This music clip may be inappropriate! But tomfoolery got us here. Have we reached capitulation? I’m not so sure we have. Have a great weekend I’m going fishing.

[youtube:http://www.youtube.com/watch?v=SESr9D5Gd7A 450 300] Comments »Today’s Math

Oil was flat yesterday and the Dow was up 105.

Then tensions from Nigeria, Brazil, Israel attacking Iran, and technical trading sent oil higher by $5 and the DOW down 125 points. Those fears have spilled over this morning.

Based on this highly childish math $200 oil equals 9000 DOW with added capitulation.

Despite the childish math oil and equities are tied, married, ball and chained together.

Message to Congress: START DRILLING THE NORTH SLOPE OF ALASKA AND RELEASE THE STRATEGIC OIL RESEVES. SAVE TAX PAYER DOLLARS ON BAILOUTS AND USE THE MONEY TO SOLVE THE ENERGY CRISIS. OH YEAH TAKE A PAY CUT FOR YOUR GROSS FOLLIES OF ERROR. HOW ABOUT $1….

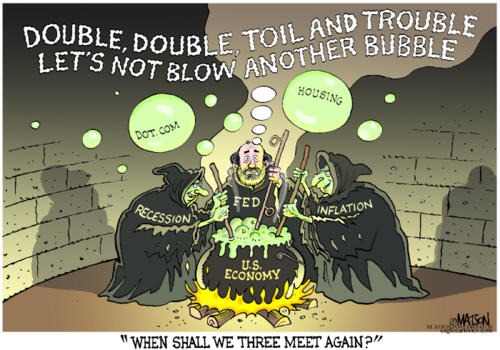

If oil continues to book higher we will not have an economy to speak of.

Seriously folks, concerns of [[FNM]] and [[FRE]] are rattling the markets.

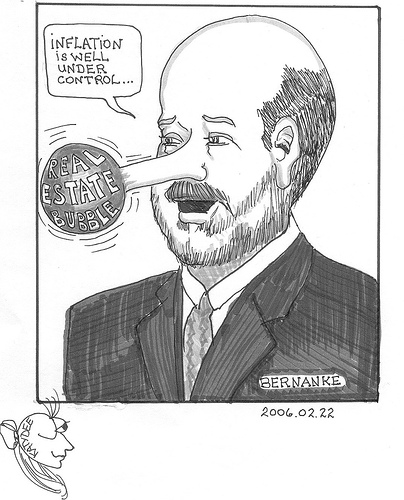

Why are Bush, Paulson, Bernanke, and even McCain saying nothing is to large to fail? FNM and FRE are backed by Uncle Sam. They can not be talking of LEH…they are not considered large by any stretch.

Here is my prediction. No one will be able to raise the colossal sum of money to save these companies from having a minimum of 1.5% cash balance against their portfolio of 40% of all mortgages in the country. Were talking over $75 billion dollars or more.

So, Uncle Sam will take control and divide the companies up amongst the inner circle of Federal Reserve banks to spread the risk and to create liquidity for these banks. Existing shareholders of FNM and FRE will not be completely blown up since they will receive stock from JPM, C, BAC, etc.

At the same time you prevent systemic failure and allow the other banks who are hurting with no future earning’s prospects to get more cash flow onto the books.

The other alternative is too take them completely onto Uncle Sam’s books and royaly screw shareholders and go back to the printing press on the Greenback.

We have already seen what dilution of the dollar has created. Can we really afford to dilute the dollar any further? I do not think so. Because this would send oil to $200 plus and the market along with your 401k and pension plan into the garbage.

This is something we can not afford. Just my guess at this point.

In other news GE beat the revenue side and came in line on their EPS. Interestingly their global infrastructure revenues were up 24%….

Yesterday I stopped out of some issues and for now I am considering some short sales in COF and some of the FLY’s “reverse horseman,” but for the most part I’m going to “hang out on the bench.”

GLT

by GW

[youtube:http://www.youtube.com/watch?v=hZ8UqstzNlU 450 300]Comments »

How Much Risk Can LEH Take?

Apparently a lot of risk is the answer. I’m not sure why we should be happy that they reduced leverage from 40:1 down to 22:1.

Everyone is talking about LEH…After hitting $15 and change I’d say there is something to talk about.

Bill Gross believes as long as the Fed’s discount window is open then no one will fail. He has also stated that he continues to trade with them….LEH that is.

If you ask me dealing with ill liquid securities would keep me open to trading with them hoping for a bid or some sort of exit strategy.

I know that I have been struck with the homo hammer in UNH and TSO. I do not want to uderstand why a company with positive cash flow and is not leveraged 22:1 gets more of a homo hammer than a company like LEH or C….

Merideth Whitney talks of tangible book value….I’m talking about positive cash flow.

Now the tv is talking about FNM raising $75 billion. Along with FRE they are holding $1.5 trillion in loans.

Why is Paulson even saying they are not to big to fail or even that they government might not back them? It is a government backed agency.

If you ask me between Paulson and Bernanke today nobody seems to really know what is going on here.

Did you see Ron Paul today wish that guy was still running for president.

So here we are another head fake in the market and oil is racing higher. See you later TSO…

GLT

by GW

Comments »

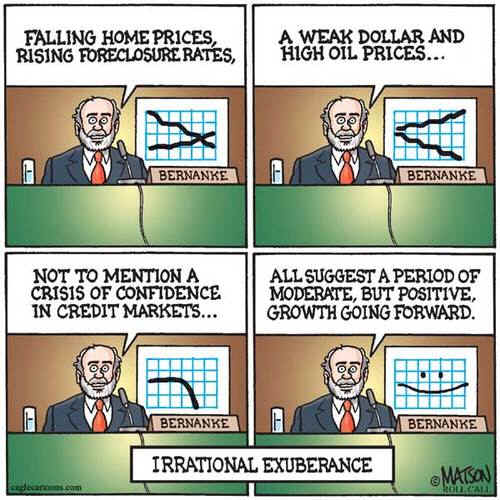

Do Not Believe the Hype

So this morning, The Fly reports on no growth for Jim the “Bow Tie.”

We have ROH getting bought out by DOW. The CEO of DOW said he believes all of America and the world for the most part is slowing down.

BTW I seem to remember a flurry of LBO deal activity right before the market tanked last year. Remember this for the rest of your life. There are only three scenarios when a flurry of deals come through.

1) Times are great and companies want to control a space, 2) Times are horrible and the cash rich acquire companies for pennies on the dollar, or 3) Interest rates are low and soon there will be a negative business environment and companies are looking to beef themselves up for the lean times ahead.

Also this morning we had better than expected retail sales with guidance being raised. Remember that is raising guidance after it had been lowered tremendously.

As well we had better than expected jobless claims.

Will all of this get the market to really rally? I would not bet on the hype here since yesterday turned from boring to death warmed over.

The S&P needs to break 1251, 1260, and then 1283 most importantly. Today is a good day to follow intra day trend lines (like day traders always do) for market direction. Like yesterday we saw a reversal and potentially we may see the same activity today.

Oh Asia is mixed, but Europe is tanking. I am reconsidering getting back into CHK, HK, and PVA. This will be determined by oil. So far oil is continuing its pause. I still would like to see it go down, “but it is gonna do what it is gonna do baby.”

GLT

by GW

[youtube:http://www.youtube/watch?v=JX2PtstlODw 450 300]Comments »

Full Stop

What can you do in this market?

Sit on the sidelines! Or be quick. Or market neutral.

Figures I go out for some fishin’ and when I get back after the close I receive the homo hammer.

For those long term investors I’m not taking your unsolicited trades. Blow yourself up else where. Then I’ll acat what is left of your value plays. No such thing in this type of market.

For my traders and momo’ players; they know the deal. Time to stop out. YTD were now down about 4.9%. No biggie. Shameful after being up almost 14% just a month or two ago.

As for myself, my trading account is up 21.8% …Thank you very much. I do not have to argue with myself to buy or sell.

Everyone needs to sign discretionary papers…. Do you have your papers?

As for my don’t look till I’m 65 account I’m down about 16.6%…..oops I looked. I guess the income has kept this account out of bear market territory for now. Mutual funds suck!

At any rate, go on vacation or follow the order of RC he does seem to have a sixth sense lately. Of course The Fly has navigated this horse puckey quite nicely too. And I thought 35-40% cash would be fine.

Well let me just say this homo hammer is coming for you longs like a child molester fresh out of jail. Don’t know why they ever let those guys go.

I’m looking for the S&P here to come into the 1216-1224 area. I’m also looking to go back to 80% cash tomorrow no questions asked on all my trading accounts. Maybe I’ll go short and then add when the market is at zero. Zed is when you know we have reached the bottom.

I will stay the course on SNHY and SY. Without question the QLD and SSO are gone 9:30am. Minor nick.

GLT

by GW

[youtube:http://www.youtube.com/watch?v=PybccIKbtSw 450 300]

Comments »

Summer Doldrums

Watching this market is like watching paint dry on the wall.

Remember when you were a child and the summer seamed to last for like an eternity?

Well that is our stock market; hours have turned into days, days into weeks past that I get sick.

If we erase yesterday’s rally then I feel we have more downside probing to accomplish.

I still remain fairly positive that we have found a short term bottom until market moving news hits the tape in either direction.

I’m guessing here that this is a minor pause or shake out before we get another lift. Upon any lift we need a S&P 1283 close for conviction the bulls are taking charge.

Otherwise, I can not wait till August since this is the month to scoff a Euro freaks and question the idiocy of allowing garbage to pile up everywhere during the height of the tourist season.

I’m thinking a gastronomic tour of Italy. Start north then head south for 3000 km. Perhaps the price of petrol will cause me to see the Badlands or the Grand Canyon…something domestic. Maybe a visit to the fam’ in CA. and then up to Sierra Nevada altitudes. Something must be done to kill off the Doldrums.

For now I’m going to skip and play hookey on a rainy river for some trout.

GLT

by GW

[youtube:http://www.youtube.com/watch?v=FSBYfc46rhk 450 300] Comments »