We had 3 bank failures in 2007. We had 25 in 2008. So far, we have 14 YTD 2009. The FDIC’s troubled bank list now contains more than 250 institutions. How many banks will fail in 2009?

Have you noticed that when a politician speaks, such as Obama, Bernanke, a bunch of senators, or the occasional Geithner, the market trades in a neutral bound range? It’s a coincidence. It’s important to note who is speaking and when. For example, both the Boston and San Fran Fed Reserve bank presidents will be speaking later today. Have you noticed that Obama has been speaking almost every day? The market trades in a consolidation waiting for clarity, to find a direction at least for the day. It is dangerous to be rapidly trading in these environments. For days now, I have advised against it.

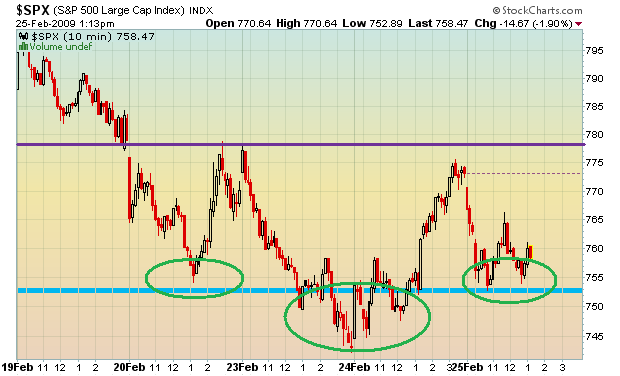

The SPX is still boxed in despite the intraday breakdown. This brings the market to a neutral status where I expect consolidation between 740-780. I warned that the market is flagging and it is very bearish sign. Each day that passes where the market trades in this range, the sooner the market will be able to continue to the downside. Most notably of the three indices, the COMP is the last to test it’s low. This divergence will soon be corrected. The probabilities for a downside move (over several days) are higher, simply because they are continuation patterns in most cases. Be careful trading in this range. There will be continued whipsawing.

We have GDP Q4 in the morning (8:30AM) in addition to the Chicago PMI (9:45AM) and Consumer Sentiment (9:55AM). I am 100% cash, so again, I could care less. Trade the reaction, folks.