First, RC and I made a video. It is on his blog. They are all high probability breakout and/or continuation plays.

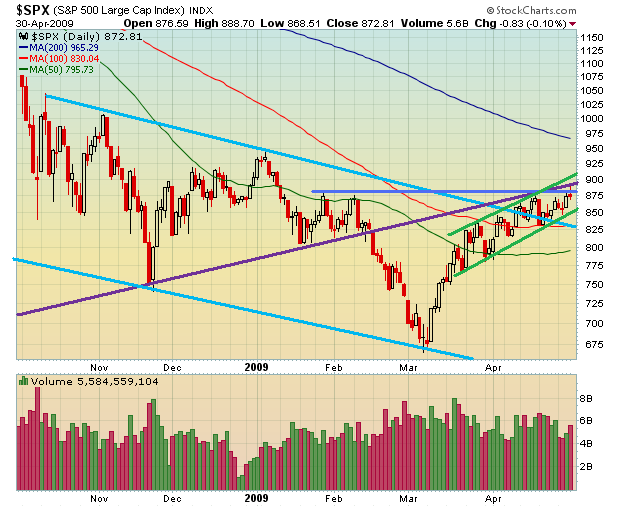

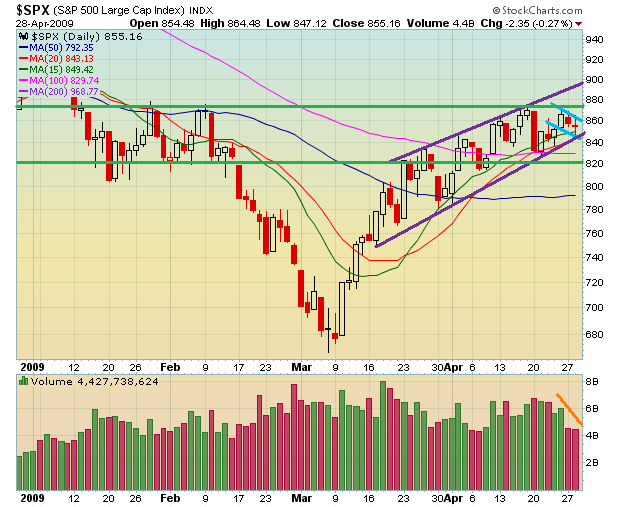

875 continues to be in focus (as is the 867-877 range). The market needs to break from this holding pattern quickly to meet resistance at 888. Frankly, if we continue to flag in this range, then it is bullish. If we breakout, it is obviously bullish. Even a breach of 860 leaves the uptrend still intact. There will need to be a major breakdown or a huge exhaustion gap in order me to go short at this point.

As you know, I already own CBB, CNXT, COIN, CPE, IO, THC, and WRES. I have a few other cheapies in my sights: EMKR, NXG, XTEX, GSIG. I made north of 50% last month playing only $1-3 stocks. In addition, there are a lot of oil/gas earnings plays that should breakout, including CHK and FST. I’ve said it many times before and I’ll say it again: be selective in your picks. Don’t pick random stocks and definitely don’t pick anything just because I’m buying something, despite the fact that I’m banking some serious coin.

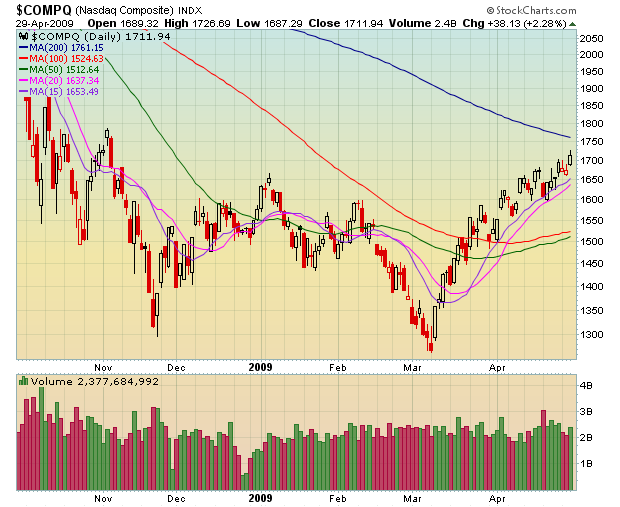

I received hundreds of questions/e-mails over the past few weeks on a variety of topics. I think I’m going to cover moving averages. The main question was, “what MA’s do you use?”. That’s simple. I layer all of my long charts with the 15, 20, 50, 100, and 200-day MAs. For shorts, I add the 5 and 10 as well. The MA’s for the long-term are the 200-day (primary) and the 100-day (secondary). The intermediate-term MA is the 50-day. Short-term MA’s are the 15 and 20-day, and the most important for swing trading.

The most ideal situation is when the 15 and 20-day both provide underlying support. What’s even better is if the 50 and 100-day MA’s also provide underlying support. Right now, in the majority of stocks, the 200-day acts as an initial price target for exit. The 200-day MA is the strongest MA out of the ones mentioned. It defines the long-term trend. The COMP is the only MA that is testing the underbelly of the 200-day. Interestingly, the QQQQ is resting above it. Technically, if something is above the 200-day, it is in bullish territory, so keep an eye on tech.

The MA’s also gets rid of headaches and panic attacks. If you know where one of these significant MA’s are located, then you know there will be a bounce, at a minimum (in most cases). Conversely, if a stock is approaching a major MA, you know there will likely be a pullback or failure. Besides price, volume, and the basic chart patterns, I’ve relied primarily on the moving averages to make my trading decisions. I let the MA’s make the call. Stop panicking and impulse trading for no good reason. Let the charts make the decision for you.

Comments »