__________________________________

Young Daniel-san has been nagging me lately about the other lustrous beauty, Platinum —

I interrupt this blog post to tell a funny story about an even younger Daniel — my son. Tonight we were alone together, as the Good Woman took the other kids to see “Star Trek” (she for the second time) and I stayed home with “the baby.” Problem is, he’s not so much a baby any more and quite prone to mischief. Case in point, he had been locking himself in his room lately, so — clever us — we turned his doorknob around about six months back. Skip to tonight, whilst I’m preparing him beddy-bye, he’s mucking about with the door again. Too late — I heard the “click” — did I realize he’d turned the lock and pulled the door shut, effectively locking us in his room until Star Trek was out. Bugger.

Anyway, ever since Danny bugged me about Platinum, I’ve been watching [[PTM]] — the most liquid ETF of the metal I could find. Tonight I’ve taken the decision to grab some given a break from it’s current position. Given a trial period, I may even consider it for the JCHP. I believe the following limpid, elucidating, facile and explanatory CHART will show my reasoning (rather than have you guess as to what the hell goes through my head on taking decisions like these, along the lines of certain obstreperous , cranky “Uncle Fuckers” with whom we may be familiar):

Overbought? Most assuredly. That’s why I’ll wait to see if it clears this critical $15.40 mark before I dip my beak. I think PTM should likely match the other precious metals, and continue to hold value, like it’s other “precious industrial” twin, Silver. We shall see.

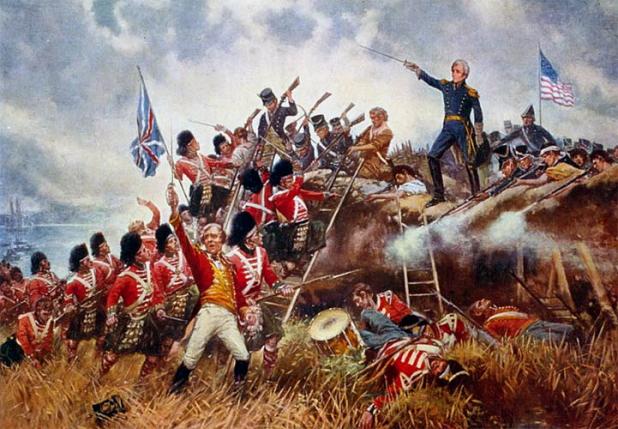

Meanwhile, ho hum, the Jacksonians were mostly green-hued again today, all save the two I’ve hedged with sold calls (TBT & TSO). Odd, no? It looks like TSO may take something of a hit here tomorrow, thanks to the foolishness of VLO and WNR, it’s villainous brothers. I’m not overly concerned, as I sold the June $17.50’s at close to $2.00 some weeks back. That said, I’d like to see TSO hold the $16.70, area, as that is the bottom range of it’s current ascending triangle.

The $HUI continues to consolidate under $400, even as the Jacksonians move forward. There should be some room for additional accumulation this week, I hope.

| Name | 2-Jun | % Change | Comments | ||||||

| ANDE | $ 26.84 | 3.23% | Another 3%+ day, Ags still strong | ||||||

| EGO | 10.13 | 4.54% | So much for accumulation. Hope you got some. | ||||||

| GDX | 44.55 | 2.63% | $HUI under $400, yet GDX still up. | ||||||

| GLD | 96.36 | 0.66% | Gold (the commodity) only $14 away from $1k | ||||||

| IAG | 11.20 | 1.63% | Friday’s gap gets further away. | ||||||

| MON | 82.70 | 1.50% | Moving back in the right direction for MONGO | ||||||

| NRP | 24.30 | 0.25% | Back at the top of the consolidation range | ||||||

| PAAS | 23.86 | 2.01% | Chug chug chug chug | ||||||

| RGLD | 47.76 | 3.51% | Just the best thing you can own | ||||||

| SLV | 15.75 | 2.61% | POS over $16 tonight, should follow | ||||||

| SLW | 10.87 | 3.62% | Overbought, but silver rocketing | ||||||

| SSRI | 24.67 | 1.52% | Ditto | ||||||

| TBT | 55.00 | -0.94% | Pullback from yesterday’s gapup | ||||||

| TC | 10.39 | 4.00% | Considering selling the calls on this huge move | ||||||

| TSO | 17.50 | -0.06% | Will have to fight the VLO news tomorrow | ||||||

| AVG | 2.05% | ||||||||

_____________________________________________________________________________

Comments »