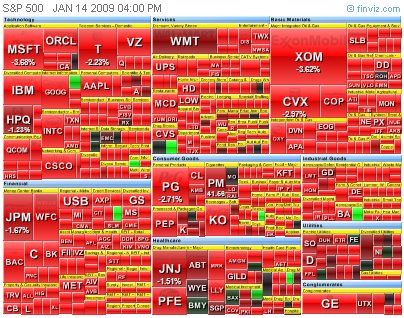

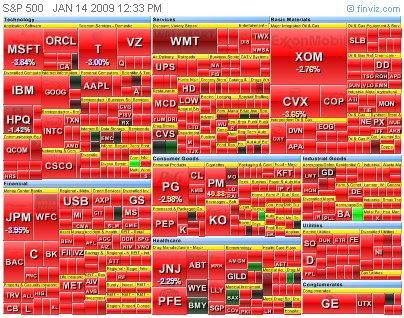

Wow, that ride down ended quick. Really quick, at least temporarily. I would have gotten my face ripped off today if it weren’t for my program auto-buying FAS in increments. I realize that the market is becoming more volatile with multi-percentage days, just as it did back in September, but is that a good thing or a bad thing? This is why it’s so important to be flexible. It doesn’t matter what you think…if the market thinks otherwise.

What today showed me is that there are too many things, both visible and invisible, that are propping up this market. In addition, the news flow EOD today was incredibly positive and the anticipated decline will have to be placed on hold pending a possible gap up tomorrow in response to AAPL earnings and desperate bank executives buying up shares to prop up their own stocks. (Didn’t Pandit do this in November?). It’s a confidence move and it’s working, at least in the short-run.

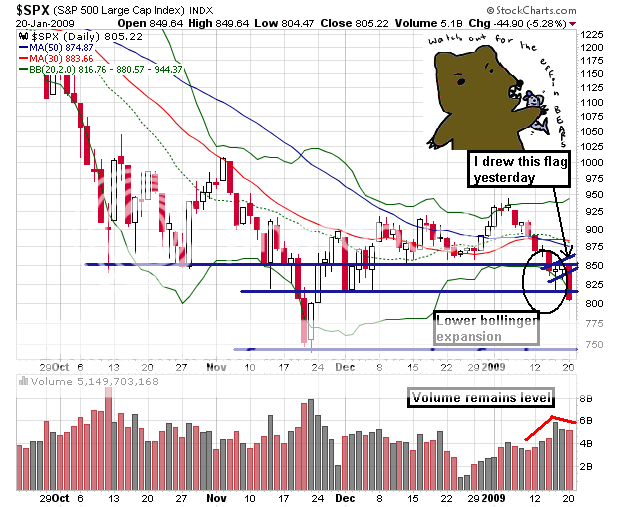

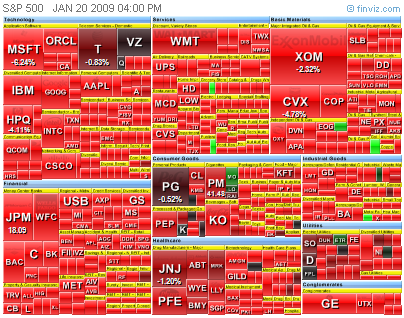

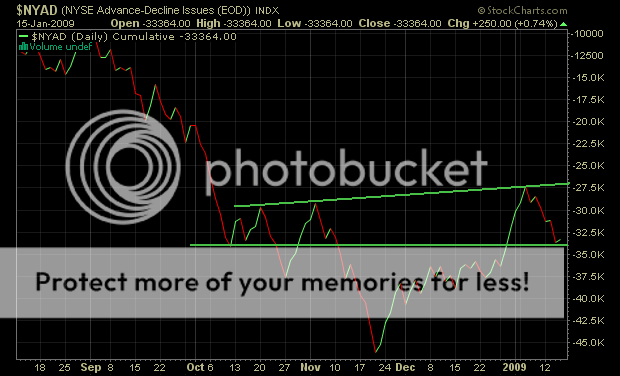

As for price action, today’s gains nearly cancelled out yesterday’s losses and the volume is being maintained. Obviously, the bears could not follow through, suggesting that it’s not quite time for an Armageddon-style cliff jump. I would like to see a stick sandwich, thank you very much.

It is possible that the financials could become those ‘Spikers’ that I always talk about, giving me the opportunity tomorrow to recover the hit I took on the gains made yesterday. The way that works is that it’s not always a long opportunity, but a short one as well. I posted it here before, so I’m going to go around looking for it.

I think 99% of traders would not be able to withstand the joy ride that goes on in my portfolio. To give you an example, I was up (YTD) around +21% on Friday, +64% on Tuesday, and I now stand at +52%. The daily change is a reminder of an ex-girlfriend that PMSed on you – sometimes she loved you, sometimes she just wanted to kill you. But I can handle that.

Let’s see what tomorrow brings. Currently, I am hedged and willing to stick with a short bias IF the market action indicates further downside continuation, but I’m currently more inclined to preserve my ridiculous January gains. At this point, some financials look like they will spike higher and some do not, giving me mixed signals. Another thing to look for is if they lead the market right out of the gate tomorrow. This will all be looked into further.

I also see that the “haters” have re-emerged from their cave. lol, please. Make note that I never had a down month in over 2 years, Madoff-style. You can kindly suckle on that till it bursts on your face. Have a good night!