He was Emo when Emo wasn’t cool.

_____________________________

Stubbornly and like an ass, I sold continuously throughout the day.

In drips and drabs of course, but it becomes cumulative after a while. Frankly, I don’t know how Docteur Le Fly does it. It seems like one day he’s fully invested and then — BOOM! — He’s 60% in cash.

It doesn’t even seem to faze him.

I, on the other hand, agonize on every share sold in a rising market, even as I know deep down in my medulla oblongata (sic), it must be done. I am at a little more than 25% cash right now and I feel as if I’ve been scourged on the wheel for a fortnight.

Perhaps I shall cut out that nasty M.O. and be shrived of my cognitive dissonance sins at last. Who needs motor function anyway? I can always blog at you via sophisticated “eye-blink” technology, right?

Onto the shriving. Needless to say, I bought nothing today, despite the ambulatory nature of such Ag Gems as Jacksonians The Andersons, Inc. [[ANDE]] and Monsanto Company [[MON]] , which finally broke back over the $80 barrier. You remember the old Fly-saying, yes? “If it gets over $80, it’s going to $120?”

We shall see. I also like Intrepid Potash, Inc. [[IPI]] and Agria Corporation (ADR) [[GRO]] , but lower.

Sales today were across the board on the PM’s and I even took the time to sell off some odds and ends as well.

I sold some enormous Eldorado Gold Corporation (USA) [[EGO]] today — almost 30% of my stash, 4k at $13.12. I also sold 2k shares of the enormous performer IAMGOLD Corporation (USA) [[IAG]] , one third of my holdings in that name, for $18.85. Sawing a hunk of my shoulder blade off would’ve been less painful.

Of my 6k shares of [[GDX]] I sold 2k outright at $50.18, and then hedged the remainder by selling March $50 calls at $5.25 a piece.

Taking a dull spoon to my eyes, I sold another 4k of Silver Wheaton Corp. (USA) [[SLW]] , and then hedged 7k of the remaining 11 by selling 70 March $16 calls at $1.90 and $2.00. Perhaps talking about it here will assuage my pain?

I sold 2k of [[PAAS]] at $24.68 and another stray K of Allied Nevada Gold Corp. [[ANV]] at $12.16, leaving me with 4 and 10k respectively. What will you have of me next? My children?

Oh my, I must have been putting this one out of my mind, as I’d almost forgotten… I also sold 8k of [[EXK]] today (40%!) at $3.68. Arthur Koestler, I know your Darkness at Noon!

Last on the precious fronts, I sold 1.5k of [[CDE]] at $21.99 and $22.03, and 4k of Rubicon Minerals Corp. (USA) [[RBY]] at $4.16.

On the “odds and ends” front, I sold another 2k of [[BIOS]] at $7.68, leaving me with only 2k left, which I will not sell outside of Armegeddon, where I may need River Styx fare.

I also sold 6k of Citigroup Inc. [[C]] for a rare loss (only a couple of pennies plus commish) on a complete “cautionary” basis. I think I can buy those back cheaper, is all. Last, I sold a stub amount (1k) of Sinovac Biotech Ltd. [[SVA]] which I’ve owned since the low $3 range, for $7.51.

Last, but not least, I booted the remainder of my [[ERX]] (1.5k) with the dividend pushout, at $38.46.

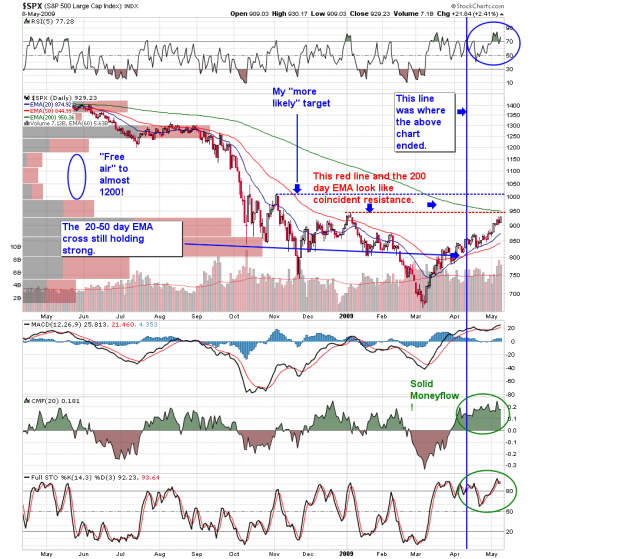

I am quite exhausted and on tenter-hooks, ovah heah, but I must trust my charts and instincts, or all is lost. I am thinking we will see a correction at least into Turkey Week, as Tim Geithner and the Klown Kircus will be selling more yummy T-bonds into the maw of Mother Market whilst we prepare for Pilgrim Foods.

You know what that usually means by now, I expect. If not, you have not been paying close attention, and are condemned to suffer the fate of Piglet during Swine Flu Saison (sic). (Ostracism)

Best to you this weekend. Off to see an Opera.

__________________

Addenda — if you haven’t already done so, be sure to ring up your block head Senator and tell him/her that this Obamacare is a train wreck waiting to happen. It looks like Dirty Harry Reid and the Dem Senate are taking a page out of Madame Pelosi’s book of legerdemain and are going to try to jam this through in a Saturday Night Special. If this were a good bill, of course they’d have no need to be so serpentine.

Ciao.

______________________

Comments »