For starters, I have no idea whether the Fed will raise. If I knew, I wouldn’t be dishing that information out free.

What we can do is analyze impacted areas that may imply the market is anticipating a rate hike. When the Friday jobs report came out, the dollar index jumped about 1.10%.

How does this connect to raising interest rates and investing overseas? At a very high level, when interest rates rise, a nation’s currency should rise. Global investors want higher yields, and to get that exposure, securities need to be purchased using the greenback.

When there’s a higher demand for anything (in this case dollars), price goes up (dollar becomes stronger). One could reasonably interpret this as markets pricing in a rate hike.

Which brings me to the attractiveness of investing overseas, specifically Euro-denominated countries (U.K. is excluded). I have two main drivers of this thesis.

First, with a stronger dollar, Euro’s become weaker, but their goods become cheaper. In theory, they should sell more goods.

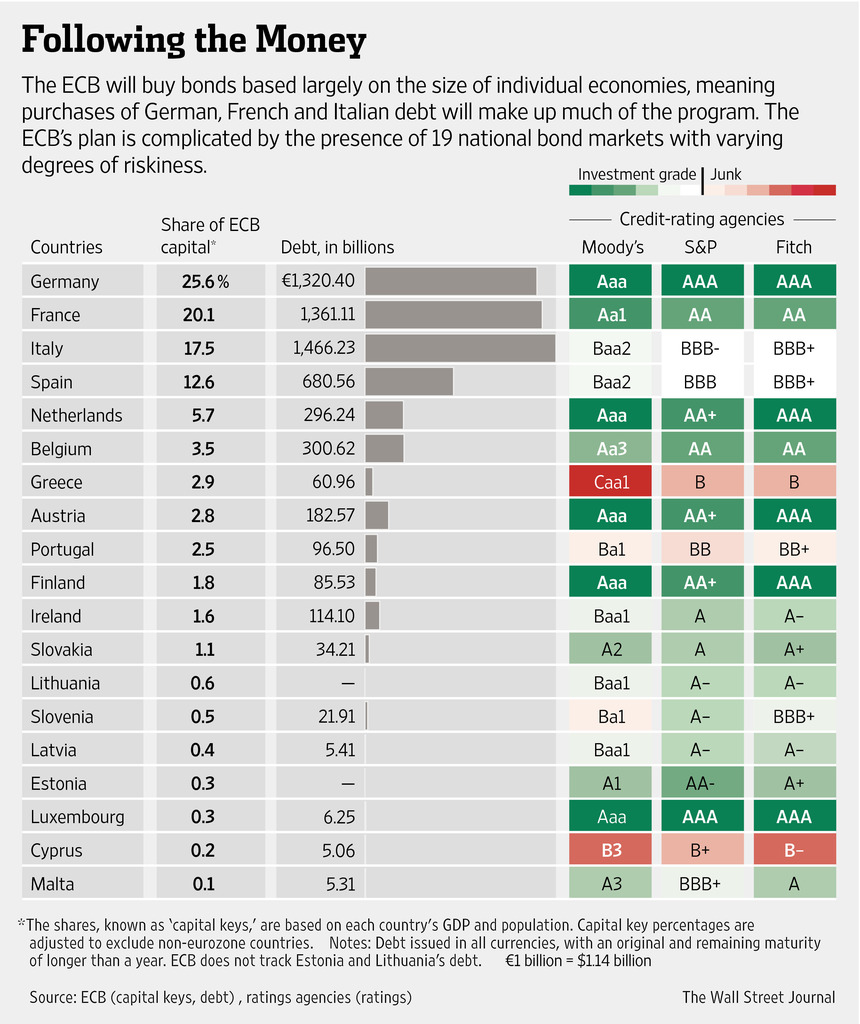

Second is Draghi & the ECB’s new QE initiative. Euro QE (similar to Euro Disney?) and a potential drop in U.S. exports due to King Dollar’s prowess makes this an attractive investing idea. Yes, Euro QE won’t have the same impact as it did here, but it’s not unreasonable to posit that stocks over there will get a boost.

At the beginning of this year, many money managers we clamoring on CNBC that Europe would out-perform the U.S. They were right for the first half; not so much lately.

I apologize if it’s difficult to see, but as of Nov 9 close, S&P is up 1.25% YTD while FEZ (ETF for Euro Large Cap) is down -2.17% and EZU (ETF for Euro Large & Mid Cap) is down -0.15%. FEZ is much more concentrated in terms of stock holdings, but another option is to be concentrated by country.

Below is a rough gauge of how the Euro impacts an individual Eurozone member:

Based on the ETFs of the top four countries, here are their YTD results: Germany -3.4%; France +3.3%; Italy +5.5%; and Spain -10.7%.

With Germany down YTD, it shouldn’t surprise that Euro ETFs have trailed. My first thought was the VW must be a huge holding, but it wasn’t.

I’m not recommending to buy up all Euro ETFs you can. And unless you know you’re shit, don’t buy individual companies across the pond.

Whether you want to be a little risky and go country concentrated, or get broad exposure, the risk-reward is there with the threat of a rising dollar and Euro QE.

If you enjoy the content at iBankCoin, please follow us on Twitter