Yo. I just arrived home from the Gym. Did mostly arms, then swam some laps, steamed for a while and came home. Not much has changed. Oh thank goodness.

This is actually getting kind of ridiculous. There is mad complacency and not really any fear. Just whatever support it is on, buy it apparently. Buy the zone. Buy the zone. Buy the Zone. Don’t have a panic attack.

I think I gave my number to 3 girls yesterday. It was like I was on speed, and I had a long list of things to do which I pretty much got everything done. Now there is nothing to do, which is perfect. Killed the excessive inner dialogue, which was annoying and not helping anyways.

Some ideas that I like, which are happening: CCL seems to be a smart play. USDJPY to 100 then to roll 104 (but not 105). Still a couple good trades in that, but getting kind of extended. USDCAD to go back to par, cause’ that’s what it does. I think the MJNA’s and HEMP’s of the world will surprise all of you, and go up more than you thought. I want to become a hemp farmer. Only 1/3 kidding.

I haven’t watched oil or gold for a while. I haven’t had much interest. There can be amazing moves in both of those futures contracts, but they can also be few and far between. I don’t like losing a pile of money just to make it back. IT DOESN’T AMUSE ME ANYMORE.

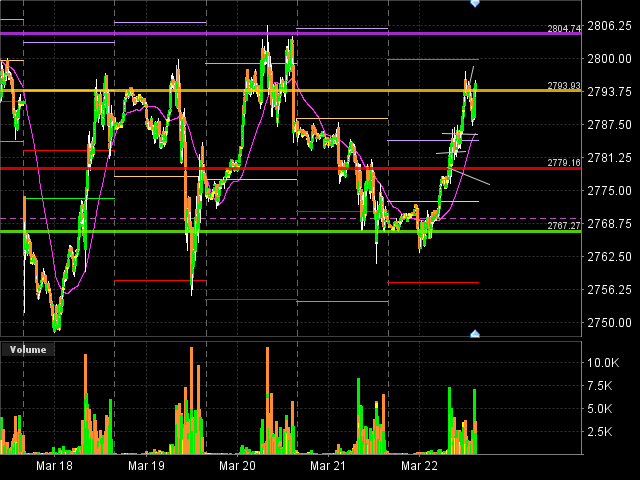

I trade off 2 monitors, showing 2 charts of the 3 index’s I like to trade. I have a basket of tickers, containing the contents of each index. And a miscellaneous quotes page, where I put other ideas, which I probably won’t touch. Then another one, for secret purposes.

The DOW has been out performing. It will on days like today, until something changes. If I’m not being naive then The Dow Jones actually owns owns the government then eh. So what does that say… Are people worried about the safety and integrity of the rally, and that is why they are gravitating towards DOW stocks? Is it because there are simply less stocks in it? I do not know.

I’m done typing now, as I now require steak, with primal tenacity. I hope when the pullback does come, with great surprise to market participants, that you are well prepared.

Every man should have a suitcase packed, and be ready to leave at a moments notice.

http://youtu.be/m2sNh0CHDTM