Tonight it looks like the oil market wants to retest the $64.38 level which is the 61.8% Fibonacci support from the 2008 low. We tested it last Monday and it bounced but it has lately slid lower over the last week. If we should take out that level with conviction then we are going to the low $50’s to test the next Fibonacci support.

Tonight it looks like the oil market wants to retest the $64.38 level which is the 61.8% Fibonacci support from the 2008 low. We tested it last Monday and it bounced but it has lately slid lower over the last week. If we should take out that level with conviction then we are going to the low $50’s to test the next Fibonacci support.

I was thinking about writing a piece on Oil and its detrimental effects on the debt markets and the economy and how equities will implode. There are plenty of other people who have written on the subject over the last several weeks and they make a compelling fundamental case that is bearish for equities. Rather I decided to investigate the long term relationship between oil, the dollar and equities and boil this all down to simple math. Math is elegant and less subject to the vagaries of fundamental debate.

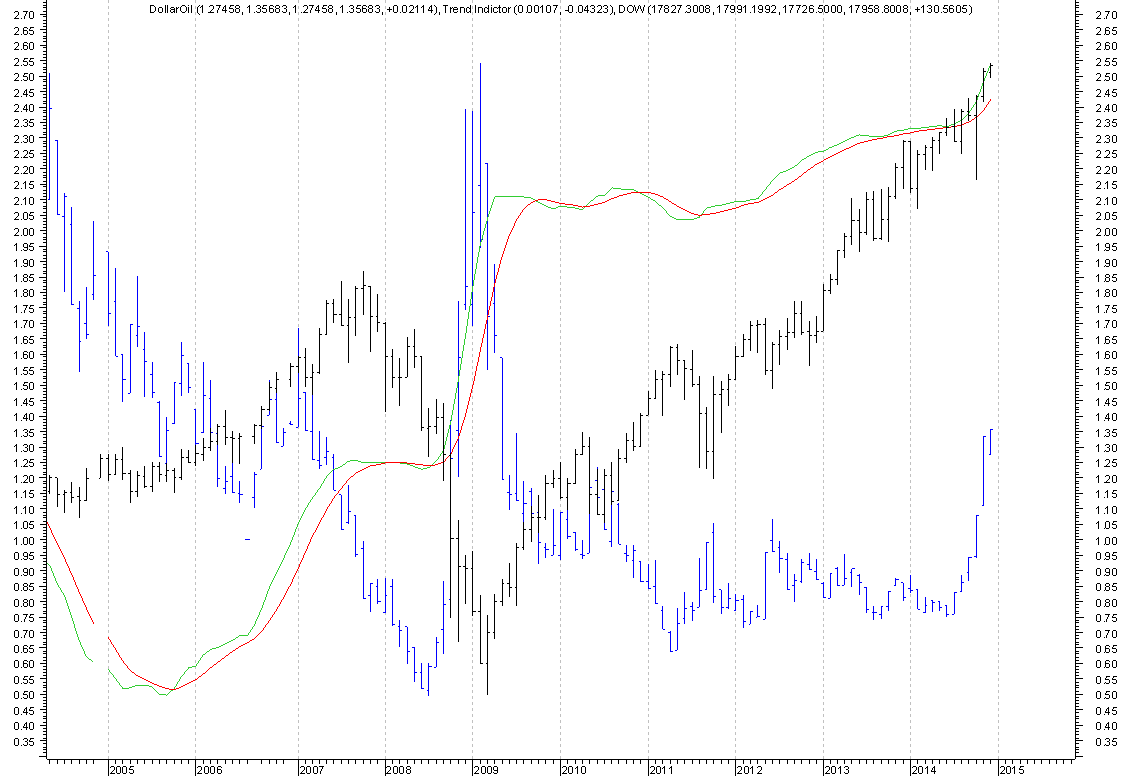

I consulted my buddy Tim Wood who was also pondering this question as well. We looked at the Dollar:Oil Ratio and noticed some curious chart patterns. This ratio peaked out at around 9 in 1998 and has been decimated by the Feds efforts to reflate since the tech bubble implosion in 2000. The ratio bottomed in 2008 at around 0.50. In the financial crisis the ratio spiked back up to 2.6 as the dollar rallied and oil imploded. Since 2011 the ratio has stabilized at around 0.75 and has based. Since the middle of the year the ratio has slowly gathered speed and lately exploded up to 1.37, a level not seen since 2009. What does this have to do with equities? Since 1985 the Dollar:Oil ratio has had a negative correlation of -0.71 with equities meaning that a rising ratio suggests weaker equity prices over time. In the financial crisis years 2007 and 2008 the correlation was -0.84. Sometimes the correlation in any given year is low from closer to zero correlation to -0.50. In general this is not a good timing tool for equity tops or bottoms. However, from eyeballing the data the correlation tends to be stronger when there is a second derivate change like we are experiencing now. Violent moves tend to suggest more inversely correlated moves in equities. The graph below is courtesy of Tim and shows the ratio in blue and the DJIA in black.

What is rather interesting is that YTD the correlation between the Dollar:Oil ratio and equities is a positive 0.60. Yes that is correct it is positive! So that begs the questions is it different this time? Sure anything is possible or is it more likely the the relationship has been temporarily warped by three of the worlds largest central banks promising or pumping new candy into the system after the Fed ended QE. If you believe that the correlation will mean revert to its long term -0.70 then 1 of 3 things needs to happen. Oil needs to rally back to $110, the Dollar needs to fall substantially or equities need to correct a lot. I don’t see the first two happening given the damage in the Oil chart and the strength in the Dollar chart. The equity chart looks strong now but the internals are awful and there are numerous divergences that I have talked about before that, if not for the CB intervention, we would have seen stocks a lot lower by now. The question as always is: can the CB’s deny mother nature? My bet is they must pay the piper at some point and this analysis suggest we are closer than you may think.

Hi Blue,

How do you square the large institutional buying into financials with your prognosis? It looks to me like a large bet on higher interest rates / lower bonds. The institutions that made this bet (and went big on Friday) certainly could be wrong, but it’s something that must be acknowledge in the analysis, don’t you think? I’m open to both scenarios and it’s one of the advantage little guys have over institutions: we don’t need to start changing position months in advance of an actual turn.

Best, Trader X

Trader X,

This analysis is just math. Either its different this time or its not. Remember this is not a timing tool. I don’t get what you are saying about banks. Last I checked rising interest rates will kill them. I am not following your logic.

all I can say is there is more than meets the eye to this decline in earl

there is a secret beneath that has yet to be revealed & this decline won’t be over until it comes to light

thats my conspiracy theory du jour

I have to agree with Juice, here. This will all seem so clear…. in hindsight.

My best bet for why oil is going down and why the dollar is up is deflation that has yet to manifest itself in us equities.

Blue,

Amazing work yet again. Thanks.

Putin please ,please ,please squeal,

then this will be over.

Juice,

Keep it simple. Its all math. I like conspiracy theories which are usually fact.

Helicpter ben,

I agree.

Quality,

Thanks

Putin will actually go to war. thats how this ends.

whoah nellie .. China tossed in the murder-hole overnight ! Shanghai shanghai’d to the tune of 5.4% ! Hang Seng -2.3% … even the bullet-proof $BSE down over a percent

our day of reckoning cometh sooner .. or later , but she’s a-coming round the mountain, she’s a-coming

When I saw that Barron’s cover on my doorstop, I immediately divested the rest of my longs.

tell me why the markets should adhere to the natural laws…

new balance,

I mean they go up and they go down. Never in the history of a market have these things not occurred.

new balance

tell me anything, that does not adhere to the natural laws over the long haul

BlueStar what is your take or thesis on USD/JPY and it’s effects on the markets, carry trade and so forth?

velth.

correlation to equities in the US has been high lately. I watch USD/JPY and pretty much know what is going to happen to the indices. It has topped and likely tests 113. I added to equity shorts on Monday.

Blue –

You still long TLT? It looks like a cup-and-handle breakout.

fry guy,

Largest part of my portfolio. Cup and handle is wildy bullish. I am going to add here. If you are not long you should buy this break out, very powerful. I am long IWM puts, bought more on Monday. I am still short amzn. Just turned profitable (bad entry in november but i know this will go much lower). I have tons of fire power left to add shorts. I will likely wait for a bounce but I think it may be on. Refer back to my Thats all folks piece. I will be blogging tonight after I can think and look at charts.

Blue –

TLT is 35% of my account since Monday. I have a few stock shorts in stuff that did not participate on the way up (PKX, NDLS). I like the AMZN short even now. It looks like it can go to $200. I have a few longs left in my trading account that are near zero beta (weird shit).

Question, do you roam around The PPT? if not, you should.

Tnx for your work here.

-Fry

Blue,

Thanks for your continued outstanding analysis. I loaded up on TLT calls earlier in the week and my account now thanks you as well.

I do have a question about the cup and handle pattern on TLT. it seems the breakout has been relatively low/moderate volume….does this concern you at all? Thanks for any input and again thanks for the continued insight.

re: bananas

The question is, why is Saudi Arabia knocking the price of oil down?

The best explanation I’ve heard is the Chinese are supplying SA with solar and other goods in return for low priced oil. China of course likes low priced energy but it also gave them leverage when negotiating those long-term energy deals with Russia.

SA is also saying fu to the US. Hasn’t the US frackpatch been a big driver of well paying US jobs? Low oil shuts that down, leaving the US economy in face-plant mode.

this is financial war. Screw people over and they will find a way to get back at you, if/when the opportunity arises

fry guy,

I roam the PPT.

billie jones,

Remember the TLT is just a proxy for the US bond market. It is the deepest and most liquid market on the world. big money flows are driving the bus here. and they buy actual bonds not the tlt.