Click chart 2x for a better view.

Click chart 2x for a better view.

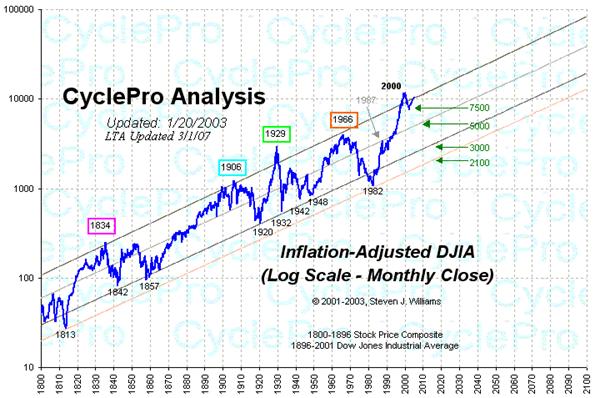

Pay close attention to the chart above. Notice how we are retracing the footsteps of the ’29 debacle. Scary if you ask me.

Back from Boston. I got to thinking how do I lighten up on my concerns? Perhaps distraction.

So I go to a poster gallery to see some fine art from the Hippie Love Movement.

Enjoy a little seafood at lunch and then catch a review of Cole Porter.

The whole time I’m thinking what’s the market going to do Monday?

Why am I thinking this? Well partly ‘cause I’m long and wrong. I’ve got a 35-40% cash position, a small short position, and some how I keep thinking is this going to be the big one?

You know where Fly kicks old man market down the stairs.

Is the RBS guy or the multiple reports of systemic failure going to pass right here and now?

At any rate, I’m going to set my limits and say if the S&P breaks this 1239-1246 level I’m going to have to consider stopping out of long positions. To protect myself I’m going to try and sell some covered calls. I’m betting the premiums are low right now. If some how the S&P holds this mark I will also use the dollar index as a key to reducing exposure.

We really do not want to see the dollar break 72.03 on its index. If it does the final warning will be a break of 70.96. The difference between these two numbers is quite a bit so of course this is a red flag outstanding for the next couple of weeks of trade. Mind you Peter Schiff (who has been right all along) believes the dollar could go to 50 on its index.

I believe A’dawgg and some others went short on COF. A break of $37.41 for a closing price sets up a nice short down to $25. Any short sells can be made in the $41 – $45 range. I like this idea considering this:

http://www.informationclearinghouse.info/article20196.htm

With oil down and the futures pointing higher we could see a snap back rally, but this is dangerous territory for the indices and concern for EXTREME CAUTION! Let us face the facts with GE and other multinationals selling off lately the market is telling us this is the time to reduce exposure.

GLT

by GW

[youtube:http://www.youtube.com/watch?v=A27FF2T2z2k 450 300]

If you enjoy the content at iBankCoin, please follow us on Twitter