One of these days I’ll shut the hell up about moving you into real money assets as quickly as your penny stock-spindling portfolio will allow.

But that day is not this day. Not when the latest news clacking over the Jesse Livermore-era news ticker in my offices reveals how Kommandant Barack is now going to nationalize GM — but “only temporarily.” Turns out Dear Leader wants just enough time for Rahm Emmanual and Lanny Davis to wheel that aging aerophin-appended Caddy into his airplane hangar chop shop so to whack it up for distribution to loyal U.A.W. gummint cheese recipients.

Tanks you veddy much, Kommandant, and dont’ forget to save the steering wheel, the white wall tires and the chrome ashtrays for the bond holders! I said leave those white wall tires, you!

So if the good fellahs in charge of everything — and damn, they really seem like they are in charge of everything these days, don’t they? — are that cavalier about the big buck bondholders (some of whom were stupid enough to give them campaign money just months ago) , doesn’t that make you just a wee bit nervous about how well they are going to treat that other little U.S. bond obligation: The Federal Reserve Note?

So have fun, and be a silly piebald carnival piker if you’re so compelled. By all means, stuff yourself into the clown car with all the other PPT nutjobs . Throw some funny money at chip stocks that have been moribund since Bill Gates was still a virgin, if you feel that exercise will further your spiritual growth. Go nuts.

Hell, you’ll probably find me in that same Yugo from time to time, playing Parcheesi with Ragin Cajun whilst simultaneously sword fighting The Chart Addict. I’m human, after all, and enjoy an OTB rocket ride for greasy coin and bed bugged comfort as much as the next guy.

Just don’t get too homey in that clown car, Homey. Five will get you ten it will soon be remandered by the EPA for egregious CAFE standard violations, environmentally malevolant tailpipe emanations, and toxic silly string abuse. Then it’ll be medical experiments for the lot of us.

Well, not those who have been prudent about tendering some savings to the Jacksonian Core Holding Portfolio, whose hard money and hard asset plays will serve to keep some of us cosy with hot buttered rums and chedder toasties , whilst the OTB pikers scrape at our doors. No luck for them I’m afraid. They shall be turned out with a stern warning from Cuddy, our trusty footman.

But Cuddy welcomes the purchase of silver this day, as the Three Musketeers SSRI, PAAS and SLW scored again, with wins of 7.64%, 5.39% and 3.75%, respectively. Do you get the feeling the market is trying to tell you something, Jacksonians?

Beating even silver today was coveted (but not precious) metal molybdenum, as JCHP member TC rang the bell with gains of 9.36% today. All in all, the Portfolio only had two slight losses, and both in the red hot agricultural sector. I expect MON (-0.69) and ANDE’s (-1.09) small losses to be more like rests than ultimate pullbacks. Still, this is why we’ve diversified even within this stable grouping, up 2.85% for the day. Now quickly, onto our daily review:

ANDE — $22.62 (-1.09%)

GDX — $38.43 (+2.51%)

GLD — $90.96 (+0.66)

IAG – $9.88 (+1.23%)

PAAS — $19.74 (+5.39%)

RGLD – $40.66 (+2.16%)

SLV — $13.98 (+2.95%)

SLW — $9.13 (+3.75%)

SSRI — $20.86 (+7.64%)

TBT — $51.04 (+1.07%)

TC — $9.00 (+9.36%)

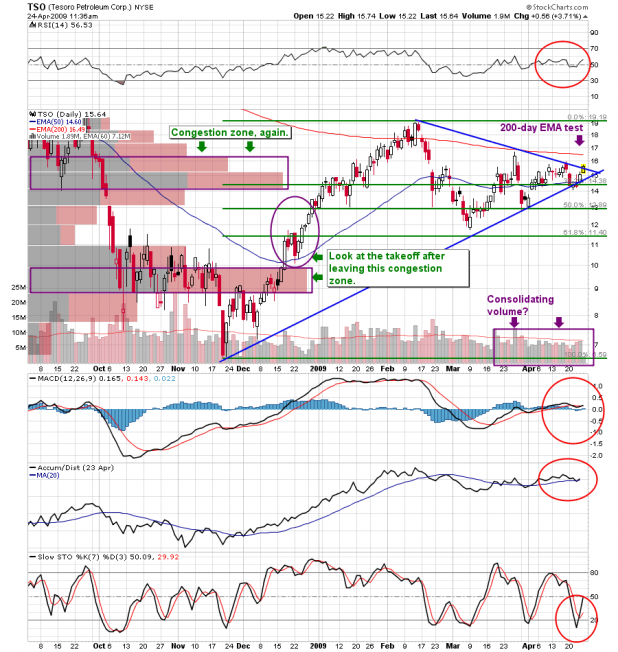

TSO — $17.22 (+3.11%)

Daily Average: +2.85 %

________________________

Comments »