The Mark of Chaos

This will be the weekend educational post. I decided to openly answer some recently submitted questions. Apologize for any grammatical errors in advance.

—

1) “OpihiMan” wanted to know about my trading routine, post-trade analysis, record-keeping, my definition of trading success, if I pay attention to macro situations/news, the stylistic differences between day and swing trading, and whether I subscribed to any paid services.

a) Trading Routine – I create my watch list the night before. Then, I try to be ready 2 hrs before the market opens. I watch the futures market as well any gap ups or downs on any of the stocks on my watch. I plot them on “blank boxes” to see if they will fade or break higher. I also plot the approximate open of the market on the chart. I go through my scan one more time in case I missed anything (and I do miss things anyway).

b) Post-trade Analysis – I review the daily charts of my holdings and the market indices. I mark all holdings as either “hold” or “possible sell” for the next day. The ones with a “possible sell” are given higher priority the next morning.I also monitor the Asian and European markets and plot them on the daily as they progress.

c) Record-keeping – A simple spreadsheet for the trades. The blog is my trading journal.

d) Trading Success – My personal definition is measured on monthly percentage returns. My goal is 10%+ per month. If I don’t hit double-digits in any given month, then I know I did something wrong. March 2009 was the first month in 15 months where I made less than 10% and I did make quite a few mistakes.

e) Macro Situation/News – I do pay attention, but I don’t put much weight on them at all. I let the charts do the decision making. Sometimes, news can gap the markets beyond a consolidation range and form a breakaway, in which case it is technically significant.

f) Day/Swing Trading – same patterns, different time frames. Tolerance for risk and loss and the margin of safety is greater for swing trading than for day trading.

g) Subscriptions – I only have a monthly membership to Stockcharts.com, which I highly recommend for candlestick chartists.

—

2) “Kush” wanted to know how trading the opposite of the media (CNBC, Cramer) makes you money, finding a trader that’s a contrary indicator, best time to buy, and FAS/FAZ range trading.

a) Trading Opposite of Media – I use CNBC only for breaking news, economic data results, etc. I do not watch Cramer’s show and ultimately, you shouldn’t blindly trade a stock because someone mentioned it. You have to do your own homework. Sometimes the media is right, sometimes they’re wrong. You should trust in your decisions based on fundamental and/or technical facts.

b) Contrary Indicator – Josh. He bet against me for 7 weeks, and look what happened to him.

c) Best Time to Buy – For anything, the best time to buy is when a high-probability setup emerges. Doesn’t matter when. Same goes for short setups. High-probability setups ensure that the odds are in your favor in most cases.

d) FAS/FAZ Trading Range – First of all, when and if I trade FAS/FAZ, I use the SPY. It may not be as accurate, but it will help when the market gets to become too volatile and it can help you control your emotions. I personally do not recommend day trading within a tight range, such as the triangle we’ve been seeing for the entire month of May. The range is about to close, and the market will make a major imminent move.

—

3) “GonzoTrader” wanted to know what intra-day scans I am running, the most reliable chart setup, pre-market homework, setting stops and limits on buy orders, finding stocks with the most market orders pre-market, and what sectors are in play for next week.

a) Intra-day Scans – I hardly run intra-day scans. I get my slaves to do that. Since I am a swing trader, I can get away with scanning after the market closes each day. My scan right now is all stocks between $1-3 with volume above 100K. Prior to the dollar stock circus, my “normal” scan was stocks above $5 with volume above 500K.

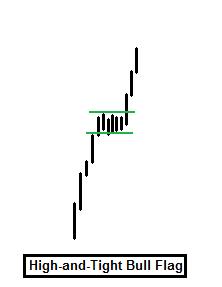

b) Most Reliable Setup – This one goes to the High-and-Tight Bull Flag. I drew it out below:

c) Pre-market Homework – refer to (1a).

d) Setting Limit and Stop Buys – In cases where I believe that a multiple number of stocks will breakout at or near the same time, I will set limit orders immediately above their breakout resistance levels. The vast majority of time, I use market orders and manually make entry.

e) Finding Stocks with most Pre-market Interest – You can use http://money.cnn.com/data/premarket/nyse (also contains NASDAQ stocks). You can also go to http://www.allstocks.com/markets/premarketactive.html or http://dynamic.nasdaq.com/dynamic/premarketma.stm.

f) Next Week’s Sectors in Play – TBD, but I am long biotech/pharma, oil/gas, and commodities.

—

4) “Cuervos Laugh” wanted to ask how I managed my information flow.

a) I actually do not read blogs on my blogroll unless something is brought up to my attention. As for the links on the sidebar, I primarily look at pre-market action and analyst upgrades/downgrades. The link library is for the readers, not me.

—

5) “P” wanted to know about using different time frames.

a) Using Different timeframes – Intra-day, daily, weekly, and monthly time frames should all support each other. Which time frames should you use? It all depends on your holding period. I use intra-day and daily charts since I am a swing trader. If you are a buy-and-hold investor, you should use the daily and weekly charts more frequently. Intra-day and one-day breakouts or breakdowns are your earliest signals for entry or exit.

When you mentioned the SPY, the weekly pattern is not a bear flag, it is a bull flag as noted below:

—

6) “Juice” wanted to know how I spot s FEED, CAR, DDRX in it’s early stages and how I can tell if it’s going to go to sub-$1 to $5+, and if ATSG can get over $5.

a) Finding Next Multi-bagger – This is a difficult question because no one knows for certain whether a stock will go from sub-$1 to $5+. The only thing that I can tell you is to keep true to the technical pattern of the chart. If the chart remains intact, then hold the stock. It also depends on your time frame. In these cases, you’ll most likely have to be a positions trader, holding positions for several weeks or longer. The important thing is to catch the first high-probability setup for the stock and ride it until one of the wheels fall off.

b) ATSG – I would be mindful of the May 2008 breakaway gap down as it will create some resistance. Like I mentioned above, ride the trend until it trends no more. See chart below:

—

7) “Kel” wanted to know about target setting.

a) Targets – Usually, my targets are located at major moving averages and support resistance areas. I do not use MA crossovers, because they are lagging. Instead, I first determine which MA a stock is following (e.g. 15-day, 20,day, 50-day, etc.). When the stock reaches striking distance, it is automatically placed on my watch list. An intra-day setup and/or breakout will confirm the entry. As for exits, I usually sell at least a partial position at the first major resistance area (by major, I mean the 50,day, 100-day, MA’s or 200-day or any large previous breakaway gap downs). It all depends on the individual stock.

—

8 ) “Susannah” wanted to know about setting stops and exiting positions.

a) Stops – I rarely use them. The last time I used stops was when I was on vacation in Mexico. I use flexible and mental stops and the shorter-term MA’s, such as 15 or 20-day MA’s, dictate my decisions. If a stock closes below a short-term support area, I would most likely exit the position. If I am wrong, I can always re-enter the stock.

—

9) “Yogi & Boo Boo” wanted to know how I keep myself from blowing up.

a) Anti-Blowup – Keep most of your positions small. With the exception of CTIC, all of my positions are between 5-10% per position. This way, ff a stock drops -20%, you don’t freak out (you shouldn’t). In addition, make sure your stocks have the best setups, thus ensuring a higher success rate. Sometimes I recommend stashing away your gains to protect them during times of extreme uncertainty.

—

10) “Lindsay” wanted to know if I watched any bellweather stocks during the day, hedging long/short positions, the US Dollar, China, hyperinflation, and ETF use.

a) Bellweather Stocks – I do not, but that doesn’t mean people shouldn’t. I keep things very simple, so basically I simply keep an eye on the SPY, my existing positions, and my watch list stocks.

b) Hedging – Hedging is highly recommended during times of consolidation to avoid whipsaw and during times of uncertainty of market direction. Once it becomes apparent that one side has the greater odds of winning, release the hedges.

c) I do not particularly pay attention to the US Dollar, China, or hyperinflation for my trading. I refer to the other bloggers to answer these questions for you (feel free to chime in).

d) Using ETFs – The positives are less vs. individual stocks, diversification. The big negative associated with ETFs (I’ll refer to the 2x & 3x ETFs) is time decay. Over time, price will decay as a result of the daily compounding of the NAV. This is especially true for the 3x ETFs (e.g. FAS, FAZ).

—

11) “Fortune8” wanted to know about trading options the “right way”.

a) Options – Not an expert. Comments are open for expert options traders who use them frequently since I do not use them often enough.

—

12) “All About Health” asked what my process is for deciding to switch from long to short and vice versa during the day, as well as selecting the right industries/sectors to trade.

a) Switching Sides – Under extreme circumstances, I find myself having to entirely switch sides. This occurred at the March bottom when I was briefly caught short, a mistake that contributed to my worst month in 2009 (+2%). I am not a primary day trader, but the same patterns that apply for swing trading also apply to day trading. Use chart patterns, intra-day moving averages and trailing stops to guide you from one direction to another. It’s all the same thing, just a different time frame.

b) Choosing the Best Industries/Sectors – First, I look at the SPRD sector ETFs for any clues (XLV, XLB, XLK, XLI, XLY, XLP, XLF, XLE, XLU). I then look closer into sub-sectors (e.g. for Health Care, I’d look into biotech, drug manufacturers, healthcare providers, etc.). Then I’d look into individual names. This is a variation of the top-down approach.

—

13) “Nashville Cat” wanted to know about gap strategies at the open.

a) Morning Gaps – When a stock gaps within a range/consolidation/S&R, then it is not very meaningful to me and the gap has a higher chance of fading. However, when a stock gaps outside of the above, it has a higher chance of following through. This is not true for exhaustion gaps (which fade anyway), but they are true for breakaway gaps and continuation gaps.

—

14) “Relaxsome” wanted to know if I used oscillators.

a) Oscillators – I don’t use them. They are unnecessary. Focus on the basics.

If you enjoy the content at iBankCoin, please follow us on Twitter

Great Stuff! Much appreciated!

You must really still be liking the set up on CTIC even after Friday’s run to break from your usual rules on how big a position will be for you huh?

Thanks for the info CA.

Hail Chaos!

CA – excellent post.

I will be printing this and referring to it often. Enjoy the rest of your weekend. I have a sense this week will be huge.

Thanks again

Just when I thought your post cannot get any better!!! Best most YTD 2009!!!!!!!!

Full of surprise my friend!!

“best POST YTD 2009”

Wonderfully material. I am saving it permanently so that I can come back to it. Thanks, CA. Have a great weekend.

CA – Mahalo (that’s “thank you” in Hawaiian) for the clear, thoughtful, informative responses! Out of all the expert traders and teachers that I’ve studied and learned from, for some reason you are having probably the single biggest impact of them all. No-BS, straightforward, almost idiot-proof, and transparent – your results speak for themselves. It’s been a wake-up call to say the least.

Your help has been very much appreciated. Best wishes for your continued trading success!

Those were very knowledgeable responses. I agree that it is imperative to check things out yourself instead of blindly doing the opposite of CNBC, Josh1ngu, or the other comment-spamming bear-shitting pikers that are on the fly’s new posts’ comments each day, despite his automatic spam deleter(similar to time machine).

Great stuff thank you for taking the time! These educational posts are gold.

i echo the above sentiments … very informative

a real pro

thanks mucho

Great stuff CA – I’m reading an emphasis towards simplicity, consistency, and rejection of emotion and ego when making calls, all coupled with a hefty dose of learning, experience, and acknowledgment of strengths and weaknesses. A familiar combination for success, and makes perfect sense to me (even if I’ve a long way to go).

Recently banned individual remaining nameless failed to accept errors, learn and accept – leading to predictable self flagellation. Also a good lesson, I regret he’s been banned – a valuable daily reminder it was. Reminds me of a few basics…

in some corners of medicine a saying goes, “making the same mistake over and over again does not constitute experience”, there was also a hint of the famous “doing the same thing over and over and expecting a different result…” well you get the idea.

There will be bumps – no doubt – part of the deal. Mustaches should be well secured for the coming week…

Thanks!

CA, thank you so much for taking the time to teach us. How did you come up with your stategies? Trial and error, or did you watch and learn from another trader as well? You obviously know what you are doing and it’s an honor to learn from you.

Good. You’re all welcome.

Controller – I read over 100 books a year since I started in 2002. I tried and tested everything and developed my own way of doing things. I never had a mentor or coach. Finding what works for you might take a while, but in the end, you’ll be happy you went through the trouble.

—

People are getting the right idea. A chart is just a colorful picture/drawing with pretty lines on them. How I do things can be taught to a little kid. Unfortunately, as adults, we tend to make things way too complicated, thus putting our own selves at an automatic disadvantage. Even kids have more emotional control because money is not relevant to them. You won’t see them refreshing their P&L all day long, but I’ve seen some grown people go crazy over every tick, falling victim to the death spiral.

I encourage everyone here to think like a kid when trading, but not necessarily act like one.

Best frigging post, yet.

CA,

you mentioned:

a) Using Different timeframes – Intra-day, daily, weekly, and monthly time frames should all support each other.

does it mean that if a stock is showing an inverse H&S on the daily but is showing a H&S on the monthly, then you don’t buy it? isn’t it hard to find a stock with all timeframes line up?

does that mean that for every stock, you look at the monthly, weekly, daily, 60m, 10m charts every day?

for each time frame (say 60m), how many period chart do you look at? the default in stockcharts.com is 70 period i think. i ask this because you use moving averages and i think moving averages change depending on the number of periods used.

thanks

This is without a doubt one of the best posts I’ve ever read about simple basics that are IMO far more important than trying to explain highly advanced technical extrapolations..I must say this was a simple, elegant read..FLY should raise your pay to executive level 3, just for the response to ibc followers.

Thanks CA – very informative post. You’re the man!

Great post! Thank you!

Thanks so much CA– you’re a really good teacher

Your answers to the questions are more enlightening than I thought they would be. I like your psychological approach you recommend “… think like a kid when trading” and “… don’t make trading so complicated.” Thanks again.

Good stuff CA! I like keeping it simple.

For those who are playing the biotech breakout game—-here is an article on some biotech plays that are due for an FDA approve/disapprove in the coming weeks:

http://seekingalpha.com/article/136045-vanda-pharma-an-extreme-fda-trade-that-paid-9-more-to-go?source=yahoo

adls hit on Friday, with a decison due on Tuesday. Next one up for FDA decison is BDSI (likely on Monday)

CA, What do you think of STEM (also a bio)?

Although it is trading below its 50dma, but seems last Friday’s close formed a reversal from the strong resistance 1.57. a double bottom formed.

Thanks CA,

great post and educational fo sho!

CA, can you elborate more on the fas/faz time decay that you mentioned? i been trying hard to search for the answer on the web but no luck at all. thanks in advance.

thank you, thank you!

Thanks!

Thanks a lot CA. I admire your dedication and willingness to share your insight with us.

BTW it looks like we will get a nice gap up in the SPX out of the consolidation zone and rip right throug the 200 DMA today. Let´s bank some coin boys 🙂

hey CA,

Thanks!! when will you turn bearish?

***RANGE BREAKOUT on all indices, except the DJIA.***

—

Chuan – When it’s the right time.

STEM…who knows. I’d wait a bit.

Mike, thx for that list.

—

I WIN AGAIN.

Hey CA – Thanks for this wonderful post. I love your strategy and how you simplify things.

THLD cut $1.41. A loser on a non-losing day.

STEM is good with a big volume day. imo.

UGNE..breaking to upside..above 1.29…its a rocket ride to the bank.

Wow, we are really banking coin here.

Now, it´s important to consider your exit strategy so that you keep the bulk of the profit. But for now I guess its best just to float along the money river.

Everyone,

Current Holdings?

I’ll be rebalancing today bigtime, but here’s my list.

MIPI

MITI

FACT

SCLN

AGQ

GBG

ACAD

VVUS

CDE

AZK

ICO

AHD

URRE

UXG

TLB

SVNT

END

TC

THQI

OCNF

TGB

UNG

XTXI

CPE

JASO

CUZ

CTIC

Here’s mine

AVII

BLTI

CTIC

DVAX

MRGE

PLLL

CZZ

NCOC

SHI

YZC

NGD

DGP

DXO

BDD

BHP

GDX

RJA

EWA

FSUMF

AAUK

CPE

NG

NGD

SA

SSRI

WRES

Looks like gold and silver is starting to pullback/consolidate here. However, I keep them as long as the consolidation is healthy looking.

MRGE down 10%, still in this one?

Hey CA,

Can you take a quick look at WFR? If you were to get long, what do you think the potential is?

Hey guys – what do you think of DDSS?

Looks interesting here, but I would wait til it broke $2 convincingly although you’d probably miss out.

Sit tight, this is a continuation range breakout.

emkr

pwav

Chuan – EMKR does not look pretty.

PWAV – looks very interesting…

torono canuck

emkr: i guess the bounce will come soon, still watching

pwav: in at $1.33

what do you think about abat? another feed maybe?

ATSG is a monster … sexcellent volume, insider buying, great price action

still riding this ho

hope I don’t jinx the sucker

LEA ..rallies on bankrupcy..bond default 30%

You guys are getting pretty confident and bold… that makes me wary. I’ve paired my longs, and gotten slightly short. Believe a pullback is imminent.

Watch out with how many of those smallcaps you have when the downturn begins (not saying we’re at the top, just believe we have to consolidate now).

CA what’s your thought on CTIC? thanks

and what the holy hell happened to ADLS? I went to lunch up a bunch and came back to a big fat 0. I think most sold out of this one last week — I was just stubborn.

I may have to take some profits today

On CTIC perhaps?

CTIC = I WIN.

WTF happened to CTIC?

and you made winners of us all! Many thanks!

Thanks CA.

When are people getting out of CTIC? Looks like it will have some legs $2+. In addition, the news was very promising. Thoughts?

WARNING: Loyal Readers…

You guys are slowing down the entire iBC site, taxing multiple servers.

IF you have my blog on auto-refresh, TAKE IT OFF NOW.

Fair warning, those that do not comply will get banned, per Fly’s orders.

—

Just chill out on the refreshing. I’m not doing much today in terms of trading, so no need to go crazy on the browser please. Thanks.

Follow CA on twitter (WeeklyTA) and save the bandwidth.

I gotta say, IBANKCOIN is amazing… just killing it left and right

Just took off half of CTIC for 65 percent gain. Letting the rest run for another day or 3.

goddamn, I’m up like a motherfucker today.

Hope all of ya’ll made some money.

CA- Thanks again for sharing your trades, I believe most people here are having tradegasms over CTIC (myself included).

Now the question: will CTIC (and the other $1-3 breakouts) still be uneffected if there is an egregious pullback tomorrow?

good on ya, mate!

I tagged along .. still in the sucka (CTIC)

CA,

What do you think about ACAD? If I remember correctly you bought some last month…they release trial results in ~4 months or so….what’s your target/still holding?

yea still got it

A CA, do you mind listing your current biotech holdings…I have lost track… Tucker

did you sell anything today CA?

Bought FNSR $0.739 for an overnight.

fin – I sold THLD in the morning. It’s not looking right on the daily.

Current bio holdings:

ACAD

AKRX

AVII

BLTI

CTIC

DVAX

MRGE

ADLS

Thanks man! Really Appreciate it, I will hold on to a few of these longer than I did CTIC…just missed it by THAT much…

+13% today.

Goodbye.

Hey CA;

Delurking on the west coast..

Been following you for a couple of months now. I used to think TA was just some sort of Ouija board sh!t, you have convinced me otherwise!

Thanks a ton for all the educational posts and posting your trades. It is HUGELY appreciated!!

CA,did u sold EAD???

im still holding from 1.42

CTIC holders –

I’m one of them, as I decided to hold into the bell because it looks like she still has room to run.

With that said, it does look like it’s shitting the bed in afterhours. Hopefully it’s nothing, but I just read this article release on the street (link below). CA- You think it’s worth unloading on this? Or do we say F it and stick to the charts?

http://www.thestreet.com/_yahoo/story/10507889/1/cell-therapeutics-downplays-drugs-heart-risks.html?cm_ven=YAHOO&cm_cat=FREE&cm_ite=NA

Great stuff as usual CA

Sold entire position into close at 2.08 … Hopefully I made the right decision

my understanding is that CTIC’s drug has less heart risk than the others — which is why its success is so important. but i may be completely wrong. regardless, i’m holding and hoping the shit in the bed is nothing…

The guy who wrote the street article is dumb. The reason why the # of patients who received the heart scans at the end of the study dropped was because the rest of the patients had died (presumably from cancer). More importantly, although cardiac function is an important side effect of these drugs, we’re talking about very severe, aggressive cancer. These patients are much more likely to die from their cancer than from reduced heart function.

Purchased CTIC again in AH for 1.85. This thing has much more room to run.

FNSR at .78 After Hours …

I sold 50% CTIC at 2.20 and the other 50% at 2.13 as it seemed to be fading. Profit was over 60% so I am quite satisfied.

Still holding AVII, DVAX, MRGE, BLTI, PLLL. Profits in all except MRGE which was the disappointment of the day.

CA thanks for all the work, you do a great job, been following for a few months and also a member of the PPT!! Could you list your current longs when you get some time..saw the Bio longs.

Thanks,

Mike

Ring – speak english.

I love CTIC.

Mike – other longs:

BZ

UXG

PLLL

END

TGB

FNSR

damn do you guys sleep? I’m up b/c I have insomnia for some reason

haha, maybe Ring isn’t from the states?

Remember guys FNSR after the bell.

TGB playing with HOD forever. Common now!