Comments »By Scott Lanman

June 10 (Bloomberg) — The Federal Reserve unveiled its most detailed picture yet of its record $1 trillion expansion of credit, as Chairman Ben S. Bernanke responds to congressional pressure for greater transparency from the central bank.

For the first time, the Fed announced details on the number of borrowers and the ratings of securities pledged as collateral for loans. The data come in a new monthly report released by the central bank today in Washington.

The Fed said a total of 378 banks borrowed from its discount window in May or got funds from auctions of cash aimed at combating the liquidity crisis. Officials still stopped short of identifying the firms, a measure called for by some lawmakers and the subject of freedom-of-information requests and lawsuits.

Fed officials believe naming companies would undermine the central bank’s efforts to stabilize the economy, a senior Fed official said at a press briefing today.

“We will continue to look for opportunities to broaden the scope of information and analysis we provide,” Bernanke said in a statement today. The Fed statement said the central bank is providing “considerable new information.” Bernanke said in congressional testimony last week that the monthly reports would begin “soon.”

The 20-page document combines new data on collateral and the concentration of borrowers with information the central bank began disclosing in other reports on its Web site earlier this year as well as weekly balance-sheet figures.

‘Completely Insufficient’

Senator Bernie Sanders, the Vermont independent who sponsored an April 2 resolution that urged the Fed to identify borrowers and passed by a 20-vote margin, said today’s Fed report is “completely insufficient.”

“It is time for the Fed to name names,” Sanders said in a statement. The money “belongs to the American people,” and disclosure would show whether banks that are repaying the government’s capital injections are getting loans from the Fed, the senator said.

Among the new data, the Fed said an average 378 depository institutions borrowed $448 billion from the central bank in the four weeks ended May 27. That included 27 commercial banks with assets of more than $50 billion that took $257 billion, and 95 with less than $250 million in assets getting $1 billion.

Of the $618 billion in securities pledged as collateral to the Fed by banks, $125 billion are Treasuries or other federally backed assets, $215 billion have a AAA rating, $29 billion have a Baa/BBB rating and $131 billion have “other investment- grade” ratings that are “determined based on credit review” by the Fed.

Shore Up Market

Some 57 firms participated last month in the Fed’s program to shore up the market for corporate short-term debt. The top five commercial-paper issuers borrowed $57 billion on average in the four weeks ended May 27, out of the $159 billion total for the program. The bottom 47 firms took $73 billion.

The central bank said its lending to banks, bond dealers and American International Group Inc. produced $1.2 billion in interest income for the first three months of 2009, on a balance of $607.2 billion.

Also in the report, the Fed gave an update on the government’s January agreement to give Bank of America Corp. an aid package to help it absorb Merrill Lynch & Co. “The agreement has not yet been formally signed and is under review by the parties involved,” the Fed said.

Bank of America agreed to a loss-sharing plan with federal regulators in January on $118 billion in assets, mostly involving securities held by Merrill Lynch. Bank of America in May said it is negotiating to end that agreement because improving credit markets make the protection unnecessary.

Congressional Votes

The Fed’s effort at greater transparency in its emergency lending programs is a response to an April 2 nonbinding budget amendment sponsored by Senate Banking Committee Chairman Christopher Dodd, a Connecticut Democrat, and the panel’s ranking Republican, Alabama Senator Richard Shelby, Bernanke said. That proposal passed 96-2.

The Fed didn’t mention the tougher measure, also nonbinding, sponsored by Sanders, which passed 59-39 on the same day. Bloomberg News filed a lawsuit against the Fed in November seeking the names of borrowers.

Sanders, in a statement last month, threatened to pass the measure again “in a stronger form” if Bernanke failed to accept it. Bernanke told Sanders in February that identifying borrowers would be “counterproductive” and result in “severe adverse consequences for the economy.”

May Be ‘Overblown’

Robert Eisenbeis, former research director of the Atlanta Fed, said those concerns “might be overblown” because borrowing from the Fed doesn’t have the stigma it did before the financial crisis. “Right now it’s not really a sign of weakness,” said Eisenbeis, who is chief monetary economist for Vineland, New Jersey-based Cumberland Advisors Inc.

The new monthly report will be released two weeks after each month’s final Wednesday, which is when the Fed closes its books each week, an official said. The officials spoke on condition of anonymity.

Japan’s Economy Shrank 14.2% Beating Estimates

Comments »By Jason Clenfield

June 11 (Bloomberg) — Japan’s economy shrank at a record 14.2 percent annual pace last quarter as exports and business investment plummeted.

The contraction in gross domestic product was smaller than the 15.2 percent estimated last month, revised figures from the Cabinet Office showed today in Tokyo. The fourth quarter contraction was revised to 13.5 percent from 14.4 percent.

The world’s second-largest economy is forecast to expand this quarter as demand from China helps stabilize exports and manufacturers increase output to replenish inventories. Still, with factories sitting idle and profits falling, companies are slashing investment and jobs, casting doubt on whether the revival will last.

“We’re going to see a pickup in exports, a pickup in production and a pickup in work hours — which means a pickup in the economy,” said Hiromichi Shirakawa, chief economist at Credit Suisse Group AG in Tokyo. “But nobody is confident that the recovery will be sustained after the inventory-related rebound ends around October.”

The yen traded at 98.22 per dollar at 8:59 a.m. in Tokyo from 98.20 before the report was published. The median forecast of 23 economists surveyed by Bloomberg News was for a 15 percent decline.

The government revised its growth figures based on a report last week that showed companies cut capital spending by 25.4 percent in the three months ended March 31, the biggest retrenchment since records started in 1955. The same report showed profits fell by 69 percent.

Recession Easing

The recession has shown signs of easing since then. Japan’s manufacturers have benefited from revived demand in China, where the government is spending $586 billion on roads, hospitals and housing. Exports and factory production increased in March and April on a month-on-month basis.

Japanese Prime Minister Taro Aso’s record stimulus spending that includes loan guarantees for smaller businesses, cash handouts to households and incentives for buying cars and appliances are starting to work.

Consumer confidence rose to a 10-month high in April. Sales of electronics are by up about 20 percent since the government last month introduced a program to encourage consumers to buy eco-friendly products, according to Tokyo-based researcher Gfk Marketing Service Japan Ltd. Tax breaks on energy-efficient vehicles helped Honda Motor Co. post higher sales in the last two months. Bankruptcies fell last month for the first time since last April.

Bright Signs

Even as bright signs emerge, manufacturers are only using about half their productive capacity because of the collapse in global demand. Exports and production have fallen by more than a third from last year’s levels and managers are under pressure to cut jobs and delay investments, which could cause the economy to start shrinking again as the effects of the stimulus wanes.

“After the fourth quarter the outlook gets very uncertain,” said Credit Suisse’s Shirakawa. “In the short term, the stimulus package will have a fairly visible impact on GDP, but it’s only for this year.”

Machinery orders, an indication of capital spending in three to six months, slid to a 22-year low in April, a report yesterday showed.

Deflationary Malaise

A dearth of demand for Japan’s products and services has started to weigh on prices, sparking concern the economy may slip back into the kind of deflationary malaise that caused wages to fall by about 10 percent in the decade through 2005. Workers at the country’s biggest companies will have their summer bonuses cut by a record 19.4 percent this year, according to a survey by business-lobby Keidanren.

Cost-cutting drives by manufacturers including Konica Minolta Holdings Inc. will chip away at wages and may cause job losses to accelerate. Economists surveyed by Bloomberg expect the unemployment rate will rise next year to an unprecedented 5.7 percent from the current 5 percent.

Konica Minolta, a maker of parts for liquid-crystal displays, last week said it will cut jobs and reduce spending on research in order to offset falling revenues.

“The underlying price trend for the economy has turned negative and that’s going to be very hard to turn around,” said Richard Jerram, chief economist at Macquarie Securities Ltd. in Tokyo. “For six months things are going to improve very quickly based on pure inventory-related adjustments, and then after that they’ll improve rather more slowly. But you’re going to have deflation eroding the growth rate.”

Editorial: State of The Union

Comments »By Shamus Cooke

As if the bank bailouts weren’t proof enough that Wall Street owned Congress. History will likely show that these bailouts involved the largest transfer of wealth ever — from the working class to that small group of billionaires who own the corporations.This fact is recognized by most people now and is such common knowledge that even the mainstream media feels comfortable discussing it…matter-of-factly.

These corporations have also exerted tremendous influence in other realms of politics, working towards destroying Obama’s campgain promises of health care, job creation, civil liberties, the Employee Free Choice Act, peace, etc.

In each case, the promised reform was gutted of its essence, and “compromise” versions of the bills are now being discussed: instead of universal health care, we will likely be universally mandated to purchase health insurance; instead of “job creation” we are told that the stimulus has “saved jobs” (contrary to the evidence); while troops are “drawing down” from Iraq, the war in Afghanistan/Pakistan is being escalated; instead of allowing workers to organize unions easier, a compromise version – Employee Free Choice Act, minus card check — seems more politically “pragmatic,” etc.

Even Obama’s smaller reforms face similar partial abortions in Congress. For example, Obama recently signed into legislation the Helping Families Save Their Homes Act. But, as The New York Times pointed out, the bill “was missing its centerpiece: a change in bankruptcy law he [Obama] once championed that would have given judges the power to lower the amount owed on a home loan.” ( Ailing, Banks Still Field Strong Lobby at Capitol, June 6, 2009)

Obama was not demanding that foreclosures cease, or that those who’ve recently lost their homes — because of the economic crisis — be allowed to return to them; he was merely advocating that those who can still afford mortgage payments be allowed to lower their balances.

Even this small crumb for homeowners was rejected by Wall Street, whose profits would have suffered.

The New York Times explains: “… the [bills] real threat was to their [the banks] profits. The proposal would have shifted negotiating power to the millions of troubled homeowners who could use the threat of bankruptcy to wrest lower monthly payments from lenders.”

This truth prompted an oddly blunt reply from Democratic Senator Sheldon Whitehouse:

“This is one of the most extreme examples I have seen of a special interest wielding its power for the special interest of a few against the general benefit of millions of homeowners and thousands of communities now being devastated by foreclosure.”

The New York Times article also quieted those apologists for Obama who claim that he is an honest leader held back by an unreasonably conservative Democratic Congress:

“Throughout it all, the banks took advantage of the Obama administration’s seeming ambivalence. Despite its occasional populist rhetoric, the White House was conspicuously absent from weeks of pivotal negotiations this spring.”

And:

“While Mr. Obama reaffirmed his support for the proposal shortly after becoming president, administration officials barely participated in the negotiations, a factor that [corporate] lobbyists said significantly strengthened their hand.”

It must be noted that the corporation’s next big demand on the government will be to eliminate the tremendous U.S. debt, which they rightly view as a destabilizing factor for making profits. The problem lies in how they will propose to correct the problem: through the gutting of the U.S. social safety nets such as Social Security, Medicare, Medicaid, and other programs that benefit working families and the poor.

This government debt is the direct result of trillion dollar bank bailouts and wars of aggression that benefit only the rich. The working class, however, is being enlisted to pay for these polices.

The New York Times article ends with an important lesson:

“There was no counterweight to that [the banks] legislative muscle. Bankrupt homeowners do not have a political action committee or lobbyists.”

And while labor unions do have lobbyists, they cannot compete with the purchasing power of the banks. The fact that these two groups are both members of the same political party — vying for the ear of the same politicians — is utter lunacy. This tactic has yielded absolutely zero results for workers: every progressive promise of Obama’s has been butchered beyond recognition, or outright ignored.

This is because the Democratic Party is a party of big business, now more than ever. This fact is especially important in these times of economic crisis, where corporations are — because of shrinking profits — becoming louder in their condemnation of unions, while being emboldened by Obama’s horrendous anti-labor handling of the General Motors and Chrysler bankruptcies.

The political power of the corporations is dramatically exposing the rotten nature of America’s political and economic system — represented by the Republicans and Democrats — where the tremendous wealth of a small group allows them unprecedented power at the expense of millions of others. Without an independent political voice, the working class will continue to be “betrayed” by Democratic politicians whose pie in the sky campaign promises fail to yield even crumbs.

Shamus Cooke is a social service worker, trade unionist, and writer for Workers Action (www.workerscompass.org). He can be reached

Shamus Cooke is a frequent contributor to Global Research. Global Research Articles by Shamus Cooke

The Beige Cook Book

Comments »By Scott Lanman and Vivien Lou Chen

June 10 (Bloomberg) — The Federal Reserve said the U.S. downturn may be slowing in almost half of its regions, with the outlook at some companies improving while “stringent” loan conditions and a “weak” labor market persist.

“Economic conditions remained weak or deteriorated further” from mid-April through May, while five of 12 Fed districts “noted that the downward trend is showing signs of moderating,” the Fed said today in its Beige Book business survey, published two weeks before officials issue their next monetary policy decision.

The report lends support to Federal Reserve Chairman Ben S. Bernanke’s congressional testimony last week that while the pace of the U.S. contraction is slowing, the labor market is still weak and the economy may experience further job losses. Prices, except for oil, were “generally flat or falling,” the Fed said.

“Contacts from several districts said that their expectations have improved, though they do not see a substantial increase in economic activity through the end of the year,” the central bank said in the report.

The Fed report reflects information collected through June 1 and summarized by staffers at the Cleveland Fed bank. The Federal Open Market Committee next meets in Washington June 23- 24.

“The economy has not yet bottomed out,” Robert Engle, a Nobel-prize winning economist and professor at New York University, said in an interview with Bloomberg Television before the report.

‘Low Levels’

Even so, the words “stable” or “stabilize” appeared in some form more than 60 times in today’s report. Many district banks reported that homebuilding “appeared to have stabilized at very low levels,” and some regions indicated that “manufacturing employment levels may soon stabilize,” the Beige Book said.

Earlier today, Home Depot Inc., the world’s largest home- improvement chain, said fiscal 2009 profit may decline less than it had projected, or not at all, reflecting its cost-cutting to cope with a drop in sales.

Texas Instruments Inc., the second-largest U.S. semiconductor maker, raised its second-quarter sales and profit forecasts on June 8, anticipating customers will replenish inventories.

“Labor market conditions continued to be weak across the country, with wages generally remaining flat or falling,” the Fed said today. Some employers were freezing or cutting wages or reducing workers’ benefits and hours, the report said.

‘Modest Signs’

Still, “several districts saw signs that job losses may be moderating,” and staffing firms “reported some modest signs of recovery,” the Fed said.

Commercial property vacancy rates increased in “many parts” of the U.S., and developers had more trouble getting financing for new projects, the Fed said. Lending was “stable or weak” in most areas yet “with mixed results across loan categories.”

Fed Does Well With AIG & BSC

Comments »The Federal Reserve lost $5.25 billion in the first quarter on the securities it acquired with last year’s bailouts of Bear Stearns and insurer American International Group, according to a report issued Wednesday.

The loss on the holdings, which include mortgage-backed securities, reflected a decline in their value as the recession carried over into the first three months of this year. The cumulative loss on the Bear and AIG holdings come to $16.46 billion since they were taken over last year.

The Fed is hoping that if it holds onto the securities long enough, they will eventually rise in value once the economy returns to full health again, the housing market heals and the financial and credit crises are past.

The Fed’s new report, which will be issued monthly, comes as lawmakers have demanded more information about the bailouts, and a slew of other programs intended to spur lending and stabilize the banking system.

The monthly report provides some details beyond the Fed’s weekly snapshot of loan and debt-buying programs on its balance sheet. Those details include collateral pledged by borrowers, ratings on collateral, and the number of borrowers for some programs.

However, the Fed did not budge on lawmakers’ requests that it identify borrowers for emergency and other loans.

Fed Chairman Ben Bernanke has repeatedly argued that doing so would risk a run on a bank or other financial institution, undermining the purpose of the program.

As lender of last resort, the Fed’s programs are intended to bolster the financial system, a key ingredient to lifting the country out of recession.

The monthly report showed that the Fed’s commercial paper program reported net income of $2.14 billion in the first quarter. Commercial paper is the crucial short-term debt that companies use to pay everyday expenses.

The Fed began buying commercial paper last year when that market virtually came to a halt after credit problems intensified last fall.

It also reported net earnings of $1.2 billion in the first quarter on other loan programs, including emergency borrowing to banks and investment firms.

The Fed reported $4.57 billion in earnings under its regular transactions involving Treasury securities.

As of late May, the report said that trusts affiliated with Sallie Mae, GE Capital Credit, CarMax, Ford Credit, Harley-Davidson Motorcycle, Honda and Nissan were among the issuers of securities participating in a Fed program intended to spark lending to consumers and small businesses.

Investors in the Term Asset-Backed Securities Loan Facility, or TALF, get loans from the Fed to buy newly issued securities backed by, among other things, auto and student loans, credit cards and business equipment.

It also said that borrowing banks have put up $965 billion in collateral to back emergency and other Fed loans that averaged $448 billion in daily borrowing as of late May.

For Your Viewing Pleasure

Henry Blodget|Jun. 10, 2009, 9:08 AM

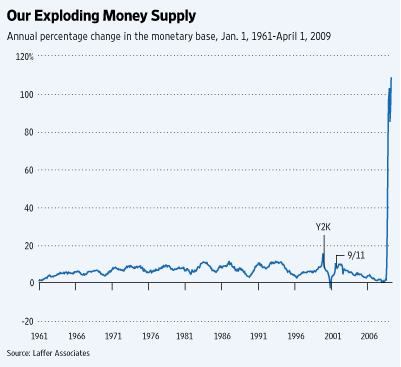

Arthur Laffer joins the chorus of economists predicting that the Fed’s massive stimulus will lead to hyper-inflation.

Laffer focuses on the huge expansion of the monetary base and predicts that faced with two bad choices–inflation or crippling the economy–Bernanke will choose inflation.

We agree. The double-digit inflation of the 1970s didn’t happen because Arthur Burns and the politicians were stupid. It happened because they didn’t want to kill the economy by raising rates. If it comes to that, in our opinion, Bernanke will likely err on the side of inflation.

Laffer doesn’t address the counter-argument, made by Paul Krugman, which is that you can’t have hyper-inflation without wage increases, and we’re not seeing wage increases (yet.)

Here’s Laffer:

The percentage increase in the monetary base is the largest increase in the past 50 years by a factor of 10 (see chart nearby). It is so far outside the realm of our prior experiential base that historical comparisons are rendered difficult if not meaningless. The currency-in-circulation component of the monetary base — which prior to the expansion had comprised 95% of the monetary base — has risen by a little less than 10%, while bank reserves have increased almost 20-fold. Now the currency-in-circulation component of the monetary base is a smidgen less than 50% of the monetary base. Yikes!

Bank reserves are crucially important because they are the foundation upon which banks are able to expand their liabilities and thereby increase the quantity of money…

What’s important for the overall economy… is how fast these loans are made and how rapidly the quantity of money increases. For our purposes, money is the sum total of all currency in circulation, bank demand deposits, other checkable deposits, and travelers checks (economists call this M1). When reserve constraints on banks are removed, it does take the banks time to make new loans. But given sufficient time, they will make enough new loans until they are once again reserve constrained…

At present, banks are doing just what we would expect them to do. They are making new loans and increasing overall bank liabilities (i.e., money). The 12-month growth rate of M1 is now in the 15% range, and close to its highest level in the past half century.

Read Laffer’s whole piece here >

Comments »