trades but not the big money yet. we shall see.

What are you doing in the market lately? I am most interested in some longs you are holding.

DId Germany just blink yesterday with the extension of the extension?

What do you think the odds are Greece stands firm and defaults next week?

Flyaway,

I am mostly cash with some index puts, I am long YNDX, TDC adn GOOG small.

jimmy two times,

I think it is as high as 25%