It looks like I may lighten up on the banking short positions and add at least one unit of FAS as a hedge and also consider sprinkling in some REIT shorts. I am up slightly over +76% YTD, so my goal is capital preservation at this point, unless an absolute “can’t miss” opportunity comes around. I guarantee you that there are and will continue to be massive opportunities to profit, despite the fact that we may go into/be in a depression. If you don’t know how to short, then you are missing out.

I was especially disturbed by the FBI’s announcement that there could be as many as 500 more cases that are either ponzi schemes or “similar-to” the ones of Madoff and Stanford and all the other retards (e.g. Sam Israel) that have already been captured, convicted, and possibly in nightmarish sexual situations. If this is true, then 2009 will not a positive year. Can you imagine hearing about ponzi schemes every week, every month for all of 2009 and beyond? It will be downright depressing.

Another thing that has come to my attention is the link between banks and drug money. Now, I just saw The International a few hours ago expecting a great movie. (Warning: Spoiler) About a third of the movie involves dozens of people shooting uzi’s in a museum and a lot of people die. The ending was terrible. When I came back, this guy NDoubles tweets me this Reuters article on how drug money is keeping the banks afloat during this crisis because this money is the only liquid capital available. You can thank the drug dealers for supporting the banking system. How fucked up is that?

Technically, not much as changed on the charts, EXCEPT that I want to point out volume. Typically on consecutive down days, you want to see increased selling pressure and larger volume on the way down. This is not the case, which is the reason why I have to becareful here. Volume has remained flat forever and this is exactly something that I do not want to see. I need to see some major selling within the next 1-2 days or else I will have to cover the majority of my short positions. There is little conviction on the sell side and hardly anything on the buy side.

I continue to look at the money centers, regional banks that aren’t at $1 already, and some REITs. Traditional names such as BAC, C, and WFC are preferred over GS, MS, and JPM. You want to be shorting the weakest stocks in the weakest sector, not the strongest stocks in the weakest sector. Get it? For regionals, I love STI, PNC, ZION, and BBT. Also, watch the insurers, such as HIG, MET, PRU, AFL, and PL. HIG is a lovable favorite of mine. This industry has much more room to the downside. As for the REITs, just pick a few. I like CLP, AIV, MAC, KIM, AMB, WRI, SLG, LHO and the like.

As for entering more shorts here, I don’t know that yet. It depends on what develops during the day. It’s almost too late to be entering a lot of stuff here. We are near the 2002-2003 bottom, so extra caution is advised in anticipation of a bounce. This is why I will not hesitate to cover or hedge at this level. Also, the Bill Miller bottom on the DJIA has been penetrated. Nice going, slick. I await your next prediction. I’m going to take it easy today (it being a Friday and all).

u da freak, being up soooo much ! noice 😮

another insurer for shorting – MKL … while they may not be the worst, there’s 100 pts for the taking

wow, up 76%! thats spectacular

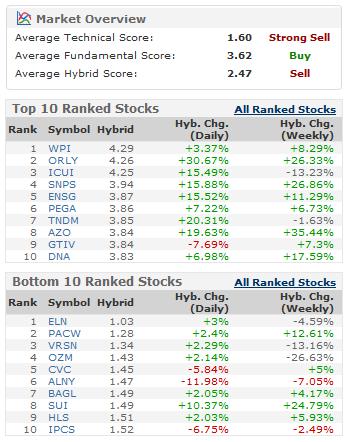

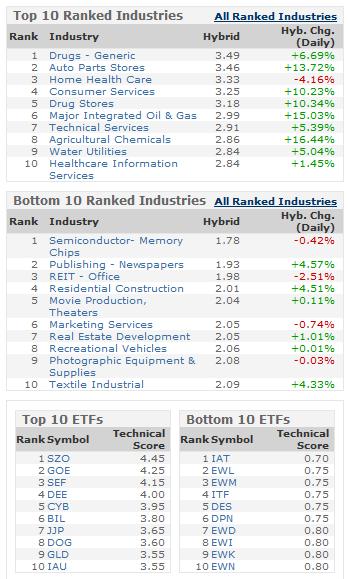

What resource are you pulling your market overview from? Would you be willing to share this with us.

It is the PPT which will be coming out very soon.

jesus christ. I’m up almost 100%.

Chart Addict, do you use any margin, or do you just use double etf’s…or do you use double etf’s on margin?

individual names and yes i do employ margin when appropriate. i don’t like etfs much.

I read Soros’ book, “The New Paradigm for Financial Markets: The Credit Crisis of 2008 and What It Means” a while back, and I must say, although I hope he isn’t, he may very well be right this time.

He postulates that Thatcher and Reagan began a super bubble, fueled by access to credit, which is now coming to an end…that makes profits from American companies since that time basically a mirage.

And if you look at a long term dow chart, it really does look like a giant bubble…

Weekend allocation is 30% long/25% short.

R.I.C.- Rest in Cash.

hey Chart,

do you apply any quantitative analysis? portfolio theory/asset allocation this kind of stuff?

This is fantastic stuff. I thought the poll was about you CA. Lol. I would have voted much much higher.

-gio-

Chuan – I keep it really simple. Only discretionary TA. Nothing fancy. My allocations are usually large and concentrated. I use the charts in my post.

Thanks Gio.

My charts tell me that Monday will be one of the best days ever.

My charts tell me that Monday will be one of the best days ever.

No doubt this applies to someone who is 30% long/25% short/RIC.

I’m not going to disagree with a technician as fine as yourself, but this caught my eye and I thought I would just bring up what another fine technician has to say about it:

“Typically on consecutive down days, you want to see increased selling pressure and larger volume on the way down. This is not the case, which is the reason why I have to becareful here.”

Don Worden from TC2000 frequently notes just the opposite in his daily reports. He argues that bear markets fall on their own weight with little participation. He considers increasing volume an indicator that the downside is getting close to being overdone.

This makes some sense if you think about it since increased volume indicates increased fear and a stage that is nearing some form of capitulation.