[youtube:http://www.youtube.com/watch?v=G1Qvnixz1TE 450 300]

Not so bright, but a good guy to have around when the Fox is in the hen house! (No really, that’s a metaphor… really!)

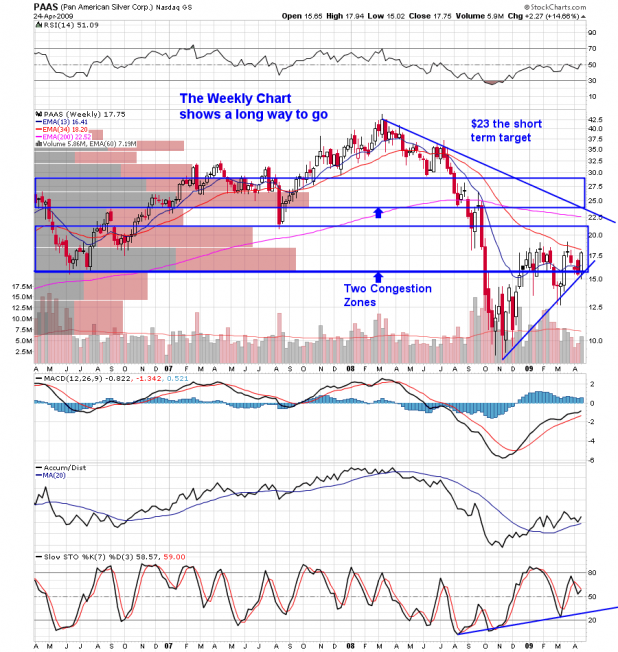

The Amex Gold Bugs Index (AMEX: $HUI) is one of my touchstone index’s for my precious metal portfolio. The $HUI contains mostly unhedged gold mining companies and a couple of crappy silver miners (CDE and HL) , who don’t really serve as good representatives for the silver mining community (unlike Jacksonians SLW, PAAS, and SSRI). Jacksonians Core gold holdings [[EGO]] and IAG are members, however, along with “possible” new entrants GG and AUY. The full fifteen components are listed here.

Because of it’s silver component, I find the $HUI even more useful than the ETF GDX as a precious metal miner index. So let’s have a look at the daily and weekly charts to see where we are:

As you can see from the chart, the current daily is showing signs of a pullback, likely to the 20-day EMA at $323 to $325. This is perfectly healthy — and in fact welcome — given the recent drive to the long term resistance line pictured. I expect it won’t be long before we are above that line and into the free air described in the “breakout zone.”

As for the weekly:

You can see we have broken above the long term downtrend line on the weekly chart, and are also seeing a bullish cross on the 13-34 week EMA’s. The midweek doji indicates we may test lower, but again, it looks like we are headed out of the consolidation zone soon.

Last, I annotated the long term weekly chart of SLW just for shits and giggles, to show where it is in relation to the $HUI weekly above, and to point out some obvious (from a weekly prospective) target zones. One thing I would point out is the long term fib lines show the 38.2% retracement line at $9.02, which we tested earlier this week. Again, it’s perfectly natural to have the price level turn away at that important point. Given the strength of the $HUI, however, I expect that $9.02 will not hold twice. Viz:

I will try to get back later tonight to update the Jacksonian Core performance stats, but I have to run to pick up one of the boys from lax practice. You know, “the aerobic baseball?”

Best to you all.

_____________

Jacksonian Core’s Performance for 5/14/09 was largely flat, with ten “down” positions keeping their losses in the pennies. On the other hand, of the four stocks in the black today, two —ANDE and TSO– were up over 5%, making it a market neutral day overall.:

ANDE — $20.88 (+5.51%)

GDX — $38.05 (+0.29%)

GLD — $91.03 (-0.07%)

IAG — $9.78 (-0.91%)

PAAS — $19.20 (-0.31%)

RGLD — $40.56 (-0.10%)

SLV — $13.85 (+0.29%)

SLW — $8.84 (-0.11%)

SSRI — $19.89 (-0.22%)

TBT — $48.94(-0.71%)

TC — $7.63 (-0.90%)

TSO — $17.21 (+6.96%)

Have a nice evening, all.

_____________________________

Comments »