Not So Hot

- Whole Foods (WFMI) – grrrr! missed buying puts. This was an easy call. Look out below!

- Infosonic (IFO) – lot of manipulating going on before earnings, then day after, stock fell back to where it started. When this happens, usually the support is broken in the next few days.

- Dover Downs (DDE) – still waiting for this stock to crumble to single digits

- Amazon.com (AMZN) – got hit hard, and still is overpriced! Heading to teens.

- Rackable Systems (RACK)- I’m not a fan of one-trick companies. Rack’s trick was Google. They depended so much on Google, now they don’t know how to manage their own company… pathetic.

- Intuitive Surgical (ISRG) – a victim of profit taking. Expect ISRG to sell off heavily when the market is down.

What’s Hot

- Apple (AAPL) – had some follow through upgrades to fuel the rally. Now trading closer to $70. Not to late to take a bite of this Apple!

- Titanium Metals (TIE) – titanum demand in Asia + great earnings + Harold buying a few million worth of shares again = rally monkey. I’m holding on to some shorts for a short term correction though.

- AT&T (T)- this giant company is actually doing good. I haven’t seen this stock move in a long time.

- Merck (MRK)- a good sign for biotechs and pharmaceuticals. Merck knows how to deal with generics… just price lower than them! Look at them fly now.

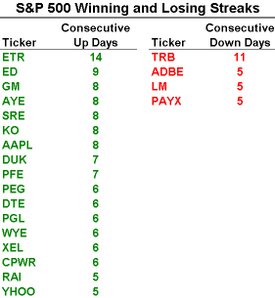

- General Motors (GM) – a classic American turnaround story.

Super Hot

- SimpleTech (STEC) – raised forecast, stock now on fire!

- Akamai (AKAM) – a rare survivor of momentum stocks this year. They have great customers.

- Leading Brands (LBIX) – up over 700% YTD, and still not heavily covered. They have a newsletter that pumps up investors. Made investor-friendly moves last week. Released a new blueberry drink. I still don’t know where to buy this crap.

- ICON plc (ICLR)- this Ireland pharmaceutical company is under heavy accumulation, before and after their great earnings report. Hot!

- Ilumnia Inc (ILMN) – breakout again!

- DXP Enterprise (DXPE) – a former high flying momentum stock that got waaaaay oversold. Now it’s flying again.

Angry Bull Reversals

- Headwaters (HW) – extremely oversold; just got an upgrade. Next stop, $25.

- China Medical Tech (CMED) – triple bottom formed just above $18. Next stop $26.

- Underarmour (UARM) – challenging Nike, doing a great job.

- Intel (INTC) – new revolutionary processors coming out. BTW, Intel historically is a super buy under $19.