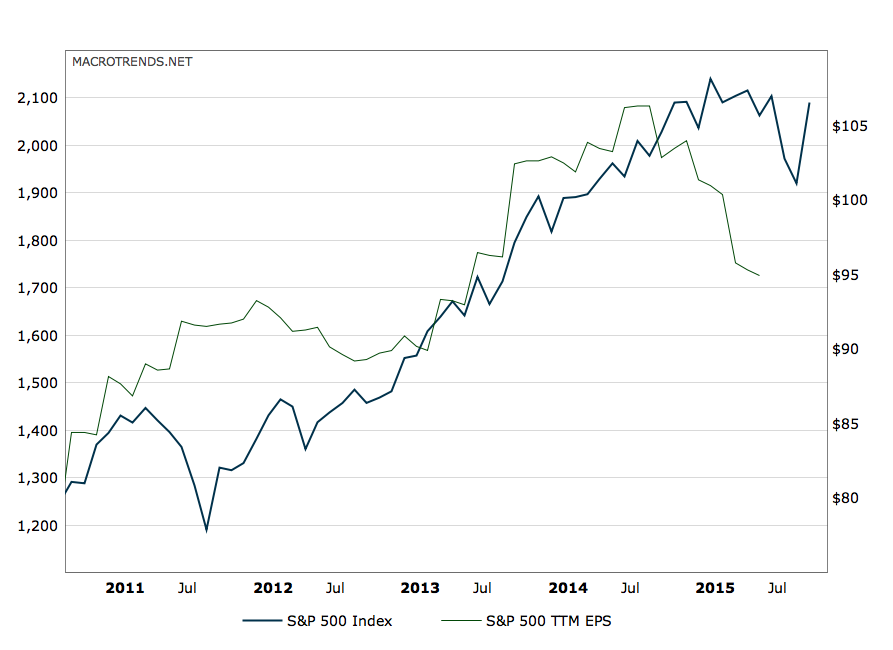

The rally has been powerful and gone on longer than I suspected. The CB’s have been up to their old coordinated tricks. However there is one big difference between last years rally and this years rally. Earnings have been coming down as well as Revenue projections since October 2014. The Trailing Twelve Month Earnings (not the Forward Earnings) have been rolling over and we now sit at the same earnings level as Mid 2013 when the S&P was 1680. We all know that QE’s effectiveness is diminishing and the sugar high most likely won’t last long. Especially with earnings and revenues apparently decelerating rather quickly.

Notice in 2011 when the market went down 20% earnings never fell. That correction was due to Systemic European issues and not the end of business cycle and tightening conditions from the Fed like we have today. The current multiple is 22 versus the 17 registered in Mid 2013. In the 1998 analogue, that everyone is so keen on, earnings came down as well but very slowly over 18 months about 8% as compared to today where earnings are down over 11% in about 12 months. In 1998 earnings bottomed rather quickly and accelerated into the 2000 top. So if you are bullish 1 of 2 things needs to happen: 1) Multiples will continue to expand as earnings and revenues continue to go lower or 2) Earnings will recover quickly and the economy will lift off like it did in 1999-2000.

The big difference between then and now is we were heading into the year 2000 computer fix problem and the birth of the world wide web. Both caused massive business investment and hiring that lead to a virtuous feedback loop of increased earnings and the blow off top to the greatest bull market ever. Oh!…did I fail to mention, the Fed was extremely loose with money then because of the fear that the world would end due to the dreaded y2k computer bug fix. So lets compare 1998-2000 to now: 1) We have no investment on the horizon, 2) the Fed is taking money out of the system and 3) firms are laying folks off again. In fact Challenger Gray, an outplacement services firm, said job cuts in September accelerated and reached a level not seen since the 3rd quarter of 2009. Additionally, the global back drop is grim and I suspect credit, which has bounced with equities, will roll over again and widen. So this is nothing like 1998…nothing at all. Its not like 2011 either but instead it’s 2015 which is the top of a business cycle and at the end of the monetary accommodation. So if you are a bull I guess your banking on multiple expansion into an earnings and revenue recession. I guess there is a first for everything.

I still expect a top soon. In fact we may have seen it this week. I have not added short exposure lately and I plan to await confirmation and shoot this market in the back. Could I be wrong?…Sure, but I don’t see anything other than a counter trend rally so far. Of interest to note that we closed this Friday below last weeks high (Chart below). After all that drama with the Fed and the BOJ this is all the market could do this week? Also this rally has been with fewer and fewer issues. Bull market rallies don’t act this way and I would also point out the dramatic underperformance of the small caps. If I am right about this being a bear market the next big move down should carry us below the August lows. If it doesn’t then something else is at play.

If you enjoy the content at iBankCoin, please follow us on Twitter

If we peaked Friday I got a great short entry.

I agree! Bad news should not be good news…but of course the markets do not ever have to be rational…so we wait patiently for the free fall to begin…standing in the doorway of that C180, one foot on the step, one hand on the strut, looking for the exit point.

The stimulus, both monetary and especially fiscal, from the Y2K boogeyman cannot be overstated. Tech managers were encouraged to buy ANY upgrade or replacement that their vendors were selling out of fear of being held liable if they did not. Further, due to the favorable tax treatment rolled out for Y2K-related capital expenditures, managers were buying every tech toy that they might envision needing over the coming several years. Years after 2000, there were still warehouses full of now-obsolete equipment that was bought then, but never installed.

As for fiscal stimulus now, this congress is not likely to provide any – – ‘cept maybe for war.

ES futures have retraced 78.2%, IWM & FTSE (and others) have retraced 50% of their declines.

The sell-off angle was very steep intitially, the next sell-off is also likely to be very steep and swift. I’m looking for 20-25% down within a couple of weeks, and I added 50% to my shorts on Wednesday evening (FTSE), already in the money on those.

Add in planetary/lunar influences, with all that Blue mentions, I think a bloodbath lies dead ahead.

The only thing that can truly hold this up much longer is China deciding to build a whole bunch of infrastructure again. India technically could fill that gaping hole as well, but they lack the political leadership to do it for now. Other than that, I don’t see where earnings are going to come from. Tech & health care are the only things holding the market up, and they’re both horrendously overvalued at this point.

This market is an odd ball. Some companies like Google Amazon Expedia Gilead Apple Microsoft are reporting great earnings. Then some are reporting horrible earnings like Chevron SCTY…etc. I just can’t see this market tanking during earning season especially when so many have reported some good numbers. Maybe after this earning season the slide will continue but for now we are basically back at the top. The S&P hasn’t even cracked below it’s 10 EMA yet. Nothing about this seems bearish to me at least not at the moment. The only concern I have is the overhead supply we have

First of all terrific post Blue.Like your

fundie views as charts aren’t as reliable

due to central bank stimulus and those

high speed traders.Comparisons to the

past don’t work well now.

The one thing that could cause an implosion

is -if some sovereign stopped paying

their bills.Otherwise all the majors still

have lots of dough and though I don’t

see growth buy the dips and sell the

rally should be a winner.

are you using puts, or outright shorts?

“Yesterday the SEC voted to adopt the final rules for equity crowdfunding under Title III of the JOBS Act. These rules will allow ordinary Americans to invest in early-stage private companies for the first time..” This and Uber valuation nearing $100b will mark the end of this bull. In the end, zirp created a monster that is much larger than the housing bubble.

If people listened to you, BS, would they make money, that is the thing to ponder. For one thing they would have missed this “countertrend” rally that you and your informed friends were predicting to roll over into abyss at any moment.

@Farmer, perhaps BS plays both sides of the market? Perhaps he does not see the risk/reward trade off to be long here? Perhaps his money management skills long or short are excellent and even with this short he has on he won’t lose the farm.

anyone who says they can catch every move in the market be it counter trend, or otherwise is full of cr*p.

long story short framer, I would bet on BS portfolio before yours over the long term.

@dragun, you are missing the point. BS has been wrong. And has been advocating this wrong vision. It is quite simple: if you say market is going to drop big time any moment, and the market does the opposite, you are wrong. You are wrong even if you substantiate that with fancy graphsor whatever – it means your read of the market is not corresponding to reality. And that is something I am looking from reading the blogs.

And if he is secretly long, it does not help the readers either…

I’m sure you have heard this before but it still needs to be said…”The market can stay irrational longer than you can stay solvent”…

Farmer,

I guess you are calling me a liar by saying I am secretly long. You are are banned. In August yes they made money. Lately no.

@Farmer

BlueStar is GOD!!! Your distasteful words will be etched into your eyesockets by the might of Zeus’s lightning bolts for your ignorance!

No one calls the top perfectly! Michael Bass was “wrong” for months until his market thesis played out in full.

This has been a snap-back rally to rival the anouncement of a new QE program. Unless you’re banking on that, all signals point to the evaporation of the 200 point rally and lower lows.

Dragun & Probucks Et Al.

Thanks for your comments!

I don’t mind criticism but at least argue facts (farmer). This market has gone nowhere for over a year. Underneath the hood is atrocious as 50% of all small caps are still down more than 20%. This has been a nice rally sure. Lets see what the month of November brings.

BlueStar – glad to see you and OA are on speaking terms again. Followed the comments on the previous post and worried a valuable relationship was damaged. I have been lucky to have followed both of you at the appropriate times. I was out of the market during the drops and got back in when OA gave the signal. I am not adverse to seeing both sides of the bull/bear argument. Timing the market is incredibly difficult. It is exhausting. I know OA has a lot of respect for your perspective and it’s good to see you value his views. We all have the same goals here – bank some coin. Respectfully disagreeing is just part of the game. Enjoy reading your perspective and I think you present a valid argument for the market to drop. The question is – when will it happen and nobody has the answer for that. Until then – happy trading!

Swinging for the fences,

I was not aware that OA and I were not speaking. Yes, Tough game lets make money.

Sell 30 April at 142!

Inception,

Maybe. I am not yelling yet.

I am. Although the hedge has payed out handsomely, play time is over. Waiting for the main ship to come in.

Buckle up.

Doug Casey

http://usawatchdog.com/bigger-financial-meltdown-starts-before-end-of-year-doug-casey/

18.75 mins

The BlueStar blog has escaped the IBC hell … what gives? Is this a sign of ?

Juice,

I am part of the peanut gallery because I don’t blog enough. No big deal.

Hard to argue the technicals. SPX up five weeks with seemingly room to run per weekly RSI. But I’m just Waiting for the call by BS. First sign of trouble on a drop and I’m ready.

Adding a modest amount to shorts today.

Get out of the way guys, we are about to rip into 2016.

What’s tough about this is you see good news and bad. Sales/Earnings mixed and up in companies I didn’t expect. Fundamentally though, this market feels sick. I’m still holding long SH down 5%.

there is no market. just CB funded crack smoking exuberance. This market will continue to press higher. Shit it cant even handle a 5% sell off without everyone screaming. Besides its the last policy tool the governments have. If and when it rolls over it will be fast and furious. Just remember Keynes and irrational markets quote.

Maybe time to revisit The Alchemy of Finance?

I just can’t bring myself to go long at this point. I had a nice day today selling short the YM near the high. I’ll just keep looking for those opportunities. Still short at the open tonight, but will be exiting that trade soon and watching where the overnight peak develops in the YM contract.

BlueStar,

Your view is so precise. Great work! It is always good to see a more accurate picture of bigger picture on what is really going on in world equity markets!

It seems, Icahn agrees with you:

In interview, 37 mins+ “I think things are going to be difficult – over the next few years.

I’m trying not to be pessimistic over the next week / year but the public is going to have a great problem in what they are doing.

You’ve got bubbles that have formed – junk bonds

If there’s a problem; they are going over a cliff.

–

There’s nobody to catch those falling knives.

So I think the public’s going to become extremely disillusioned in the next few years.”

Feels very close to me now, but maybe it extends into Friday.

The bulls will be ripped to shreds I suspect, none see it coming, even those who are aware of the bear thesis are knee deep in all sorts of cr&p.

Oh well, someone has to be caught holding it.