For DevilDog & SRS Hopefulls

Commercial real estate delinquencies broke 2% for the first time in May, observes rating agency Fitch. Weakness across various areas pushed the delinquency rate higher by 29 basis points from the previous month per a report summarized by Research Recap. Meanwhile Moody’s, tracking the same thing, thinks the delinquency rate could hit 4-5% by the end of the year.

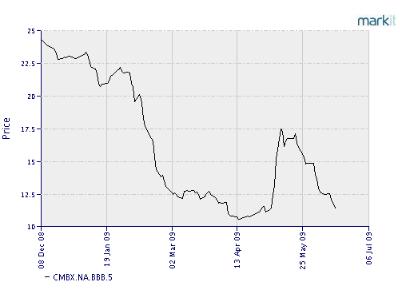

Arguably, what matters is not performance of these properties but how the market values them today, since a lot of this is expected. So how’s that looking? Not good.

Pragmatic Capitalist put up a chart of the latest CMBS action, which has fallen sharply since a rally in late April and mid May (which we discussed here).

If Your So Worried Then Bet Against It

Comments »By Netty Ismail

June 16 (Bloomberg) — 36 South Investment Managers Ltd., whose Black Swan Fund gained 234 percent in 2008, is raising money for a new hedge fund, betting that government efforts to pump money into economies could result in hyperinflation.

The Excelsior Fund targets returns that will be five times the average annual rate of inflation of the Group of Five economies — France, Germany, Japan, the U.K. and the U.S. — should the rate exceed 5 percent, Jerry Haworth, co-founder of the firm, said yesterday. Raising $100 million for the fund would be a “good” amount, he said.

“There is a sharply increased risk of greater than 5 percent inflation starting from now,” Haworth said in a telephone interview from London. “We are in the lag period between when the seeds of inflation are sown and when their off- spring, that is higher prices, are evident for all to see.”

U.S. President Barack Obama is selling record amounts of debt to try to end the steepest U.S. recession in 50 years, while Japanese Prime Minister Taro Aso has unveiled three stimulus packages worth 25 trillion yen ($261 billion) since taking office in September. Governments around the world selling record amounts of debt may devalue currencies against assets and spark inflation.

Most investors are underestimating the risk of inflation, Haworth said. Consumer prices in the U.S., the world’s largest economy, are set to rise 1.7 percent next year, following a 0.6 percent decline this year, according to the median of 70 economists surveyed by Bloomberg.

Inflation Risk

“There is certainly talk about inflation but people might think of inflation at 5 percent or 6 percent,” Zimbabwean-born Haworth said. “We’re talking 5, 10, 15, 20 percent or more.”

Investor Marc Faber said on May 27 he was “100 percent sure” that U.S. prices may increase at rates “close to” Zimbabwe’s gains, and the U.S. economy will enter “hyperinflation” because the Federal Reserve will be reluctant to raise interest rates. Zimbabwe’s inflation rate reached 231 million percent in July, the last annual rate published by the statistics office.

Universa Investments LP, the hedge-fund firm advised by “Black Swan” author Nassim Taleb, is also adding a strategy betting that stimulus efforts won’t prevent deflation or could result in hyperinflation.

Inflation will likely be “very low” through 2010, said Alvin Liew, an economist at Standard Chartered Plc in Singapore. There will only be “a risk of very high inflation” starting in 2011 if governments fail to rein in “those excesses that they did to stimulate the economy in the near future,” he said.

“For now, I will be more concerned about how sustainable the growth recovery path is,” Liew said. “When we move into the later part of 2010, investors should pay more attention to inflation.”

Options

36 South’s Excelsior Fund will buy long-dated options it considers cheap and that “stand a good chance of outperforming in an inflationary environment,” Haworth said. Options are contracts to buy or sell a security by a certain date at a specific price.

The fund will wager on an increase in commodity and equity prices, bond yields and increased currency volatility.

“It’s a very high-risk, high-return fund,” said Haworth, who has been trading derivatives for more than 20 years as the former head of equity derivatives at Johannesburg-based Investec Ltd., and co-founder of Peregrine Holdings Ltd., a South African money manager and stockbroker.

The firm will be marketing the fund in the next three months.

36 South has closed its Black Swan Fund, which bet on risk- aversion events, and returned the money to investors after profiting from last year’s global markets rout.

Returns on the inflation fund “could be even higher than the Black Swan Fund though the likelihood is smaller as options are more expensive than they were when the Black Swan positions were bought,” Haworth said.

Asia Extends Global Market Declines

Comments »By Shani Raja

June 16 (Bloomberg) — Asian stocks fell for a second day, led by automakers and mining companies, after a New York manufacturing report missed economist estimates and commodity prices sank.

Toyota Motor Corp., the world’s No. 1 automaker, fell 2.1 percent in Tokyo. Sony Corp., which gets 24 percent of its sales from the U.S., retreated 1.9 percent. Rio Tinto Group, the world’s third-largest mining company, slumped 4.9 percent to A$71.83 in Sydney as oil and copper prices fell. Declines in Asia extended a global slump that dragged the MSCI World Index down by the most in two months yesterday.

“The green shoots of an economic turnaround continue to appear, but the question is whether markets have priced in a bumper harvest,” said Tim Schroeders, who helps manage $1 billion at Pengana Capital Ltd. in Melbourne. “We need to see more evidence of a sustained pick-up in demand to sustain current commodity prices.”

The MSCI Asia Pacific Index sank 1 percent to 102.58 as of 10:21 a.m. in Tokyo, extending yesterday’s 1.5 percent decline. The gauge has surged 45 percent from a more than five-year low on March 9 amid speculation the global economy is recovering.

Japan’s Nikkei 225 Stock Average fell 2 percent to 9,834.97 before a central bank decision on interest rates today. Australia’s S&P/ASX 200 Index declined 1 percent. New Zealand’s NZX 50 Index lost 0.7 percent.

The Kospi Index dropped 0.8 percent in Seoul as MSCI Inc., whose stock indexes are tracked by investors with about $3 trillion in assets, left South Korea unchanged as an emerging market. The country, the Asia Pacific’s sixth-largest stock market, had been under review for an upgrade to developed status.

Manufacturing Contraction

Futures on the Standard & Poor’s 500 Index dropped 0.1 percent. The gauge slid 2.4 percent yesterday, the most since May 13, as the Federal Reserve Bank of New York’s general economic index fell to minus 9.4 in June from minus 4.6 the previous month. Economists in a Bloomberg survey had expected the gauge to stay unchanged. Readings below zero for the index signal manufacturing is shrinking.

“Investors expected the global economy will recover at a fairly fast pace, but this view is changing to one that a recovery will remain moderate,” said Fumiyuki Nakanishi, a strategist at SMBC Friend Securities Co.

Toyota, which gets 31 percent of its revenue from North America, sank 2.1 percent to 3,750 yen. Sony, the maker of the PlayStation 3, lost 1.9 percent to 2,580 yen.

Rio Tinto Group, the world’s third-largest mining company, slumped 4.9 percent to A$71.82. BHP Billiton Ltd., the world’s biggest mining company, fell 1.8 percent to A$36.35. Copper futures dropped 3.6 percent in New York yesterday, while crude oil sank 2 percent, falling for a second-straight day.

‘Under Pressure’

“We’re seeing a bit of a snap-back after markets got ahead of themselves, especially commodity stocks,” said Ben Potter, an analyst at IG Markets in Melbourne. “Despite some green shoots hinting at a recovery, the fundamentals of the global economy are still under pressure.”

Materials and energy stocks are the best performing of the MSCI Asia Pacific Index’s 10 industries in the past month as investors bet demand for raw materials will pick up as the global economy recovers. The International Monetary Fund raised its growth forecast for the U.S. economy yesterday.

The MSCI gauge climbed more than 10 percent for a second month in May, which hasn’t happened since the two months ended 1993. The rally since March has driven the average valuation of companies in the gauge to 1.5 times the book value of assets, the highest level since Sept. 26, according to Bloomberg data.

“The likelihood of a global depression has all but disappeared,” said Pengana’s Schroeders. “People are now turning their attention to the appropriateness of stock prices.”

10 Signs You May Want To Consider

Comments »These off beat barometers of the economy can give you much needed guidance for your portfolio or simply a good laugh.

Everyone is scrambling to get their fingers on the pulse of the economy. When will it turn around? Have we seen the worst? The answers may not be as elusive as you might think.

In the past, you might have relied on the old Hemline Theory to determine which way the market was heading: As hemlines rose, so did stock prices. Think model Twiggy in her super-short mod dresses of the ’60s, followed by falling hemlines in the ’70s as the economy weakened.

But these days you’ll find all sorts of clues in everyday life to help determine where the economy really stands. Dry cleaners, for instance, may seem a bit more cluttered these days, and it’s true — many people are stalling an extra week before shelling out to pick up their clothes. Eyeliner sales are surging these days, and a cutback in eye makeup may signal a resurgent economy in which people are spending on costlier personal luxuries.

1. Packed Theaters

During the last seven recession years, box office sales have increased in five of them. The new Star Trek movie pulled in more than $200 million in the month of May, just one example of how well cinemas are faring these days. According to the National Association of Theatre Owners, the number of movie tickets sold in the first quarter of 2009 increased more than 9% from last year.

Better films? Hot new actors? People continue to fill theater seats, NATO says, because movies are one of the least expensive entertainment options out of the house. The average ticket price in 2008 was $7.18. So when the lines get shorter, go buy some stock.

2. Green Thumbs

The National Gardening Association finds that the number of households who will grow their own fruits, berries, vegetables and herbs this year is 19% higher than in 2008.

That makes 43 million gardeners in the United States this year. It’s fun and relaxing, no doubt, but 54% of the respondents say the prospect of saving money on groceries motivates them to till the soil.

3. First Dates

Misery loves company, eh? Online dating service Match.com notices a pattern in its site activity during tough times. The fourth quarter of 2008 was their busiest in seven years (the site has been around since 1995). Match had a similar surge in late 2001, right after 9/11.

The company believes people are looking for someone with whom to try to forget about money troubles — or share the pain. When the Dow Jones industrial average dropped to a five-year low last November, Match.com had its second busiest weekend of the year.

4. Romance Novels

The economy has broken your heart and stomped it to pieces and now you need to put it back together. At least that’s what Harlequin, the giant romance novel publisher, says is happening. In 2008, Harlequin’s sales were up 32% from the year before. In 2009, its sales are still rising.

The publisher credits this its uplifting stories that offer a haven, and to the low prices of the books relative to other entertainment. This theory has stood the test of time. Harlequin saw a similar sales increase during the recession of the early 90’s. So if these stories start piling up unwanted on the discount table at the bookstore, alongside all those mis-timed guides to real estate riches, better news is on the way.

5. Droopy Eyes I

America is all tuckered out. A poll by the National Sleep Foundation found that nearly one-third of Americans lost sleep because they were worried about their finances. The 2009 Sleep in America Poll also found that 10% of those people tossed and turned specifically worrying about their jobs — roughly the same percentage of Americans who are out of work.

6. Droopy Eyes II

Americans spent $10.3 billion in 2008 to endure 1.7 million cosmetic surgeries, which is 9% less than in 2007. The American Society of Plastic Surgeons cites the bad economy.

Without as much extra cash — and facing depleted retirement funds and much less home equity — fewer people can spend freely on plastic surgery. The number of liposuction procedures was down 19% in 2008 and tummy tucks down 18%. If you can get an appointment with a top surgeon without much of a wait, that’s a sour sign for the economy. But, then again, maybe you can strike a deal.

7. Goopy Eyes

You’ve got that recession look in your eye. Total eye makeup sales at supermarkets and drugstores were up 8.5% in the one-year period that ended on March 22, compared to the previous year. In that time period, more than $260 million was spent on eye makeup — in particular, eye liner was up 9% and mascara almost 13%.

The leading lipstick indicator — the idea that lipstick sales rise in economic downturn as consumers settle for inexpensive luxuries — is not holding up. Lipstick sales are down 11%. But eye make-up has replaced lipstick as the indicator, so the principle is the same.

8. Gators

What do 100,000 alligators have to do with the economy? The gators are all residents at Savoie’s Alligator Farm, one of the largest alligator farms in Louisiana. The farm, which sells gator skin hides to tanners who in turn sell them to luxury designers like Louis Vuitton, has not sold a single hide since November, according to Savoie’s.

This business is awful because people are not buying alligator skin handbags and luggage. The makers of designer labels therefore don’t need to buy hides. This is tough on the gator farmers who are losing money fast and trying to keep the hides they already have in stock from spoiling. But it’s good news for alligators everywhere — if they only knew.

9. Dry Cleaning

The International Drycleaning and Laundry Institute is hearing gripes from many of its 5,000 members. The poor economy has customers are visiting less frequently and leaving clothes for longer. Weekly customers visit every two weeks, monthly customers visit bi-monthly, and some people delay their pickups even longer to avoid the bill. This has been a staple indicator of hard times before.

10. Mosquito Bites

We know the real estate bust has done a number on the economy, but did you know it can actually make you itch? In Maricopa County, Ariz., enormous numbers of foreclosed or abandoned homes have vacant swimming pools and unattended ponds. The stagnant waters — known as green pools — are a hotbed for mosquito breeding.

Maricopa County Environmental Services Department’s Johnny Diloné says crews have treated more than 4,000 green pools already in 2009. During the same period in 2007, before metropolitan Phoenix’s housing market collapsed, they had treated only 2,500. While most of the “green pools” are on vacant properties, some do belong to residents who just cannot afford to maintain their pools and ponds.

No Comment

Follow the link for a video special

Fake or dumping ?