Damn.

Two hours after the close, I can’t drink enough Jameson to calm my nerves.

Today’s Play-by-Play:

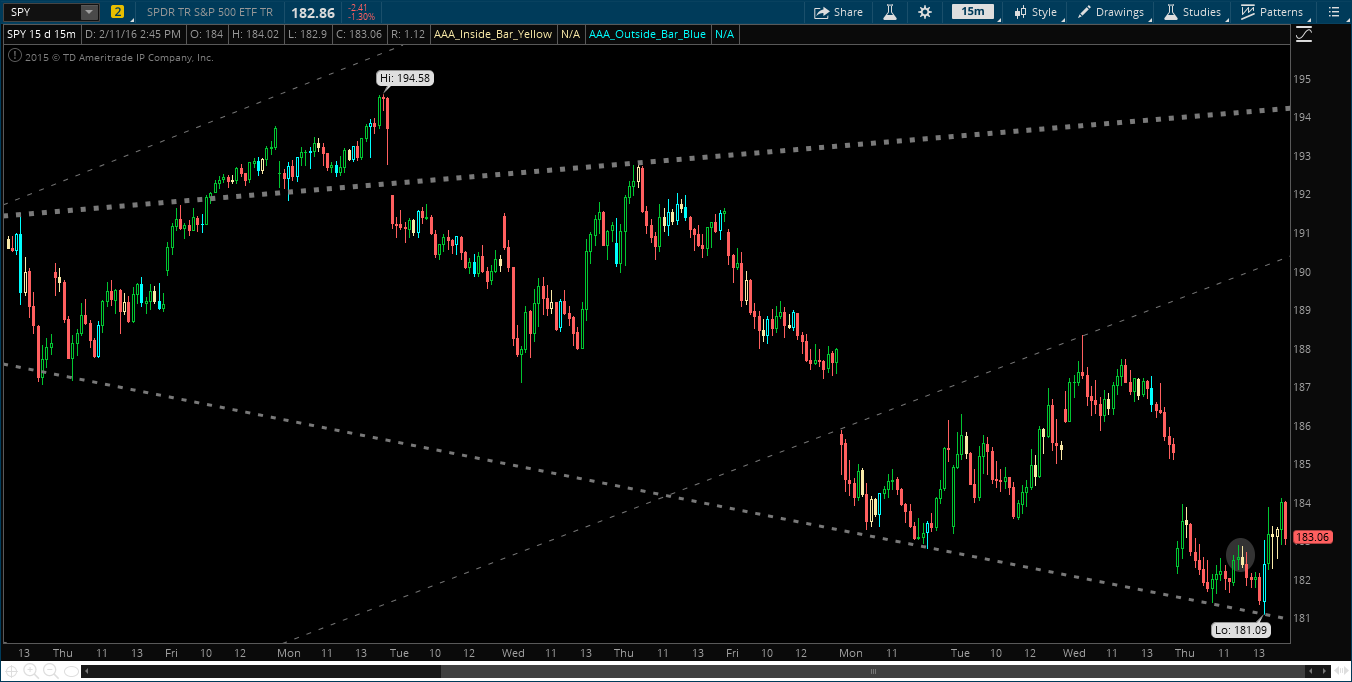

SPY goes inside-15 and down at 1:15 below 182.30, after a squeamish mid-day rally.

I am GIDDY as all hell at this point, I KNOW we are going lower and I’m pressing so hard short that my fingers are about to fall off.

“There is no chance we don’t see 180 in the SPYs this week, absolutely none. This market is about to get absolutely punished”

We are gliding to the lows of the day, just beautifully; PnL is climbing and I’m happier than a pig in shit.

As we nose dive, I have a thought to myself, “Self, let this one ride, SPY is going to AT LEAST 180 this week. Put the stop at even and go take a break.” I have had a tendency to book profit too early, so, I left the trading desk for a bit. Until my phone decides to give me some nonsense market update:

ALERT: SPY FEB 16 180 P SOLD PHLX

ALERT: SPY FEB2 16 182 P SOLD CBOE

ALERT: SPY FEB 16 182 P SOLD BOX

“What in the actual shit”

So here I sit, out of no where I’m flat and gave back a mid 4-figure trading day.

Speechless.

The beauty of trading, though, is that you can regroup, take a second and gather your thoughts. As traders, if you don’t have short-term memory loss you might as well just quit now – because stuff like this sucks.

Regardless if the news was real or not, we have back-to-back inside 15-min bars (above) to stop and think.

During this 30-minute break I did just that. See here how we are at the bottom of this broadening formation? What this means to us is that we have already made lower-lows and we have brought even more sellers back into the market, taken a few longs out that had their stops at the low of the day (hey there’s a new one), and possibly potentially exhausting the majority of sellers in the short term.

Further, IF we break this equilibrium to the upside, we are now trading higher than we opened for the day (182.34). So, very safe to say we test longs as we have no resistance up to the high of the day, at 184.

As the story ends and as you can tell, we did, in fact, go back to the highs briefly.

Going forward, the overnight futures are going to play a huge role in where this market goes. If we gap down and take out the lows I think this is the swift kick the bears need to finish them off. However, I am in the camp that the more probable move is a gap fill to back up 185 and a move to 190 next week.

At this point we are still in trading mode until we get more information. Regardless, I think the next day or two will provide a lot of clarity as to where this market wants to go. Still no need to go ape shit either direction.

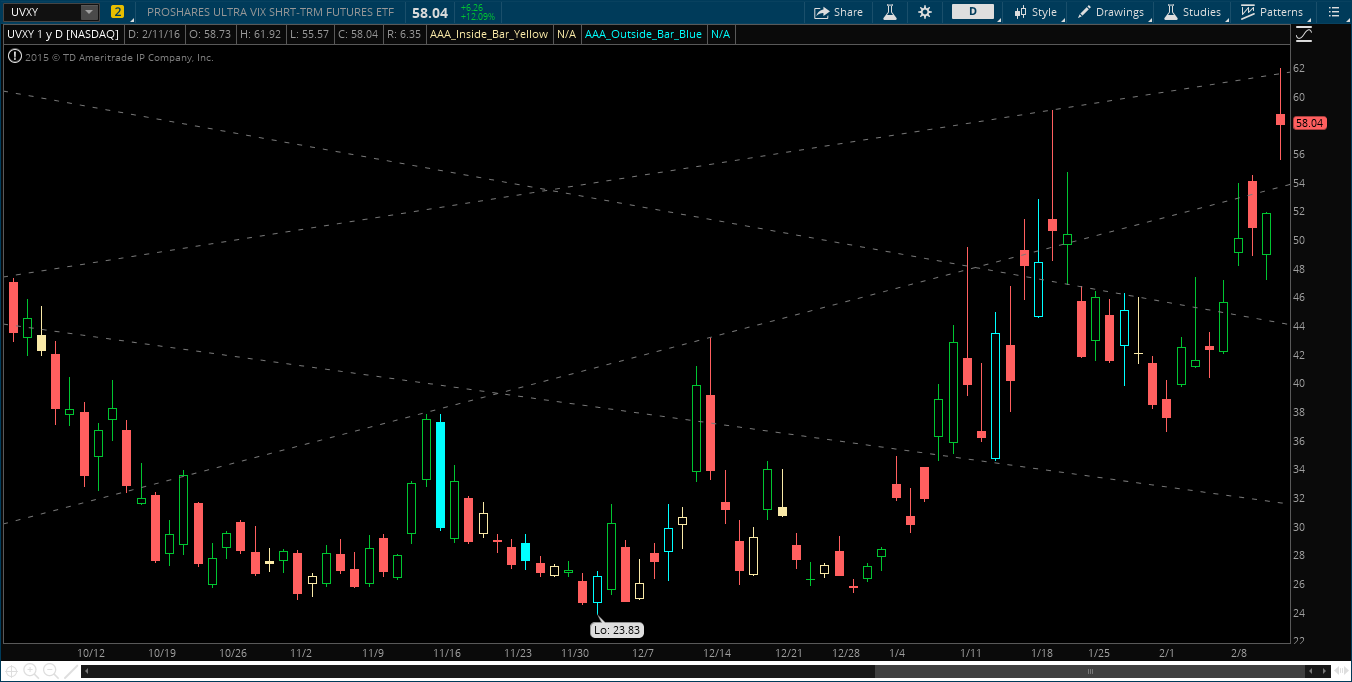

If we do start to bounce, you HAVE to trade the VIX products. UVXY and VXX will get clobbered if we bounce, do yourself a favor and keep an eye on them. I am a fan of UVXY, and will not be surprised if we see this in the low 40s next week. I have already started a short position, and will be adding with lots of size over the coming sessions.

I’m off to the pharmacy, I’ve got a prescription to re-fill.

If you enjoy the content at iBankCoin, please follow us on Twitter

Nice recap., Good job collecting yourself after the spike.

Thanks for the feedback!

2day was shit. I’m putting my castle back together.