Now that I’ve my day behind me. I like to go over some more thought on how I trade the biotech.

I’m sure you’ve many questions popping out of your head while you’re reading my previous post:

1) How do you know which biotech stock to buy?

2) Are you kidding me, you can lose real money fast by trading biotech! This is real suffering!

3) Ain’t you exposing yourself all over again by jumping back in after you’ve taken profit? How do you know it won’t gap down the next day?

I’m sure you have more questions but let’s just deal with this three questions for now.

1a) It’s all about the story and potential catalyst.

The story usually begin with a new discovery and that Phase 1 or 2 studies are positive; and that the next phase result will be coming out in a few months. If there is a prospect of a takeover due to an “expected” positive result, there will be a pump to drive the price up. The catalyst can be a single news item that show some minor progress which by itself means nothing much until the result comes out in a few months.

However, be aware that some news will simply trigger sell the news scenario; therefore, instead of seeing price increases, you see a price drops from early buyers taking profits. And to minimize our exposure to sell on news, we need to pay attention to the chart.

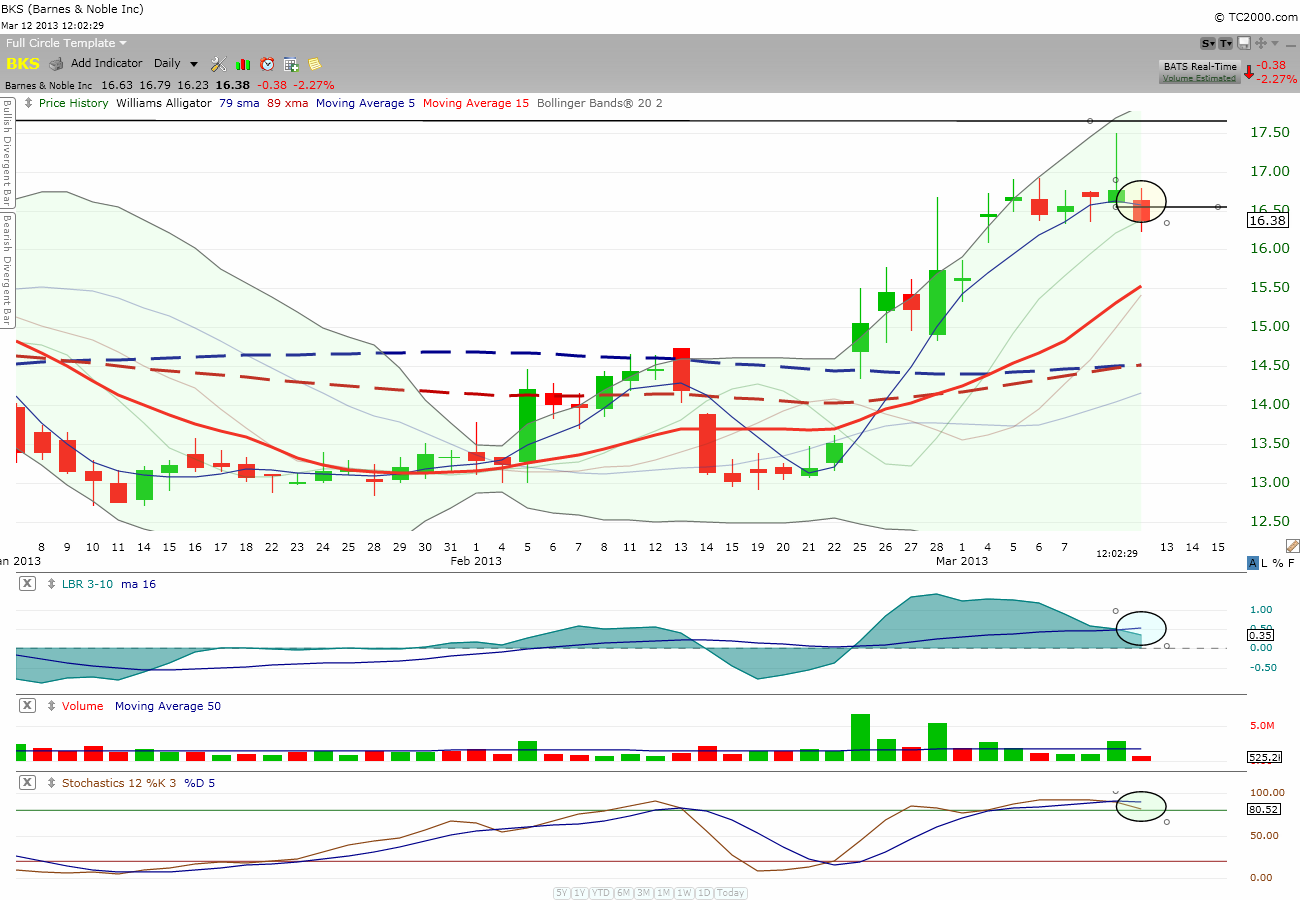

1b) I like to look at the daily chart to see if the price action is acting like it is going to bust out. If you go back to my older posts here and my twitter historical tweets, you will see that I’ve bought in the biotech stocks due to price action looking like it is going to bust out, or breaking out of a downtrend line, or taking out previous pivot high. These are all simple basic breakout chart patterns I go by.

Of course, there is no guarantee that price action will actually broke out or continue higher after taking out the previous highs; but together with a good story and a catalyst, those breakout may just have a better odds in following through.

It’s all about playing the odds.

2) Yes, you can lose money really fast trading biotech.

One of the key factor in causing most people to lose money in biotech stock is greed. I’ve witnessed first hand a friend who just could not take the profit despite my pounding my fist on his table (figure of speech). The drive was phenomenon. Price had gone from 75 cents to over $3.00 after almost six months in waiting (did I mention ‘patience’ in my last post?). The catalyst was that the Phase III result would be fantastic due to a similar “test” done in Russia. However, when there were doubters who started questioning the so-called “Russian result” and asked for links to access the said result, no one was able to provide a link.

Right there and then, I took profit as soon as the market opened the next day. I believe I sold my shares around $3.50 even though the price continued to rally to $3.80 the same day. I told my friend I had my doubt and suggested he should take his profit as well. Unfortunately, his greed had such hold on him that he told me he bought more at $3.80.

I guess you could predict the rest of the story; $3.80 was the high of the stock and it eventually crashed to penny because the phase 3 result failed.

From my experience, most of the money in Biotech are made during the drive to higher price in anticipation of a positive result. The fuel to supply these dizzying rise is the greed of the buyers. Sometimes, you will be amazed at the POWER behind the greed that can drive the price so high that if you don’t take that precious moment to take profit, it will crash down so fast that you can see your paper gain evaporates into thin air.

How do you know when is the precious moment to take profit? Ha! You will never know. You just have to bite the bullet and take that profit in front of you. Sometimes, you just happen to pick the top and sometimes you will just see the price continues to gap up from where you’ve sold.

I left quite a bit of money on the table when $MJNA went from 11 cents (where I bought) to 35 cents and then it started crashing back down to 25 cents on the day it touched 35 cents. I sold all my shares around 28 cents on its way down and thought I had a good day. Then the price turned back up to 32 cents by end-of-day.

Ok, I told myself it was not a big deal.

Then the next day, price gapped up and reached 50 cents before settling down around 40 some cents. That is the “suffering” I refer to on my first post. Price continued to bounce off 50 cents in the next day which drove me even crazier. Boy, did I suffer! (grin). It was like the stock god was taunting me… “neh neh neh neh neh… I’m hitting 50 cents, where did you say you sold? Ha! Ha! Ha!” So cruel!

Now, you know what I mean by “suffering”. However, I prefer this type of suffering over actual loss.

If you read my twitter and past post here, you will find out that I’ve lost dearly on my $ETRM trade. Foolishly, I traded thru the release of the result. I knew the result might come any day but I thought I had a few more days to decide. Noooo! The result came out and I instantly lost close to 60% of my $ETRM investment. Ouch!

Luckily my win on $MJNA helped offset this loss.

Trust me, biotech is not for the faint of heart.

3) Yes, I’m exposing myself again by going back in before the day is over. Usually, I try to buy less than half of my original position after I’ve taken profit. Therefore, if price drops the next day, I won’t lose too much since I’ll dump it first thing. However, if price takes off like I think it will, I’ll then add more like I’ve added to $PACB today.

It’s all about taking a calculated risk by not buying size on the second time around until you see proof that the momentum is still there.

I think I’ve written this post longer than warrant so I hope you don’t fall asleep half-way here. Thanks for reading if you’ve come this far.

My 2 cents.

Comments »