As some of you may know, I really enjoy watching TLT’s relationship vs. the equity markets. I’ve come to notice that TLT has been right significantly more often than it is wrong, whereby if TLT is significantly green on the day, as are the equity markets, the equity markets will usually sell off, or, at the very least, have limited to no upside left. But recently, over the past two weeks, this relationship is starting to erode. I’m not sure what it means. Is this just end of the year shenanigans? Or is there something actually changing in sentiment where investors are simply bidding up “less risky” names that drag up the markets to justify both equities and treasuries trading higher?

Regardless, I think equities are trading significantly higher than they should be. Over the next few weeks, I am expecting a vicious sell off. TLT is too high here, and equities are responding less than ever to people moving their money into risk-off assets.

Happy New Year.

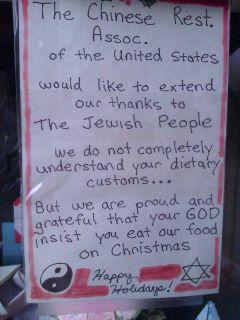

NOTE: Saw this on a friend’s Facebook today – pretty funny. Enjoy:

9 Responses to “TLT vs SPX”

thorium

Is there anyone who is NOT expecting a selloff?

djmarcus

i heard doug kass was long. not sure if he still is though.

djmarcus

and the obvious answer is yes… we continue to churn higher – someone(s) buying.

thorium

ha, right, I mean there’s a difference between thinking the market is going to fall but still owning stocks, and trading your convictions and going short or to cash…

djmarcus

also my stupid AMR puts are finally making money. cant believe i owned puts since it was over $1 and am only now making money. makes me nuts. I’m most likely selling them before end of day.

thorium

congrats

djmarcus

not enough liquidity to sell the puts. oh well. holding it into next week.

DJMarcus

out now.

10banger

I would mention, the more TLT tests that overhead resistance the weaker it becomes. Not to mention that the TLT is currently within a ascending triangle.

I would be expecting the TLT to move higher from here.