So much for keeping a relatively large cash position.

So much for choosing a nice mixture of high, mid and low beta stocks.

So much for dutifully taking profits on positions that are up as a form of protection.

So much for checking major finance websites upon buying shares to make sure that I’m not holding a large position into earnings.

It is all folly.

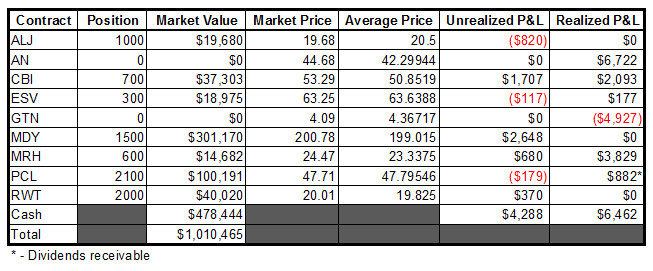

I gave back MORE THAN HALF of my YTD gains in a session that was fitting for the general atmosphere surrounding my life yesterday. Sure, things could be much much worse. However, I have spent so much time crafting this portfolio with such a conservative bent, that I thought I could sidestep such egregious losses in a single day.

Walking up the stairs for almost two months, slowly moving ahead to +2.5%, and more than half of that is gone in a day? It certainly makes one question what all of this is for.

We all think that we can “beat” the market…dreams of making “Maybach money”, buying 1.725 million dollar 2 bedroom, 2 bath condos, but then we realize that this is all one big (I’m really really tempted to start using some fouled language here…) joke and we are the punchline. Nevertheless, I shall carry on in my most masochistic manner, cutting losses, trying to eke out miniscule gains and using this “dip” as a buying opportunity

Obviously one day of heinous losses will not deter me and this blog will carry on…mostly as a forum for your entertainment, because it certainly is not for the benefit of my financial well being.

I see no reason to try and rationalize with my positions after yesterday. I have my stops in place and I shall adhere to them should they be reached.

BEHOLD THE FOLLY:

Note, I sold a bunch of ESV at 63.15 near the close yesterday in preparation for the earnings release prior to today’s open. Let me translate what this means for you: they will crush it and the stock will rip.

-EM