What exactly does Appaloosa, at ~$25B AUM, one of the world’s largest and most powerful hedge funds, have in mind for Terraform Power, the battered yieldco of SunEdison?

With a 1.5B market cap, Tepper’s 10% TERP stake is worth all of ~$145M.

Based on filings, he’s up $50m (~$9 basis, TERP trading at $12) which is great for the PM’s EOY bonus, but relatively insignificant for the greater Appaloosa. To put this in perspective, if TERP goes back to its all-time $42.66 high, the 4x gain on Appaloosa’s initial $100M investment represents all of 150 bps.

Appaloosa’s 10% $150M stake in tiny TERP, with its best-case payout of ~150bps appears – underwhelming?

Equally curious, other hedge funds that are getting involved in the SUNE soap opera also appear to have aligned on the side of the yieldcos, TERP and GLBL. BlueMountain announced an activist TERP stake of >10% (cost basis of $11) and DE Shaw just filed a passive position of >5%. Greenlight, the original SUNE cheerleader, had reduced its SUNE stake by 25% (9/30 filing) and appears to have redeployed the funds into GLBL, the international yieldco.

To my knowledge, no one has announced an activist position in SUNE.

This positioning suggests funds are attracted to the yieldco’s shareholder rights. The avoidance of SUNE may limit conflicts of interest for any potential, future litigation proceedings.

The 12/30 filings will be interesting, to say the least.

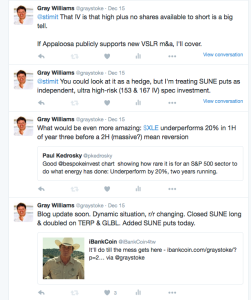

Twitter followers know I’ve been curious about Appaloosa’s silence on the renegotiated VSLR deal. I’ve also been surprised that the majority of SUNE investors assumed the changes satisfied Appaloosa’s stated concerns and that they wouldn’t litigate to block. I’ve reread the letters, which I though raised a number of questions that increased SUNE’s uncertainty. On December 15, I flipped out of a SUNE long to buy SUNE puts, while doubling down on both TERP and GLBL longs.

Today’s new letter from Appaloosa suggests their intentions:

In a letter to TerraForm management, Appaloosa asked for all documents related to their transactions, management changes and SunEdison’s planned acquisition of residential installer Vivint Solar Inc., according to a regulatory filing Tuesday.

Even if it is still low probability, should Appaloosa litigate to block the VSLR deal, today’s equities action offers an alternative view of where that would leave SUNE.

Tepper’s MO is to see and act on things that other investors miss.

The creation of the yieldcos meant ring fencing SUNE’s highest-value assets into standalone, legally protected entities. The purpose was to achieve a lower cost of capital, but now that SUNE is (still?) under a margin-induced liquidity squeeze –despite a number of (questionable) asset sales and canceled deals– could it be that the yieldco’s represent a critical vulnerability to a sophisticated predator?

The Yieldco’s are not SUNE’s private piggybank, to do with however they please. The world has changed, there are now other (veteran) TERP and GLBL shareholders, and they know their rights.

The replacement of TERP CEO Domenech and replacement by SUNE CFO Weubbels and resignation of multiple directors (an episode that has still not been properly explained to shareholders) suggests a blatant disregard for the new world order.

Its actions suggest SUNE still does not differentiate TERP & GLBL assets, cash and credit from its own. Out of desperation, the SUNE management team seems to be changing the rules as they go, whether its forcing low quality assets into TERP, selling unfinished projects into GLBL, or using the yieldco balance sheets to fulfill the parent warehouse responsibilities.

I’ve delayed writing this update as it’s been difficult to assign a probability until we saw Appaloosa’s next move.

Today, that may have happened.

With 50.3% and 30% ownership stakes in TERP (1.5B) and GLBL (.63B) representing about $1B of SUNE’s ~$1.3B cap (falling rapidly while the yieldco’s seem to have stabilized), the market is telling us how it values the standalone devco.

Again, what’s Tepper’s end game? Only he knows for certain, but there’s a finite number of possibilities.

Investors should consider that one speculative possibility is Appaloosa has been planning all along to force a vulnerable and weakened SUNE into relinquishing some or all of its holdings in TERP and GLBL.

Once freed of the SUNE albatross, there are scenarios where TERP and GLBL could rapidly recover as much as 2-4x while the remaining SUNE devco – undifferentiated in a highly competitive space where it’s unlikely to maintain its industry-leading margins- is devalued and left to fend for itself.

Interesting thought exercise: If Appaloosa blocks, what are SUNE’s remaining options in regards to satisfying obligations to BX/VSLR? That could be what triggers the liquidity event, and it’s what I’m researching now.

If so, what would then stop Appaloosa from acquiring what remains of SUNE in order to own the majority of a newco that tackles the 70T green energy opportunity?

Why wouldn’t Tepper do it? Why settle for 10% of TERP when you can take it all?

After all, it’s not just a $3.5B collection of devco/yieldcos. With Tepper behind them, it’s at least +$35B potential, based merely on where it all traded 5 mos ago. Now that’s a meaningful win.

Perhaps Appaloosa only squeezes SUNE until they cry uncle and give him what he wants – majority ownership. Perhaps SUNE bankruptcy not in the cards.

We shall see.

Stay tuned.

If you enjoy the content at iBankCoin, please follow us on Twitter

Well thought out

As pointed out in my most recent post on $SUNE, the creation of a 3rd SunEdison YieldCo to house the “resi” US domiciled solar asset, TERR – TerraForm Resi (or similar) could allay some of Tepper’s concerns on TERP getting the non-optimal end of the drop-down stick. There is something bigger afoot in my view. A tender offer for o/s debt at a deep discount could pave the way for a bid (with partners seeking long duration assets) to take one (TERP) or all (SUNE, TERP & GLBL) private.

Probability for there being any market appetite for a third yieldco at present is nil.

Beyond being the most egregious example of poor governance, VSLR is unlikely Appaloosa’s primary focus. In other words, SUNE could have canceled VSLR and I think Appaloosa would still be gunning for them.

As to their strategy, Appaloosa dropped an important clue when they mentioned the Entire Fairness Doctrine.

I’d be scheduling “catch-up” coffees with former bosses and colleagues if I was in SUNE management, particularly the c-suite. But I don’t think cleaning house is all Tepper has in mind. Feet to flame, I think he’s going after the whole thing, and burning SUNE to the ground first may be part of the plan.

Regardless, the most important thing for retail longs to understand is that a great deal of what’s good for TERP is not necessarily good for SUNE.