Listen, I’ve been pounding the damn table for THREE DAYS now that you should have been buying any and all dips. Yesterday’s call was EPICLY timed, not to toot my own horn or anything.

Today we muddled around, holding yesterday’s gains nefariously so, pissing off any and all short sellers.

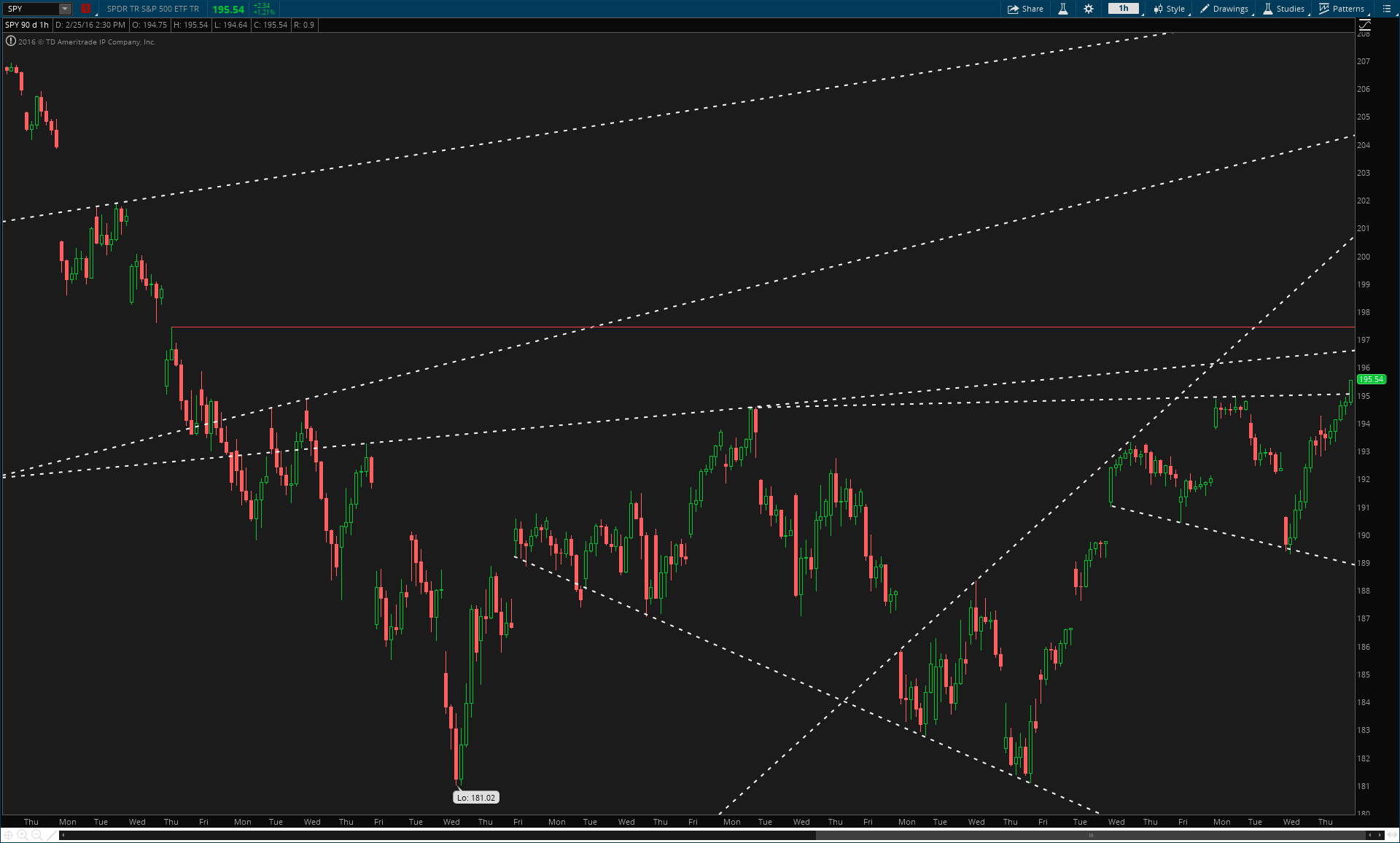

At 12:30 CST we see a momentum hammer on the 60-min chart, the nail in the coffin for hopeful bears.

So what does this mean going forward?

Well, for starters you can see clear resistance at 196.50-197.50 as our next top-end target.

If and when we break out of this, we are destined for 200 in the SPY, with a push to 202 most likely. As far as the timing goes, it is still hard to tell, but price is not letting up. We could see this in two weeks at this rate.

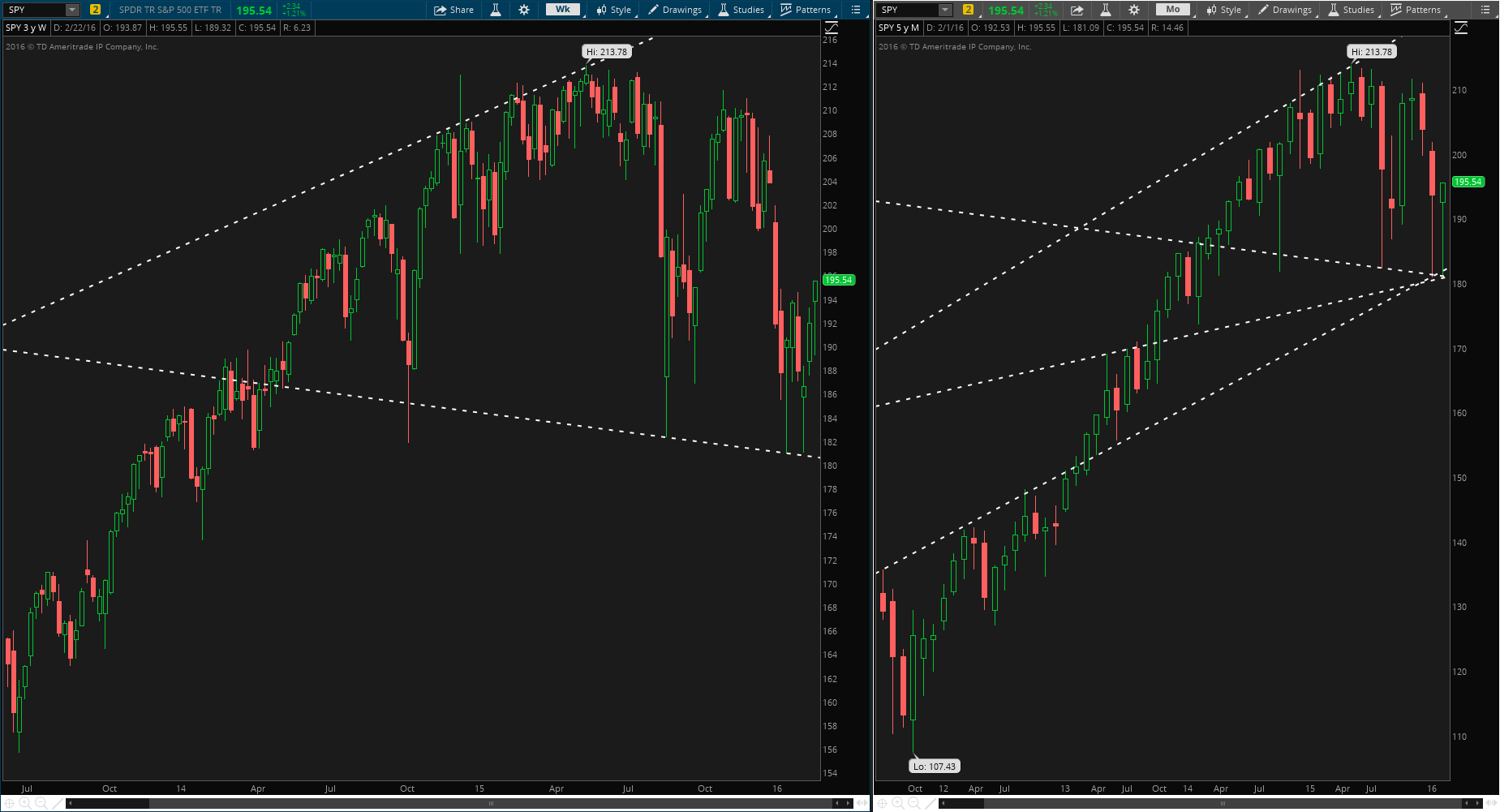

Let’s look at the weekly and monthly charts for SPY and take a little longer-term thesis approach:

As you can see we’ve got a weekly hammer and an inside monthly hammer. Two extreme buy signals (upon confirmation) into a new month. If and when these signals confirm as we go into March, we then also have full time frame continuity (green day, week, month) – adding to our long-term conviction bias.

We have zero sell signals at the moment. ZERO.

As much as everyone wants to complain about low-volume and how the market does not make sense. We still have to trade what price is telling us, and until we get even the slightest short-term sell signal, I am pressing longs until my fingers fall off. I added more today from yesterday’s buy, and will press and press until I see something change.

Load the boat.

If you enjoy the content at iBankCoin, please follow us on Twitter

Futures indicate your right, again.

Well now that they’ve gapped them up, probably best to take some profit into the weekend.