Comments »March 20 (Bloomberg) — Asian commodity stocks climbed on a rally in oil and metal prices, offsetting declines by banks amid skepticism U.S. and Japanese plans to purchase bonds will ease the financial crisis.

BHP Billiton Ltd., the world’s largest mining company, rose 4.3 percent in Sydney, while Posco, Asia’s third-largest steelmaker, gained 2.6 percent in Seoul. Commonwealth Bank of Australia, the nation’s largest mortgage lender, fell 2.9 percent, tracking declines by U.S. financial shares. Japan’s stock market is closed for a public holiday.

“Investors are switching out from banks and into the resources stocks because they’re waiting for signs of improvement in the credit markets,” said Rob Patterson, who manages about $2 billion at Argo Investments Ltd. in Adelaide, Australia.

The MSCI Asia Pacific excluding Japan Index was little changed at 236.31 as of 9:42 a.m. in Hong Kong, taking its advance this week to 6.3 percent. The gauge that includes Japan has climbed 7.8 percent in the past five days, the most since August 2007, as banks including Barclays Plc and Standard Chartered Plc reported “strong” starts to the year.

South Korea’s Kospi climbed 1.3 percent, while Australia’s S&P/ASX 200 Index lost 0.1 percent. Benchmark indexes in New Zealand, Singapore and Malaysia declined, while Taiwan’s rose.

Futures on the Standard & Poor’s 500 Index fell 0.5 percent. The gauge dropped 1.3 percent yesterday, led by financial shares, which had risen in seven of the previous eight days. The decline halted the S&P 500’s rebound from the 12-year low reached on March 9, paring the gain to 16 percent.

Commodities Rally

BHP gained 4.3 percent to A$32.60 as a measure of six metals jumped 5.6 percent yesterday in London. Rio Tinto Group, the world’s third-largest mining company, added 3.7 percent to A$47.18. Posco rose 2.6 percent to 356,500 won.

Other commodities followed gains in metals, with the Reuters/Jefferies CRB Index of 19 commodity prices climbing 5.3 percent, the biggest gain since Dec. 31.

Woodside Petroleum Ltd., Australia’s second-largest oil producer, added 1.7 percent to A$37.59 as crude oil futures surged 7.2 percent yesterday to $51.61 a barrel, the highest settlement since Nov. 28. Santos Ltd., the nation’s third- largest oil and gas producer, jumped 4.6 percent to A$16.05.

Newcrest Mining Ltd., Australia’s biggest gold producer, rose 2.7 percent to A$33.97. Lihir Gold Ltd. climbed 3.1 percent to A$3.36. Bullion jumped 7.8 percent in New York, the most in six months, as a Federal Reserve plan to buy debt weakened the dollar and revived concerns inflation will accelerate.

Commonwealth Bank of Australia fell 2.9 percent to A$33.03 in Sydney. Macquarie Group Ltd., Australia’s largest investment bank, dropped 3.6 percent to A$23.71.

A gauge of finance stocks on the MSCI Asia Pacific excluding Japan Index fell 1.1 percent, snapping a five-day, 15 percent rally. The comments this week from Barclays and Standard Chartered added to similar statements from Citigroup Inc. and Bank of America Corp., which fueled speculation the worst of the financial crisis is over.

Lets Get This Right: Tax Bonuses Which in Some Cases Are Paid by Taxpayers

Am I confuse or is this a form of theft ?

Comments »March 19 (Bloomberg) — Congress, moving swiftly in response to public outrage, advanced legislation to impose steep taxes on employee bonuses at American International Group Inc. and other companies that received taxpayer bailouts.

The House voted 328-93 to set a 90 percent tax on bonuses paid to employees of companies that received at least $5 billion in federal bailout funds. Hours later, four senators proposed a lower 70 percent rate on bonuses at companies getting more than $100 million in taxpayer aid, affecting a wider pool of workers.

The congressional action came amid a national furor over $165 million in bonuses paid last week by AIG after it received $173 billion in federal bailout funds.

“These people are getting away with murder,” said House Ways and Means Committee Chairman Charles Rangel of New York. “They’re getting paid for the destruction they’ve caused to our communities.”

The House measure would cover companies receiving 75 percent of federal bailout funds, according to Rangel’s panel.

President Barack Obama said in a statement the measure “rightly reflects the outrage” among the public over bonuses and said he hopes to receive a bill “that will serve as a strong signal to the executives who run these firms that such compensation will not be tolerated.”

The Senate measure, proposed by Senate Finance Committee Chairman Max Baucus and the panel’s top Republican, Iowa Senator Charles Grassley, would also restrict the amount of income that can be deferred from tax to $1 million. Democrat Ron Wyden of Oregon and Republican Olympia Snowe of Maine also are sponsoring the measure.

‘Simply Unacceptable’

“I’ve said before that paying excessive bonuses to the same group of folks that helped get us into this crisis is simply unacceptable,” Baucus said in a statement. “Millions of Americans continue to struggle to get by, counting their dollars, and Congress needs to do the same.”

Senate Majority Leader Harry Reid sought to have Baucus’s measure immediately passed, though Arizona Republican Jon Kyl objected.

“Other senators need time to consider the bill,” said Kyl. “The public ought to have a right to review this legislation to make sure it doesn’t have any additional loopholes or unintended consequences.”

While the two chambers differ in their mechanics, both pieces of legislation would target bonus pools that in healthier economic times, as recently as 2007, totaled more than $39 billion.

Constitutional Question

Senator Judd Gregg, a New Hampshire Republican, predicted Congress’s efforts to rescind the bonuses through higher taxes would be thrown out in court. He said the legislation violates the constitutional ban on bills of attainder, which restricts lawmakers’ ability to punish individual Americans.

“It’s basically targeted on a small group of people,” Gregg said. He also said the bill may exceed lawmakers’ power to rewrite existing contracts. He said “of course” the government ought to try to rescind the bonuses “but we’ve got to do it legally.”

Some academics said the legislation may survive a court challenge. “From what I’ve seen, it would pass constitutional muster,” said Alexander Tsesis, an assistant professor of law at Loyola University in Chicago.

The reason, Tsesis said, is that the legislation doesn’t target one company and instead applies to those that have received government funds. For the measure to be unconstitutional, courts would have to find that the predominant motive of the legislation was to target one company, he said.

‘Think It’s Okay’

Baucus said, “We’ve pushed the constitutional question pretty hard with constitutional experts and we think it’s okay.”

The House’s 90 percent tax would apply to people with income exceeding $250,000, including bonuses. The tax would apply to bonus payments made after Dec. 31, 2008, and it would cease when the U.S. government’s investment in the company fell below $5 billion. The tax wouldn’t apply to any bonus returned to a company, or to commissions or fringe benefits.

About $3.6 billion in Merrill Lynch & Co. bonuses wouldn’t be affected by the new legislation because they were paid before Dec. 31. Bonuses for employees at Bank of America Corp., Citigroup Inc., JPMorgan Chase & Co., Goldman Sachs Group Inc. and Morgan Stanley would be affected because they were paid after Dec. 31.

Fannie, Freddie

The measure also would affect employees of Fannie Mae and Freddie Mac, Rangel said yesterday. It wouldn’t apply to foreign workers of U.S. companies.

Voting for the House measure were 243 Democrats and 85 Republicans; six Democrats and 87 Republicans voted against it. A two-thirds margin was required under a fast-track procedure that barred amendments by opponents.

The Senate bill would tax retention and performance bonuses paid to foreign workers of U.S. companies. The 70 percent excise tax, split between employee and company, would be non- deductible. It would apply to 100 percent of any retention bonus and any other bonuses, including those that are performance- based, over $50,000. Certain stock options that vest for at least three years would be exempt.

“I wish we didn’t have to do this, but the administration didn’t stop the bonuses this year,” said Grassley, the top Republican on the Senate Finance Committee. “Using bailout dollars for bonuses after companies have been run into the ground adds insult to injury against taxpayers.”

‘Political Charade’

House Republican Leader John Boehner of Ohio opposed that chamber’s measure, demanding to know who added language to the $787 billion economic stimulus bill last month that protected executive bonuses that were promised before Feb. 11.

Boehner called the measure a “political charade” and said, “Why don’t we just get it all back?” He said Republicans offered an alternative requiring the Treasury secretary to devise a plan within two weeks to get all the bonus money back.

The House bill was drafted yesterday as AIG Chief Executive Officer Edward Liddy told a House Financial Services panel that he asked employees who got bonuses over $100,000 to repay half. Employees who made bad trades that triggered the company’s meltdown have been fired and received no bonuses, he said.

Editorial: America’s Fiscal Collapse

“We will rebuild, we will recover, and the United States of America will emerge stronger” ( President Barack Obama, State of the Union Address 24 Feb 2009)

“Those of us who manage the public’s dollars will be held to account—to spend wisely, reform bad habits, and do our business in the light of day—because only then can we restore the vital trust between a people and their government.” President Barack Obama, A New Era of Responsibility, the 2010 Budget)

“Strong economic medicine” with a “human face”

“Promise amid peril.” The stated priorities of the Obama economic package are health, education, renewable energy, investment in infrastructure and transportation. “Quality education” is at the forefront. Obama has also promised to “make health care more affordable and accessible”, for every American.

At first sight, the budget proposal has all the appearances of an expansionary program, a demand oriented “Second New Deal” geared towards creating employment, rebuilding shattered social programs and reviving the real economy.

The realities are otherwise. Obama’s promise is based on a mammoth austerity program. The entire fiscal structure is shattered, turned upside down.

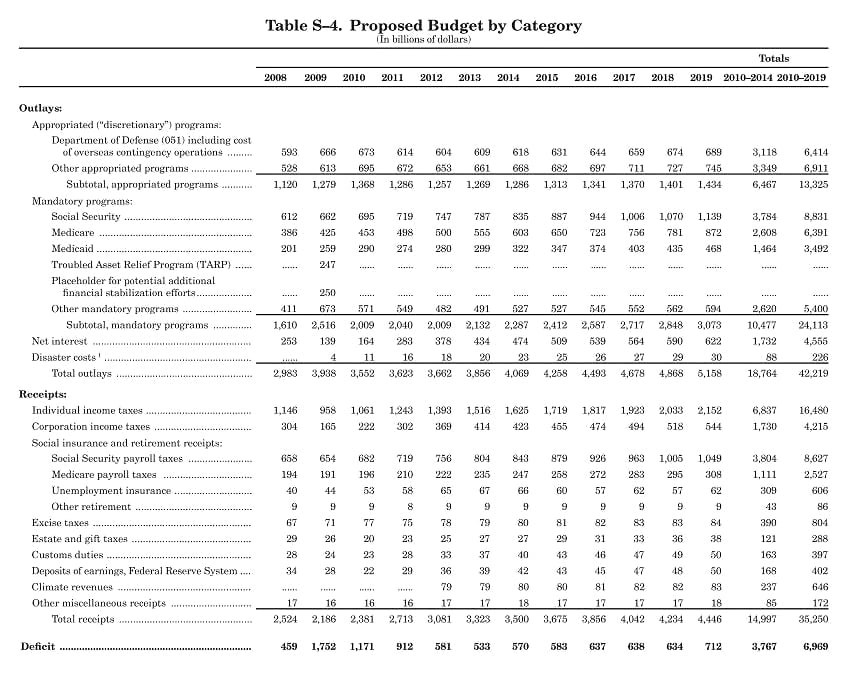

To reach these stated objectives, a significant hike in public spending on social programs (health, education, housing, social security) would be required as well as the implementation of a large scale public investment program. Major shifts in the composition of public expenditure would also be required: i.e. a move out of a war economy, requiring a movement out of military related spending in favour of civilian programs.

In actuality, what we are dealing with is the most drastic curtailment in public spending in American history, leading to social havoc and the potential impoverishment of millions of people.

The Obama promise largely serves the interests of Wall Street, the defence contractors and the oil conglomerates. In turn, the Bush-Obama bank “bailouts” are leading America into a spiralling public debt crisis. The economic and social dislocations are potentially devastating.

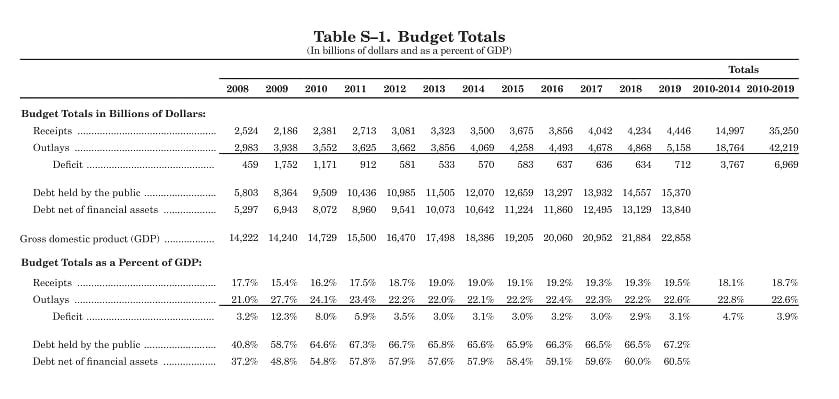

Obama’s budget submitted to Congress on February 26, 2009 envisages outlays for the 2010 fiscal year (commencing October 1st 2009) of $3.94 trillion, an increase of 32 percent. Total government revenues for the 2010 fiscal year, according to preliminary estimates by the Bureau of Budget, are of the order of $2.381 trillion.

The predicted budget deficit (according to the president’s speech) is of the order of $1.75 trillion, almost 12 percent of the U.S. Gross Domestic Product.

War and Wall Street

This is a “War Budget”. The austerity measures hit all major federal spending programs with the exception of: 1. Defence and the Middle East War: 2. the Wall Street bank bailout, 3. Interest payments on a staggering public debt.

The budget diverts tax revenues into financing the war. It legitimizes the fraudulent transfers of tax dollars to the financial elites under the “bank bailouts”.

The pattern of deficit spending is not expansionary. We are not dealing with a Keynesian style deficit, which stimulates investment and consumer demand, leading to an expansion of production and employment.

The “bank bailouts” (involving several initiatives financed by tax dollars) constitute a component of government expenditure. Both the Bush and Obama bank bailouts are hand outs to major financial institutions. They do not constitute a positive spending injection into the real economy. Quite the opposite. The bailouts contribute to financing the restructuring of the banking system leading to a massive concentration of wealth and centralization of banking power.

A large part of the bailout money granted by the US government will be transferred electronically to various affiliated accounts including the hedge funds. The largest banks in the US will also use this windfall cash to buy out their weaker competitors, thereby consolidating their position. The tendency, therefore, is towards a new wave of corporate buyouts, mergers and acquisitions in the financial services industry.

In turn, the financial elites will use these large amounts of liquid assets (paper wealth), together with the hundreds of billions acquired through speculative trade, to buy out real economy corporations (airlines, the automobile industry, Telecoms, media, etc ), whose quoted value on the stock markets has tumbled.

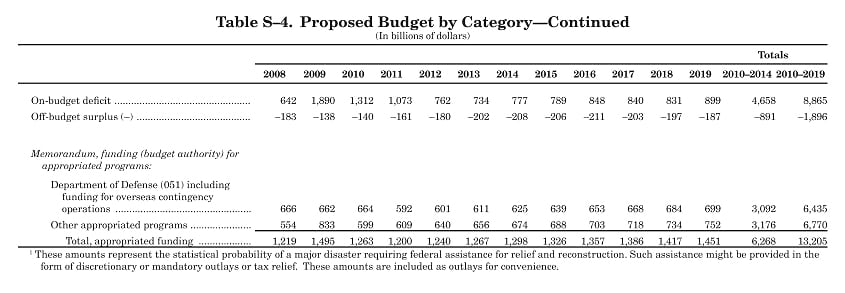

In essence, a budget deficit (combined with massive cuts in social programs) is required to fund the handouts to the banks as well as finance defence spending and the military surge in the Middle East war. Obama’s budget envisages:

1. defense spending of $534 billion for 2010, a supplemental 130 billion dollar appropriation for fiscal 2010 for the wars in Afghanistan and Iraq, and a supplemental $75.5 billion emergency war funding for the rest of the 2009 fiscal year. Defence spending and the Middle East war, with various supplemental budgets, is (officially) of the order of 739.5 billion. Some estimates place aggregate defence and military related spending at $ 1 trillion+.

2. A bank bailout of the order of $750 billion announced by Obama, which is added on to the 700 billion dollar bailout money already allocated by the outgoing Bush administration under the Troubled Assets Relief Program (TARP). The total of both programs is a staggering 1.45 trillion dollars to be financed by the Treasury. It should be understood that the actual amount of cash financial “aid” to the banks is significantly larger than $1.45 trillion. (See Table 2 below).

3. Net Interest on the outstanding public debt is estimated by the Bureau of the Budget) at $164 billion in 2010.

The order of magnitude of these allocations is staggering. Under a “balanced budget” criterion –which has been a priority of government economic policy since the Reagan era–, almost all the revenues of the federal government amounting to $2.381 trillion would be used to finance the bank bailout (1.45 trillion), the war ($739 billion) and interest payments on the public debt ($164 billion). In other words, no money would be left over for other categories of public expenditure.

TABLE 1 Budgetary allocations to Defence (FY 2009 and 2010), the Bank Bailout and Net Interests on the Public Debt (FY 2010)

$ Billions

Defence including Supplementary allocations; $534 billion (FY 2010), $130 billion supplemental (FY 2010), $75.5 billion emergency funding (FY2009)

739.5

*Bank bailout (TARP plus Obama) 1450.0

Net Interest 164.0

TOTAL 2353.5

Total Individual (Federal) Income Tax Revenues (FY 2010) 1061.0

Total Federal Government Revenue (FY 2010) 2381.0Source: Bureau of the Budget and official statements. See A New Era of Responsibility: The 2010 Budget

See also Office of Management and Budget* The officially announced bank bailouts to be financed from Treasury Funds. The timing of disbursements could take place over more than one fiscal years fiscal years. The actual value of bank bailout cash injections is substantially higher.

The Budget Deficit

These three categories of expenditure (Defence, Bank Bailout and Interest on the Public Debt) would virtually swallow up the entire 2010 federal government revenue of 2381.0. billion dollars

Moreover, as a basis of comparison, all the revenue accruing from individual federal income taxes ($1.061 trillion), (FY 2010) namely all the money households across America pay annually in the form of federal taxes, will not suffice to finance the handouts to the banks, which officially are of the order of $1.45 trillion. This amount includes the $700 billion (granted during FY 2009) under the TARP program plus the proposed $750 billion granted by the Obama administration.

While TARP and Obama’s proposed bailout are to be disbursed over FY 2009 and 2010, they nonetheless represent almost half of total government expenditure (half of Obama’s $3.94 trillion budget for fiscal 2010), which is financed by regular sources of revenue ($2381 billion) plus a staggering $1.75 trillion budget deficit, which ultimately requires the issuing of Treasury Bills and government bonds.

The feasibility of a large short-term expansion of the public debt at a time of crisis is yet another matter, particularly with interest rates at abysmally low levels.

The budget deficit is of the order of $1.75 trillion. Obama acknowledges a 1.3 trillion-dollar budget deficit, inherited from the Bush administration. In actuality, the budget deficit is much larger.

The official figures tend to underestimate the seriousness of the budgetary predicament. The $1.75 trillion dollar budget deficit figure is questionable because the various amounts disbursed under TARP and other related bank bailouts including Obama’s announced $750 billion aid program to financial institutions are not acknowledged in the government’s expenditure accounts.

“The aid hasn’t been requested formally, but appears in a line item “for potential additional financial stabilization efforts,” according to the budget overview. The budget office calculated a $250 billion net cost to taxpayers this year, because it anticipates it would eventually recoup some, though not all, of the money expended to help financial companies.

The funds would come on top of the $700 billion rescue package approved last October by Congress. The White House budgets no money for fiscal 2010 and beyond for such aid.” (Bloomberg, February 27, 2010)

Fiscal Collapse

A major crisis of the federal fiscal structure is occurring. The multibillion dollar allocations to the War Budget and to the Wall Street Bank Bailout program backlash on all other categories of public expenditure.

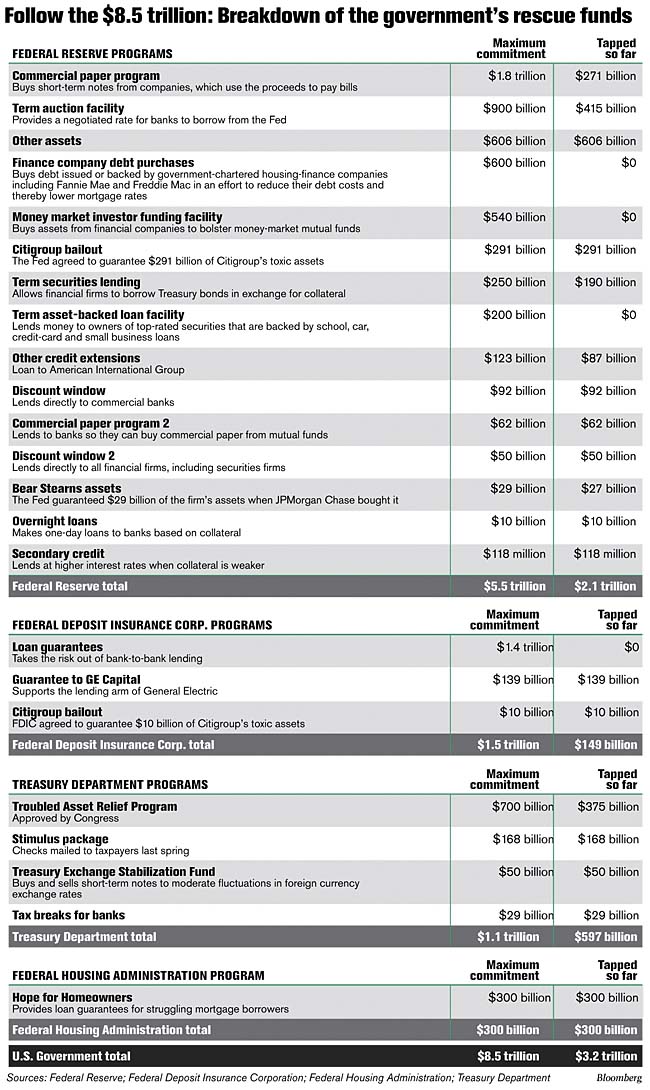

The Bush administration’s $700 billion bailout under the Troubled Asset Relief Program (TARP) was approved by Congress in October. TARP is but the tip of the iceberg. A panoply of bailout allocations in addition to the $ 700 billion were decided upon prior to Obama assuming office. In November, the federal government’s bank rescue program was estimated at a staggering 8.5 trillion dollars, an amount equivalent to more than 60% of the US public debt estimated at 14 trillion (2007). (See table 2 below)

Meanwhile, under the Obama budget proposal, 634 billion dollars are allocated to a reserve fund to finance universal health care. At first sight, it appears to be a large amount. But it is to be spent over a ten year period, — i.e. a modest annual commitment of 63.4 billion.

Public spending will be slashed with a view to curtailing a spiralling budget deficit. Health and education programs will not only remain heavily underfunded, they will be slashed, revamped and privatized. The likely outcome is the outright privatization of public services and the sale of State assets including public infrastructure, urban services, highways, national parks, etc. Fiscal collapse leads to the privatization of the State.

The fiscal crisis is further exacerbated by the compression of tax revenues resulting from decline of the real economy. Unemployed workers do not pay taxes nor do bankrupt firms. The process is cumulative. The solution to the fiscal crisis becomes the cause of further collapse.

Structure of The Public Debt

This large scale appropriation of liquid money assets under the bank bailouts by a handful of financial institutions serves to increase the public debt overnight.

When the US Treasury allocates 700 billion dollars to the Troubled Assets Relief Program, this amount constitutes a budgetary outlay which inevitably must be financed from within the structure of government revenues and expenditures.

Unless all other categories of public expenditure including health, education and social services are slashed, the various outlays under the bank bailout will require running a massive budget deficit which in turn will increase the US public debt.

America is the most indebted country on earth. The US (federal government) public debt is currently of the order of $14 trillion. This does not include mounting public debts at the state and municipal levels.

This US dollar denominated (federal) debt is composed of outstanding treasury bills and government bonds. The public debt, also called “the national debt” is the amount of money owed by the federal government to holders of U.S. debt instruments.

US debt instruments are held by American residents as part of their savings portfolio, companies and financial institutions, US government agencies, foreign governments, individuals in foreign countries. but does not include intergovernmental debt obligations or debt held in the Social Security Trust Fund. Types of securities held by the public include, but are not limited to, Treasury Bills, Notes, Bonds, TIPS, United States Savings Bonds, and State and Local Government Series securities.

The proposed solution becomes the cause of the crisis. The 700 billion bailout under the Troubled Asset Relief Program (TARP) combined with the proposed Obama $750 billion aid to financial services industry is but the tip of the iceberg. A panoply of bailout allocations in addition to the 700 billion have been decided upon.

The Bush Administration’s ” Bank Bailout”

The government’s bank rescue program under the Bush administration was estimated at a staggering 8.5 trillion dollars, an amount equivalent to 60% of the Total Gross Federal debt of $14.078 trillion (2010) (See Table 2 above). This amount does not include the “aid” to financial institutions proposed by the Obama administration, including an additional 750 billion dollars in Obama’s February 2009 budget proposal. The size of these allocations of liquid assets endangers the very structures of the fiscal and monetary system.

The total of Bush bank bailouts (8.5 trillion) can be broken down into funds granted by the Federal Reserve, the Treasury, the Federal Deposit Insurance Corporation and the Federal Housing Authority.

The handouts to the financial institutions financed out of Treasury are government expenditures, to be met either through tax revenues or through the emission of public debt instruments.

The disbursements under TARP are categorized by the Bureau of the Budget as part of “a mandatory program” under an Act of the US Congress.. The Treasury’s liability, which includes the controversial Troubled Assets Relief Program, was estimated in November 2008 at 1.1 trillion dollars. (See Table 2) Further Treasury allocations, which serve to heighten the burden of the public debt have been envisaged by the Obama administration

Spiralling Public Debt Crisis

Is the Treasury in a position to finance this mounting budget deficit officially tagged at 1.75 billion through the emission of Treasury bills and government bonds?

The largest budget deficit in US history coupled with the lowest interest rates in US history: With the Fed’s ” near zero” percent discount rate, the markets for US dollar denominated government bonds and Treasury bills are in straightjacket. Moreover, the essential functions of savings (which is central to the functioning of a national economy) is in crisis. .

Who wants to invest in US government debt? What is the demand for Treasury bills at exceedingly low interest rates?

Table 3 Interest Rates in Percent

Treasury securities Updated 2/25/2009

This week Month ago Year ago

One-Year Treasury Constant Maturity 0.64 0.43 2.10

91-day T-bill auction avg disc rate 0.300 0.150 2.160

182-day T-bill auction avg disc rate 0.495 0.350 2.070

Two-Year Treasury Constant Maturity 0.95 0.77 2.04

Five-Year Treasury Constant Maturity 1.79 1.58 2.89

Ten-Year Treasury Constant Maturity 2.75 2.56 3.85

One-Year MTA 1.633 1.823 4.326

One-Year CMT (Monthly) 0.44 0.49 2.71Source Bankrate.com

The market for US dollar denominated debt instruments is potentially at a standstill, which means that the Treasury lacks the ability to finance its mammoth budget deficit through public debt operations, leading the entire budgetary process into a quandary.

The question is whether China and Japan will continue to purchase US dollar denominated debt instruments. Washington is running a public relations campaign to lure Asian investors into buying T-bills and US government bonds. .

With the markets for US dollar denominated debt (both domestically and internationally) in crisis, further pressure will be exerted on the Treasury to slash (civilian) public expenditure to the bone, exact user fees for public services and sell off public assets, including State infrastructure and institutions. In all likelihood, this crisis is leading us to the privatization of the State, where activities hitherto under government jurisdiction will be transferred into private hands.

Who will be buying State assets at rock bottom prices? The financial elites, which are also the recipients of the bank bailout.

Consolidation of the Banks

A massive amount of liquidity has been injected into the financial system, from the bailouts but also from pension funds, individual savings, etc.

The stated objective of the bank bailout programs is to alleviate the banks’ burden of bad debts and non-performing loans. In actuality what is happening is that these massive amounts of money are being used by a handful of institutions to consolidate their position in global banking.

The exposure of the banks, largely the result of derivative trade, is estimated in the tens of trillions of dollars, to the extent that the amounts and guarantees granted by the Treasury and the Fed will not resolve the crisis. Nor are they intended to resolve the crisis.

The mainstream media suggests that the banks are being nationalized as a result of TARP, In fact, it is exactly the opposite: the State is being taken over by the banks, the State is being privatized. The establishment of a Worldwide unipolar financial system is part of the broader project of the Wall Street financial elites to establish the contours of a world government.

In a bitter irony, the recipients of the bailout under TARP and Obama’s proposed $750 billion aid to financial institutions are the creditors of the federal government. The Wall Street banks are the brokers and underwriters of the US public debt, although they hold only a portion of the debt, they transact and trade in US dollar denominated public debt instruments Worldwide.

They act as creditors of the US State. They evaluate the creditworthiness of the US government, they rank the public debt through Moody’s and Standard and Poor. They control the US Treasury, the Federal Reserve Board and the US Congress. They oversee and dictate fiscal and monetary policy, ensuring that the State acts in their interest.

Since the Reagan era, Wall Street dominates most areas of economic and social policy. It sets the budgetary agenda, ensuring the curtailment of social expenditures. Wall Street preaches balanced budgets but the practice has been lobbying for the elimination of corporate taxes, the granting of handouts to corporations, tax write-offs in mergers and acquisitions etc, all of which lead to a spiralling public debt.

Circular and Contradictory Relationship

The Federal Reserve system is a privately owned central bank. While the Federal Reserve Board is a government body, the process of money creation is controlled by the 12 Federal Reserve Banks, which are privately owned.

The shareholders of the Federal Reserve banks (with the New York Federal Reserve Bank playing a dominant role) are among America’s most powerful financial institutions.

While the Federal Reserve can create money “out of thin air”, the multibillion outlays of the Treasury (including the TARP program) will require the emission of public debt in the form of Treasury Bills and government bonds. Part of these T-Bills will of course also be held by the Fed.

US financial institutions oversee the US public debt. They are involved in the sale of treasury bills and government bonds on financial markets in the US and around the World. But they also hold part of the public debt. In this regard, they are the creditors of the US government. Part of this increased public debt required to rescue the banks will be financed or brokered by the same financial institutions which are the object of the bank rescue plan.

We are dealing with a pernicious circular relationship. When the banks pressured the Treasury to assist them in the form of a major bank rescue operation, it was understood from the outset that the banks would in turn assist the Treasury in financing the handouts of which they are the recipients.

To finance the bank bailout, the Treasury needs to run a massive budget deficit, which in turn requires a staggering increase of the US public debt.

Public opinion has been misled. The US government is in a sense financing its own indebtedness: the money granted to the banks is in part financed by borrowing from the banks.

The banks lend money to the government and with the money they lend to the government, the Treasury finances the bailout. In turn, the banks impose conditionalities on the management of the US public debt. They dictate how the money should be spent. They impose “fiscal responsibility”; they dictate massive cuts in social expenditures which result in the collapse and/or privatization of public services. They impose the privatization of urban infrastructure, roads, sewer and water systems, public recreational areas, everything is up for privatization.

The recipient banks are the beneficiaries as well as the creditors. As creditors, they will oblige the government a) to slash expenditures b) to run up the public debt through the issuing of treasury bills and government bonds.

This public debt crisis is all the more serious because the US federal government does not control monetary policy. All public debt operations go through the Federal reserve, which is in charge of monetary policy, acting on behalf of private financial interests. The government as such has no authority over money creation. This means that public debt operations essentially serve the interests of the banks.

Continuity from Bush to Obama

The Obama stimulus program constitutes a continuation of the Bush administration’s bank bailout packages. The proposed policy solution to the crisis becomes the cause, ultimately resulting in further real economy bankruptcies and a corresponding collapse of the standard of living of Americans.

Both the Bush and Obama bank bailouts are intended to come to the rescue of troubled financial institutions, to ensure the payment of “inter-bank” debt operations. In practice, large amounts of money transit through the banking system, from the banks to the hedge funds, to offshore banking havens and back to the banks.

The government and the media tend to focus on the ambiguous notion of ” inter-bank debts”. The identity of the creditors is rarely mentioned.

Multi-billion dollar transfers are conducted electronically from one financial entity to another. Where is the money going? Who is collecting these multibillion debts, which are in large part the consequence of financial manipulation and derivative trade?

There are indications that the financial institutions are transferring billions of dollars into their affiliated hedge funds. From these hedge funds they can then channel money capital towards the acquisition of real assets.

Through what circuitous financial mechanisms were these debts created? Where is the bailout money going? Who is cashing in on the multibillion dollar government bailout money? This process is contributing to an unprecedented concentration of private wealth.

Concluding Remarks

Financial manipulation is an integral part of the New World Order. It constitutes a powerful means to accumulate wealth. Under the present political arrangement, those responsible for monetary policy are quite deliberately serving the interests of the financiers, to the detriment of working people, leading to economic dislocation, unemployment and mass poverty.

This article has focussed on how financial manipulation has served to shatter the structure of US public expenditure.

More generally, this restructuring of global financial markets and institutions (alongside the pillage of national economies) has enabled the accumulation of vast amounts of private wealth – a large portion of which has been amassed as a result of strictly speculative transactions.

This critical drain of billions of dollars of household savings and state tax revenues paralyses the functions of government spending and spurs the accumulation of a public debt, which can no longer be financed through the emission of US dollar denominated debt instruments.

What we are dealing with is the fraudulent transfer and confiscation of lifelong savings and pension funds, the fraudulent appropriation of tax revenues to finance the bank bailouts, etc. To understand what has happened: follow the money trail of electronic transfers with a view to establishing where the money has gone. What is at stake is the outright criminalization of the financial system: “financial theft” on an unprecedented scale.

The monetary system, which is integrated into the State budgetary process, has been destabilized. The fundamental relationship between the monetary system and the real economy is in crisis.

The creation of money “out of thin air” threatens the value of the US dollar as an international currency. Similarly, the financing of a mammoth US budget deficit through dollar denominated debt instruments is impaired as a result of exceedingly low interest rates. Moreover, the process of household savings is undermined with interest rates close to zero.

What we have dealt with in this article is one central aspect of an evolving process of global financial collapse.

The international payments system is in crisis. The economic prospects are terrifying. Bankruptcies in the US, Canada, the European Union are occurring at an alarming rate. Country level exports have collapsed, leading to a contraction of international trade Reports from the Asian economies indicate a massive increase in unemployment. In China’s Pearl River basin in Southern Guangdong province’s industrial export processing economy, some 700,000 workers were laid off in January. (China Morning Post, Feb 6, 2009). In Japan, industrial output has collapsed by more than 20 percent since December. In the Philippines, a country of 90 million people, exports collapsed by more than 40 percent in December.

Financial Disarmament

There are no solutions under the prevailing global financial architecture. Meaningful policies cannot be achieved without radically reforming the workings of the international banking system.

What is required is an overhaul of the monetary system including the functions and ownership of the central bank, the arrest and prosecution of those involved in financial fraud both in the financial system and in governmental agencies, the freeze of all accounts where fraudulent transfers have been deposited, the cancellation of debts resulting from fraudulent trade and/or market manipulation.

People across the land, nationally and internationally, must mobilize. This struggle to democratise the financial and fiscal apparatus must be broad-based and democratic encompassing all sectors of society at all levels, in all countries. What is ultimately required is to disarm the financial establishment:

-confiscate those assets which were obtained through fraud and financial manipulation.

-restore the savings of households through reverse transfers

-return the bailout money to the Treasury, freeze the activities of the hedge funds. .

– freeze the gamut of speculative transactions including short-selling and derivative trade.

ANNEX

Documents

Budget of the United States Government

Fiscal Year 2010 The Budget Documents

A New Era of Responsibility: The 2010 Budget

The tables contained in Annex can also be consulted by clicking:

Summary Tables

See also:

http://www.budget.gov

http://www.gpoaccess.gov/usbudget/fy10/pdf/fy10-newera.pdf

Tax Havens and The Credit Crisis: What Do They Have in Common ?

It’s no surprise to see people like Martin Broughton say this. As chairman of the CBI (and British Airways), he is paid to deflect criticism from the business community. More worrying is the sight of otherwise sensible commentators making similar points. Martin Wolf in the Financial Times, for example, talks of “consternation” at the European obsession with tax. Carl Mortished in The Times says bank secrecy has nothing to do with the crisis and suggests the clampdown on tax havens is simply due to the wish of our governments to claim ever greater control over national wealth.

While it is true there were many other causes of the financial crisis – too much debt, being the most obvious – it is wrong to pretend that systemic tax avoidance of the sort practiced on a huge scale by our banks is unconnected with their eventual demise. Here are five reasons the two issues should be seen as intimately related.

1) Offshore = out of mind

The offshore vehicles used by banks to hide their activities from the taxman also served to obscure their extent from investors and regulators. Granite, the Jersey-based trust operated by Northern Rock, is exhibit A. Tax havens are also breeding grounds for corruption.

2) Pushing rules to the limit is infectious

As the FSA points out there is no point in having principles-based regulation when you are dealing with people with no principles. Similarly when you encourage bankers to ignore the spirit of tax law and only heed the letter, you encourage them to look for loopholes and shortcuts everywhere.

3) Everyone must pay their fair share

We are all going to have to pay more taxes to clean up this mess, but public support for government bank bail-outs could be fatally undermined if voters believe that only little people pay taxes. The sight of the super-rich swanning about in tax havens should be of more concern to the CBI than anything else right now – without public support, banking is toast.

4) Complexity confuses everyone

One reason why the world of finance became so convoluted was to stay one step ahead of the taxman. The “double dips” and other tax-efficient structures described here ultimately baffled everyone: including their creators. Just ask AIG.

5) Avoidance fuels unsustainable growth expectations

Hiding the true source of your wealth can give your investors a dangerous false sense of security. General Electric, for example, grew lending for years by keeping its tax rate shrinking, until suddenly it lost its credit rating. Far from being “dead money”, structured finance vehicles also require large amounts of borrowing to sustain: when the debt market dries up, they are the first to go under.

Comments »On The Heels of the Fed’s Action 30 Year Mortgage Rates Dip Below 5% to 4.79%

4.79% or pay a few points and get 4.125%

Comments »If you’ve got a good job, solid credit and your home’s value hasn’t fallen dramatically, you’re likely to benefit from the Federal Reserve’s extraordinary action Wednesday to help drive mortgage rates to historic lows and revive the U.S. housing market.

The Fed’s plan to buy up to $300 billion of long-term government bonds and $750 billion in additional mortgage-backed securities guaranteed by Fannie Mae and Freddie Mac, should benefit many—but not all—borrowers.

It’s likely to produce a big—though perhaps temporary—drop in mortgage rates. Rates rates on 30-year fixed-rate mortgages fell to 4.79 percent on Thursday, down over 0.40 percentage point from Wednesday, according to the Zillow Mortgage Rate Monitor, compiled by real estate website Zillow.com.

“It’s going to keep rates low for a longer period of time,” said Greg McBride, senior financial analyst at Bankrate.com.

Average rates for 30-year-fixed-rate mortgages hit a record low of 4.96 percent in January, according to mortgage finance company Freddie Mac. That was after the Fed launched its initial plan to buy $500 billion in mortgage-backed securities.

The Fed, seeking to push rates down further, is effectively planning to buy at least half of the home loans made in the U.S. this year based on last year’s total of about $1.4 trillion in mortgages. Around 70 percent of new loans in recent months have been backed by Fannie and Freddie, the mortgage finance companies seized by government regulators in September.

Fannie and Freddie own or guarantee almost 31 million mortgages worth about $5.5 trillion, more than half of all U.S home mortgages.

The Fed actions were great news for John Tuggle, a mortgage banker in Columbus, Ga., where the economy and housing market have remained relatively healthy.