I do not want to be an alarmist, but I can not help avoid seeing these types of articles build up. Payroll numbers suggest that income is down 10% across the board yet the government wants you to spend more. Is this a policy of economic ruin ?

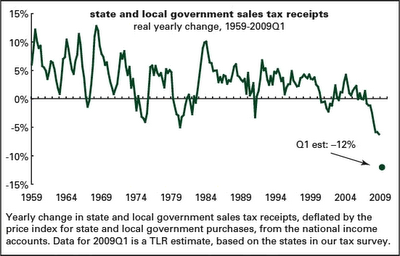

States are in major trouble with sales tax receipts down where are they collecting money ?

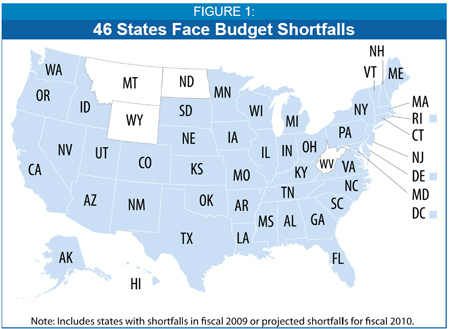

States are facing a great fiscal crisis. At least 46 states faced or are facing shortfalls in their budgets for this and/or next year, and severe fiscal problems are highly likely to continue into the following year as well. Combined budget gaps for the remainder of this fiscal year and state fiscal years 2010 and 2011 are estimated to total more than $350 billion.

States are currently at the mid-point of fiscal year 2009 — which started July 1 in most states — and are in the process of preparing their budgets for the next year. Over half the states had already cut spending, used reserves, or raised revenues in order to adopt a balanced budget for the current fiscal year — which started July 1 in most states. Now, their budgets have fallen out of balance again. New gaps of $51 billion (over 10% of state budgets) have opened up in the budgets of at least 42 states plus the District of Columbia. These budget gaps are in addition to the $48 billion shortfalls that these and other states faced as they adopted their budgets for the current fiscal year, bringing total gaps for the year to 15 percent of budgets.

The states fiscal problems are continuing into the next two years. At least 45 states have looked ahead and anticipate deficits for fiscal year 2010 and beyond. These gaps total almost $94 billion — 16 percent of budgets — for the 36 states that have estimated the size of these gaps and are likely to grow as gaps are re-estimated in the next few months.

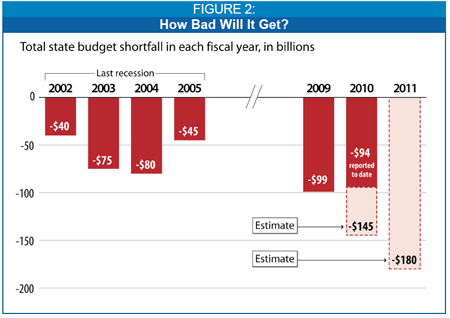

Figure 2 shows the size and duration of the deficits in the recession that occurred in the first part of this decade, and estimates of the likely deficits this time. This recession is more severe — deeper and longer — than the last recession, and thus state fiscal problems are likely to be worse.

Unemployment, which peaked after the last recession at 6.3 percent, has already hit 7.6 percent, and many economists expect it to rise to 9 percent or higher, which will reduce state income taxes and increase demand for Medicaid and other services. With consumers’ reduced access to home equity loans and other sources of credit, sales taxes are also likely to fall more steeply than they did in the last recession. These factors suggest that state budget gaps will be significantly larger than in the last recession. Based on past experience and the depth of this recession, it appears likely that all but a handful of states will face shortfalls in fiscal year 2010 and these deficits will end up totaling about $145 billion. If, as is widely expected, the economy does not begin to significantly recover until the end of calendar year 2009, state deficits are likely to be even larger in state fiscal year 2011 (which begins in July 2010 in most states).[1] The deficits over the next two-and-a half years are likely to be in the $350 billion to $370 billion range.[2]

It may be particularly difficult for states to recover from the current fiscal situation. Housing markets may be slow to fully recover; the decline in housing markets has already depressed consumption and sales taxes as people refrain from buying furniture, appliances, construction materials, and the like. Property tax revenues are also affected, and local governments will be looking to states to help address the squeeze on local and education budgets. And as the employment situation continues to deteriorate, income tax revenues will weaken further and there will be further downward pressure on sales tax revenues as consumers are reluctant or unable to spend.

The vast majority of states cannot run a deficit or borrow to cover their operating expenditures. As a result, states have three primary actions they can take during a fiscal crisis: they can draw down available reserves, they can cut expenditures, or they can raise taxes. States already have begun drawing down reserves; the remaining reserves are not sufficient to allow states to weather a significant downturn or recession. The other alternatives — spending cuts and tax increases — can

further slow a state’s economy during a downturn and contribute to the further slowing of the national economy, as well.

This also includes individuals

If you enjoy the content at iBankCoin, please follow us on TwitterAmericans are going bankrupt at an extraordinary rate. According to the American Bankruptcy Institute, Baby Boomers are filing bankruptcy more than any other group. The ABI gathered data from courts and public records to track bankruptcy filings. The study revealed the percentage of U.S. citizens over the age of 45 who filed for bankruptcy protection increased nearly 30-percent over the past eight years.

The percentage of people going bankrupt rose by nearly 70-percent in 2007. Experts predict an unprecedented record of nearly 1.5 million bankruptcy filings by the end of 2008. Predictions for 2009 are even gloomier, with an anticipated 4.5 million Americans filing for bankruptcy protection.

Economists relate the sharp increase in bankruptcy filings to the mortgage crisis. A large percentage of homeowners with subprime and adjustable-rate mortgages can no longer meet their mortgage obligations.

The decline in home values and instability within the credit industry has all but eliminated the potential for homeowners to use the equity in their home to consolidate debts. Homeowners unable to afford their mortgage payments or obtain home equity loans are being forced into bankruptcy in an effort to save their home from foreclosure.

Additionally, the failure of Fannie Mae and Freddie Mac set off a landslide of consumer panic. Numerous businesses are closing their doors, unemployment rates are skyrocketing, consumer spending has reached an all-time low and bankruptcy filings are going through the roof.

Homeowners who can no longer afford monthly mortgage payments and unable to refinance or obtain a second mortgage are forced into going bankrupt. Part of the problem stems from new bankruptcy laws enacted in 2005, which made filing for bankruptcy protection considerably more difficult and costly.

The Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCPA) was created to prevent consumers from filing for bankruptcy protection caused by frivolous spending habits. Prior to BAPCPA, the majority of consumers filed for Chapter 7. This bankruptcy chapter allows for liquidation of assets and provides debtors with the opportunity for a fresh financial start.

Today, consumers must undergo credit counseling and submit to the ‘means’ test; a tool used to determine the state median income level. Depending on where the debtor falls on the ‘means’ test scale determines how much of their outstanding debts they must repay.

If debtors fall below their states’ median income level they might be allowed to file for Chapter 7 bankruptcy protection. Otherwise, they will be forced into filing Chapter 13 and adhere to a strict repayment which typically lasts for three to five years.

A large percentage of the debtor’s disposable income must be contributed to the repayment plan. In many cases, debtors are unable to adhere to the plan and end up failing out of bankruptcy. When this occurs, the bankruptcy court can elect to allow the debtor to file for Chapter 7 or dismiss their case altogether.

Going bankrupt is never a happy event. It can be stressful and emotionally draining. However, it is important to realize there is life after bankruptcy. It is also important to retain a positive outlook and search for options and solutions to overcome financial hardships.

If you haven’t already done so, now is a good time to thoroughly review your financial situation and determine what went wrong and how you can prevent it in the future.

Simon Volkov is a private investor who offers solutions to people who are going bankrupt. He specializes in foreclosures, probate, promissory notes and bankruptcy alternatives. If you are considering personal bankruptcy visit http://www.SimonVolkov.com today and discover options you may not know existed!