I first wrote about this system on February 2, 2012, in a post entitled A Rotational System So Simple a Caveman Could Trade It.

I’ve run a test of in-sample performance (results below). Do check the above link to get the system rules. For those of you who are lazy and just skim this post, the system trades the Fidelity Sector Funds. My aim is to build a portfolio of ETFs and run the system over those, with an update on how this works out, in the near future.

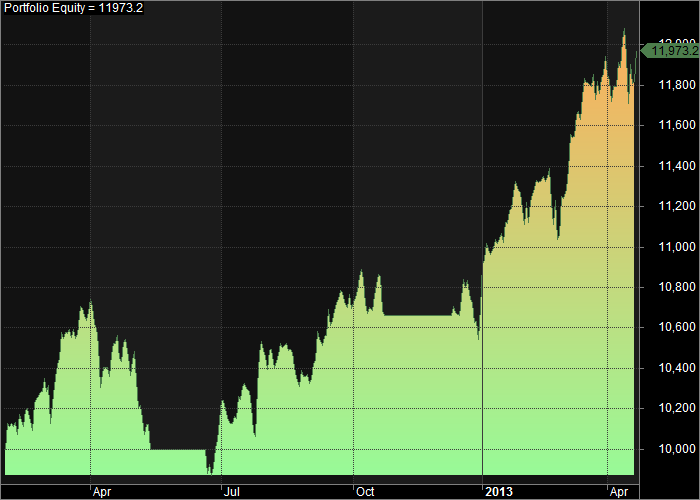

Results since 2.2.2012:

- CAGR: 16.03%

- # of Trades : 22

- % of Winners: 81.82%

- Avg. % Profit/Loss: 2.56%

- Max. System Drawdown: 8.82%

- Sharpe @ 2.5% Risk Free: 1.22

Equity Curve:

Flat areas of the curve mean the system was in cash.

I know we’ve been in a bull market, but this performance is not too shabby. Buy-and-hold CAGR for $SPY over the same time period is 13.99% with a maximum drawdown of -9.69%. The Caveman System has beat both the buy-and-hold annualized return and drawdown.

I’ll be re-examining this system in the near future.

Yes, I remember that post; it was really a wonderfully simple system. Shows how simple stuff can still work well even today.

I read a post on the Aleph blog over the weekend, and was interested in the part about “The Investor Base Becomes Momentum-Driven”: http://alephblog.com/2013/04/15/classic-the-fundamentals-of-market-tops/

Any opinion whether his momentum (which I believe is referring to single stocks or a few select hot sectors) has any relation to momentum more generally? I’ve never heard of momentum strategies being huge outperformers just as the market tops.

Well, good question, because he is not very specific.

Although, intuitively, it does seem that momo might be outperforming as the market tops. I say that because during strong momo, what else is really working besides jumping on the hot stocks or sectors? Mean reversion, while it still works, is probably not giving enough signals due to fewer pullbacks.

Anyway, just throwing out some ideas. Like you, I’ve never heard of momo strategies being huge outperformers just as the market tops.

Speaking less theoretically, some of the momo rotational strategies I’ve been looking at have been really surging over the last 1 to 1.5 years.

can I ask if you are doing these sorts of backtests with Amibroker? (I got that impression previously, from other posts).

If so … would you be so kind as to email me? I am looking at purchasing, for studies and strategy backtesting such as this. Would like to ask a couple of questions of someone who’s used it for that purpose.