Trust Ye Not the Evile Clamme!

_______________________________________

Well, wasn’t that a refreshing sell off we had today? Will we bounce from here? Likely, at some point. But I wouldn’t get overly excited about it. In fact, I’d take any rebound in the next couple of days as a welcome loosening of the steer-making device from around your sensitive bits, and lighten, lighten, lighten.

You want to be as light as a Capezio-wearing chorus line extra dangling from a dirigible. Because ladies and gentlemen, the Clamme is not your friend! The Clamme is the friend of men standing in bomb shelters poring over ruined real estate portfolios, but he is no friend of the genial Speculator.

As good as it feels to revel in the seemingly endless supply of bubblicious liquidity flowing from the Helicopter du Clamme, you must believe that the other side of that euphoria is the long weightless drop down the elevator shaft, to which there is only one end for your portfolio.

Ker-freakin’-splat!

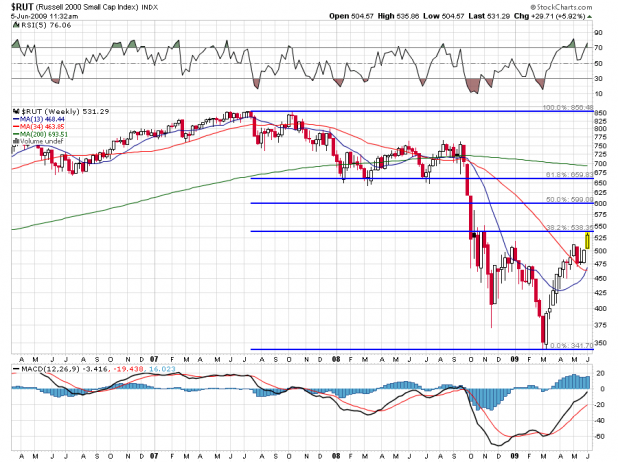

I love the Russell 2000 as a market indicator. Are you going to pay attention to the Dow 30, instead?

A 10-12% sell-off will bring us back to the $72-73.00 area, where I see pretty solid support. The 200-day EMA should rise to the $70 level here in the next couple of days, and that will offer additional support. I don’t expect a bloodbath, yet, but why watch your portfolio shrink, or worse, get thrown in the chowder bowl when we will have larders full of opportunity in the coming weeks and months?

Patience. It’s a most difficult virtue, but one that will pay literal dividends in the weeks ahead.

I added to all my market hedges today — SDD, SDS, and QID, to salutory effect. I also off-loaded a small amount of MVG that I had not hedged, and sold off another quarter of my FTK holdings. Tomorrow, I shall likely purchase some TWM and perhaps even some TZA, which I have held off on purchasing due to it’s razor-sharp canabalistic capabilities.

Best to you all, Clamme Diggers.

_____________________________

Comments »