WHY MEN ARE NEVER DEPRESSED:

Men Are Just Happier People– What do

you expect from such simple creatures?

Your last name stays put. The garage is all

yours. Wedding plans take care of

themselves. Chocolate is just another

snack. You can be President. You can never

be pregnant. You can wear a white T-shirt

to a water park. You can wear NO shirt to a

water park. Car mechanics tell you the

truth. The world is your urinal. You never

have to drive to another gas station

restroom because this one is just too icky.

You don’t have to stop and think of which

way to turn a nut on a bolt. Same work,

more pay. Wrinkles add character. Wedding

dress $5000. Tux rental-$100. People

never stare at your chest when you’re

talking to them. New shoes don’t cut,

blister, or mangle your feet. One mood all

the time.

Phone conversations are over in 30

seconds flat. You know stuff about tanks.

A five-day vacation requires only one

suitcase.. You can open all your own jars.

You get extra credit for the slightest act of

thoughtfulness. If someone forgets to

invite you, he or she can still be your friend.

Your underwear is $8.95 for a three-pack. Three pairs of shoes are more than

enough. You almost never have strap problems in public. You are unable to see

wrinkles in your clothes. Everything on your face stays its original color. The same

hairstyle lasts for years, maybe decades. You only have to shave your face and neck.

You can play with toys all your life. One wallet and one pair of shoes — one color

for all seasons. You can wear shorts no matter how your legs look. You can ‘do’

your nails with a pocket knife. You have freedom of choice concerning growing a

mustache.

You can do Christmas shopping for 25

relatives on December 24 in 25 minutes.

No wonder men are happier.

________________________________________

Comments »

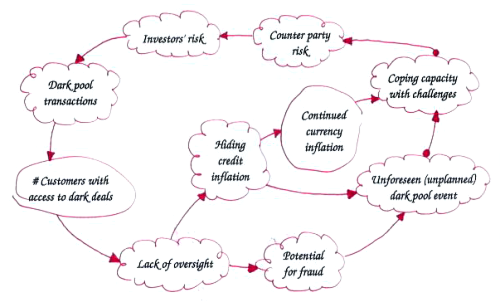

Wow, we were set for a major pitfall this morning and then the market reverses itself back to flat line. Now going positive on the DOW. A magic trick brought to you by GE.

Wow, we were set for a major pitfall this morning and then the market reverses itself back to flat line. Now going positive on the DOW. A magic trick brought to you by GE.